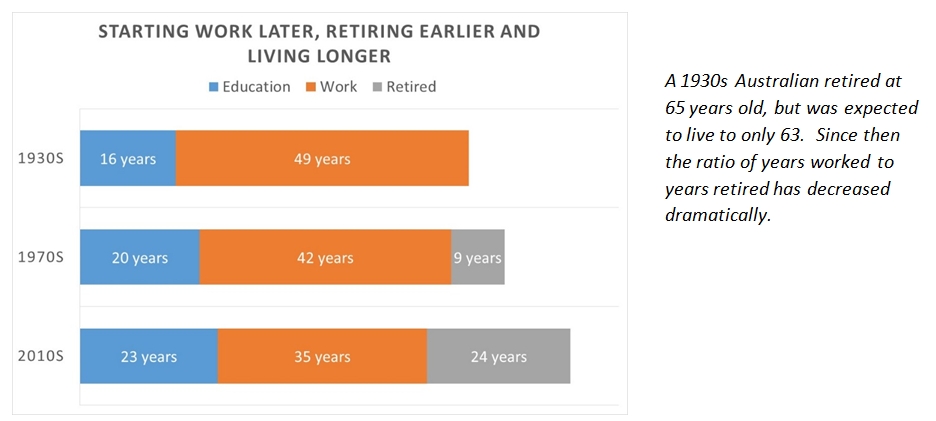

In the 1930s, the average Australian worked from 16 to 65, or for 49 years, but life expectancy was only 63 years. That is, the average person could spend 100% of their income as they earned it, not needing to worry about funding their retirement years.

By the 1970s, we started work a bit later at 20 and retired at 62, with a life expectancy of 71. That is, we worked 42 years and had an average of nine years in retirement. Each year of work needed to additionally pay for three months in retirement.

Now we work from 23 on average, and retire at 58, with life expectancy of 82. We work for 35 years and on average are retired for 24 years. Each year of work now needs to additionally pay for eight months in retirement.

If our working lives were run as a business, we’d call this having to lower our “cost-to-income” ratio – we have to spend less of our income during our working lives every generation because we are living longer:

- The Australian expecting to retire in the 1930s could have a cost-to-income ratio of 100% on average.

- The 1970s retiree could have had a cost-to-income ratio of about 80%, saving around 20% of their annual income to have enough to fund their retirement years.

- The 2010s retiree needs to have a cost-to-income ratio of about 33% or saving a massive 67% of their annual income to fund their expected retirement years.

Of course these are just the average life expectancies. Anyone expecting/hoping to outlive the average needs to save more than these ratios.

The simple analogy above ignores the fact we typically earn more in the later years of our careers and the benefits of compounding investment returns on those savings, however the clear indication is that we need to save more over a shorter working career for a longer retirement.

Managing your SMSF like a business

Managing your SMSF is no different to managing a business – the golden rule is don’t run out of money. Particularly once retired and you have no other source of income, you need to:

- earn enough income to fund the lifestyle you’d like;

- without blowing up the business (your capital); or

- try to cut costs.

The biggest difference is that in business you can sometimes raise more money. Once you retire, you have a finite amount of wealth to fund your retirement years, so the risks of getting it wrong are higher.

Because of the dramatic consequences of getting it wrong, once retired in particular you should increase income to a point that helps you fund your lifestyle but no further.

Similarly, again like in business, earning too little income will result in “going o ut of business”, in this case running out of money before you can afford to.

ut of business”, in this case running out of money before you can afford to.

In today’s environment where cash deposit rates are at historic lows, and not expected to rise in the foreseeable future, allocating too much to cash is actually one of the riskiest investment strategies.

Warren Buffett made this point: “The asset class that most investors consider the “safest”—cash—is actually extremely risky.” This ‘zero-risk’ strategy will steadily erode the value of the nest egg over the retiree’s life even with very modest withdrawals.

On the other hand, an equity-only portfolio has high expected returns, but comes with more and more short-term volatility as the world recovers from the GFC.

Given this conflict between the need for safety and the need for growth, it’s no wonder retirees around the world use bonds to increase their income. Bonds are the middle ground between cash and equities – they offer greater security than equities, while offering more income than cash.

Note that this doesn’t mean selling out of the companies you have held for years. Australian investors often have the choice of holding many ASX companies as either equities or bonds. See the article in this week’s The Wire: “Investing for yield: When to pick the equities and when to pick the bonds”, for more about how to create a high income portfolio by combining equities and bonds.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.