by

Elizabeth Moran | Nov 19, 2013

Key points:

- Bonds are the next best investment to term deposits in terms of risk.

- We compare a $500,000 total portfolio, in the first case assuming a 50% allocation to term deposits or $250,000. In the second instance, we scale back the term deposit allocation to 10% ($50,000) and allocate 40% or $200,000 to investment grade bonds. The second portfolio which includes bonds provides additional income of $1,620 or 0.32% for the next year over the other portfolio.

- Investing in bonds and compounding returns would see even higher returns in coming years.

Bonds are the next best investment to term deposits in terms of risk. They are similar to term deposits in that you invest for a set time and there are defined interest payments and principal is returned to you at maturity. There is a wide range of domestic and international banks and companies that issue bonds. Bonds are relatively low risk, but marginally higher than term deposits so pay higher returns.

A practical example of the additional income you can earn and the types of bonds available might be helpful.

Let’s assume there are two portfolios both worth $500,000: one with a straight allocation to term deposits and shares, the other includes an allocation to bonds. We assume:

1) Term deposit rate of 3.9 per cent offered by a credit union

2) The share portfolio will earn 7.5 per cent (including dividends and franking)

3) A retail bond portfolio has a projected income of 4.71 per cent for the next year

What is the projected difference in income for the next year?

The first portfolio (Portfolio A), has a 50 per cent allocation to term deposits and a 50 per cent allocation to shares. Income will be as follows:

Term deposit income $250,000 x 0.039 = $9,750

Share portfolio $250,000 x 0.075 = $18,750

Total income for Portfolio A is $9,750 + $18,750 = $28,500, which equates to an annual return of 5.7 per cent.

The second portfolio (Portfolio B) has a 10 per cent allocation to term deposits and uses 40 per cent of its holding to invest in bonds. The portfolio retains its 50 per cent allocation to shares. Income for the next year will be as follows:

Term deposit income $50,000 x 0.039 = $1,950

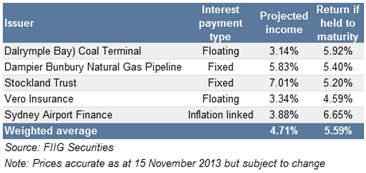

Bond portfolio of five bonds each worth $40,000, so total bonds of $200,000 x 0.0471 = $9,420 (see details in the table).

Share portfolio $250,000 x 0.075 = $18,750

Total income for Portfolio B is $1,950 + $9,420 + $18,750 = $30,120, which equates to an annual return of 6.02 per cent.

The difference between the two is $1,620, or 0.32 per cent.

This is a simple example and even so there are a few additional few points that need to be taken into consideration:

1) A year-long term deposit will usually pay one interest payment at maturity. Bonds however pay either quarterly for floating rate and inflation linked or semi-annually for fixed rate; giving investors a more steady income stream.

2) Term deposit interest payments can be made more regularly but this usually means the rate you can achieve is lower.

3) I haven’t made any allowance for compounding. Having interest income paid more regularly, means you can reinvest during the year if you don’t need the funds, to accelerate your returns.

4) Compounding also has positive benefits on an ongoing basis.

5) For the bond calculation I use the projected income for the next year of 4.71%, but note this is lower than the 5.59 per cent projected if the bonds are held until maturity.

6) There is no allowance made in the calculations for any inflation which if positive would increase the income on the Sydney Airport bond.