by

Justin McCarthy | Jul 29, 2014

Key points

- IAG released a statement to the ASX on 24 July 2014 which was, in effect, a profit upgrade.

- IAG continues to be the most profitable of the three large insurers IAG, QBE and Suncorp.

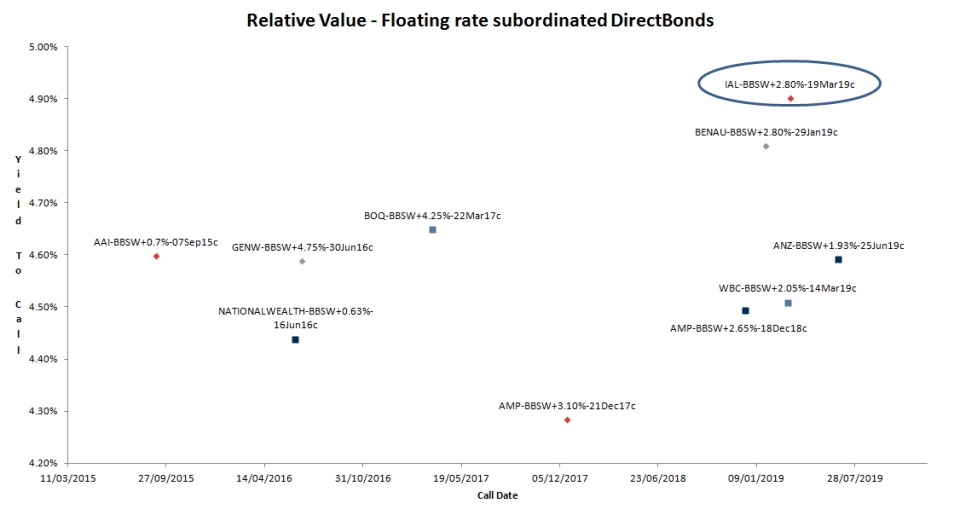

- The subordinated FRN from IAG’s wholly owned subsidiary, Insurance Australia Limited, with a first call date of 19 March 2019 is the highest yielding of any of the existing Tier 2 subordinated Floating Rate Notes (FRNs) on the DirectBonds list and one of the highest yielding FRNs in the investment grade market. Offered at an indicative yield to call date of circa 4.90% it represents strong relative value.

|

On 24 July 2014, IAG released a statement to the ASX which was, in effect, a profit upgrade. It also detailed greater than first expected ongoing synergy savings (but with a larger one-off restructuring cost) from the Wesfarmers Insurance acquisition and implementation of a new operating model in Australia.

A summary of the key points is below:

- IAG has raised its forecast insurance margin for FY14 from 14.5%-16.5% to 18.0%-18.3% due to lower natural catastrophe occurrence/claims (around $85m better than originally forecast) and tightening credit spreads which have increased the value of their fixed income investment portfolio (around $61m better than forecast).

- “Reserve releases” or reduction in provisions for future insurance claims have also had a positive impact on the FY14 profit numbers.

- Gross written premium growth is expected to be approximately 3% for FY14 which is at the bottom end of the 3-5% guidance presented in January 2014.

- IAG previously identified synergies and costs stemming from the integration of the Wesfarmers Insurance underwriting business of $140m and $120m pre-tax respectively. Combined with the effects of the new operating model, IAG now expects to realise an annualised/on-going pre-tax benefit of approximately $230m (an increase of $90m) and recognise one-off pre-tax costs of approximately $220m (up $100m) over the course of the next two years

- Managing Director and CEO Mike Wilkins said: “The underlying performance of the Group has remained strong...The underlying quality of our expected results for FY14 places IAG in a strong position to deliver on the next phase of the Group’s development, as we integrate the Wesfarmers insurance underwriting business in both Australia and New Zealand and realise the associated synergies, and as we move to our new operating model in Australia. In addition, we remain confident of improved returns from our Asian operations over the medium to longer term”.

- The Group will announce full details of its FY14 results on 19 August 2014.

Relative value of the Insurance Australia Ltd 19 March 2019 (call) subordinated FRN

The subordinated FRN from IAG’s wholly owned subsidiary, Insurance Australia Limited, is the highest yielding of any of the existing Tier 2 subordinated FRNs on the DirectBonds list (see chart below) and one of the highest yielding FRNs in the investment grade market (currently offered at an indicative yield to call date of circa 4.90%).

Moreover, the subordinated Insurance Australia Limited issue is one of the highest rated of its peers and is viewed as an excellent switch opportunity for those looking to take profits from any long dated fixed rate bonds that have rallied strongly in recent months, many of which are rated many notches lower.

For further details on the Insurance Australia Ltd 19 March 2019 (call) subordinated FRN, please see the WIRE article from 11 March 2014, written at the time of the new issue or talk to your FIIG representative.

Insurance Australia Ltd 19 March 2019 (call) subordinated FRN is available to wholesale investors only in minimum (face value) parcel sizes of $10,000.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.