by

Alen Golubovic | Dec 02, 2014

The global oil market has followed a similar trend to other commodities such as iron ore in recent months. Crude oil has fallen into a bear market amid the highest US output in three decades and signs of slowing demand growth. Prices are at levels not seen for five years, with crude oil now down more than 35% from 2014's June peak. At last week’s meeting of the Organisation of Petroleum Exporting Countries (OPEC), the organisation could not agree to the supply caps needed to stabilise the oil price, triggering even further falls.

The question is – how does a falling oil price affect domestic fixed income investors? A falling oil price creates a number of macro and micro themes that are relevant to FIIG bondholders.

From a macro perspective, one of the more noticeable impacts is on the global inflation outlook. A falling oil price is expected to put downward pressure on the inflation levels of the major economies, particularly the US given its heavy reliance on oil and the boom in shale oil production.

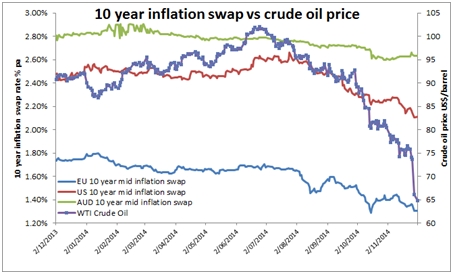

Below is a chart comparing the historical 10 year inflation swap curves for Australia, the US and the EU against the crude oil price over this year. An inflation swap is much like an interest rate hedge – it is the fixed rate of inflation which the market is prepared to pay to hedge against future increases in inflation. In Australia, the current mid 10 year CPI swap rate is 2.63%. In simple terms, this means an inflation trader is prepared to pay a fixed rate of inflation equivalent to an Australian CPI rate of 2.63% pa over the next 10 years, in exchange for receiving exposure to ‘floating’ real CPI movements. Note that there are other methods of measuring the market expectation of inflation such as break even inflation, or just comparing nominal versus inflation linked government bond yields, and so an inflation swap is just one method of referencing the ‘market price’ for inflation. Longer term inflation swaps also incorporate a liquidity premium given their longer dated exposure.

Source: Bloomberg

Since the peak crude oil price in June, the US 10 year inflation swap has fallen by about 50 basis points, the EU 10 year inflation swap by about 35 basis points and the AUD 10 year inflation swap by only 15 basis points. This result is interesting for holders of domestic inflation linked bonds. The chart shows that the price of a US or EU 10 year inflation swap has been much more correlated to the falling global oil price than the Australian 10 year inflation swap. The Australian inflation swap rate has not moved as significantly as the US and EU, suggesting the inflation market does not see the falling oil price having as significant an impact on longer term inflation in Australia as it does in the US or EU. In part this is explained by the opposite impact the falling AUD has had on domestic oil prices, with the global oil price being quoted in USD.

In the short term, while lower oil prices may have some impact on lowering CPI growth (lower fuel prices is one example), over a longer term horizon the market is pricing average Australian CPI at a level which is above US and EU inflation, and doesn’t see the recent falls in the crude oil price as having as significant an impact on longer-term Australian inflation. So for holders of domestic inflation linked bonds, it means that the CPI component on their inflation linked returns isn’t expected to be heavily impacted by the falling oil price. This is positive for holders of inflation linked bonds whose returns are linked to the level of inflation, with many of the inflation linked bonds being longer dated. Having said this, if oil prices were to plunge significantly, there may be broader global economic effects which could flow through to the Australian economy and CPI expectations.

While the decline in the oil price will hurt nations which critically depend on oil, overall the world’s economy overall may benefit from the fall. The Organization for Economic Cooperation and Development estimates a $US20 drop in the oil price adds 0.4% to the growth of its members after two years. By lowering inflation over the same period, cheaper oil could also persuade central banks to either keep interest rates low or even add stimulus.

From a ‘micro’ perspective, the following are some of the impacts of a falling oil price for FIIG investors:

- Airlines in particular will benefit from a lower oil price because it will push jet fuel prices down. So a falling oil price, generally speaking, leads to a direct benefit to an airline’s bottom line, and so is broadly a positive for the likes of Qantas, Virgin, and to a lesser extent Sydney Airport. Note that these airlines will have shorter term fuel hedges in place, so the full benefit of a lower oil price will be realised over the medium term. The Qantas 2022 bond and the Virgin 2019 US dollar bond are currently offered to investors at indicative yields of 6.46% and 7.55% respectively. With the recent rallies in share prices of both companies, especially Qantas, we may see a contraction in yields in these bonds in the coming days

- Emeco: the Canadian oil sands player needs a US$70-US$80 oil price to be profitable. If oil prices continue to fall, especially below the US$70 level, we expect that Emeco’s Canadian business will suffer as oil sands work starts to drop off. Canada has been one of the more solid performers for Emeco thus far, offsetting the flagging Australian business, so a falling oil price poses risks for Emeco’s Canadian business. The Emeco 2019 US dollar bond is currently offered at an indicative yield of 11.1%, and we expect continued volatility across the mining services sector given its high risk profile

- Antares: we don’t see major risks to convertible note holders. The Southern Star asset sale has been completed and Antares is buying back the notes on market at par. The company has sufficient liquidity to redeem all of the notes and pay 10% coupons, so we expect it will keep buying back and then redeem what’s left at par at the next reset date next October

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.