by

Elizabeth Moran | Nov 19, 2013

Key points:

- IABs offer investors a cash stream that will increase with inflation, so are perfect for investors in retirement as well as investors seeking a known cashflow over time.

- This article forecasts cashflows for five IABs for the next year and the expected final 12 month cashflow.

- Three IABs (Melbourne Convention Centre, Novacare Solutions and JEM schools NSW all show yield to maturity of over 6%.

Imagine for a moment that you are in retirement (if you’re not already there). Your investments need to generate an income to pay for those non-stop bills. The difference being that you no longer have the safety net of an income, so you really need to reconsider the risks you are taking with your investments. Any loss, however small, will have ongoing repercussions on your income.

The resurgence of annuities has been encouraging in the last few years as investors acknowledge the risks of only investing in growth assets like shares and property. Annuities offer known payments over a fixed term but can also be “lifetime” investments. That is, once you’ve invested in the annuity, regular payments continue until your death, no matter what age you live to. They are great investments for retirees and can provide comfort that you won’t outlive your savings.

The companies that issue annuities are regulated by APRA and conform to strict guidelines.

However, annuity returns can be low and it can be difficult to access your invested capital if you need it. However, there are bonds available that have annuity-like characteristics that provide an alternative. They are called Indexed Annuities Bonds (IABs) and the bonds return both principal and interest at each preset payment date over the life of the bond, until the maturity date. IABs are tradeable investments and would constitute part of your estate should you die, but there isn’t the regulatory oversight by APRA, nor the opportunity for lifetime investment.

Just like paying a mortgage loan back to a bank, IAB investors take on the role of the bank and loan money to the issuer of the bond, the borrower. Investors can then expect interest and principal repayments from the IAB issuer over the life of the bond. In the absence of any indexation (inflation), each payment would be equal, consisting of part principal and part interest. This amount is also referred to as the base payment or ‘base annuity’. The base payments are indexed (by inflation) over the life of the bond. Assuming that inflation remains positive, there is a steady increase in the payments over the term to maturity.

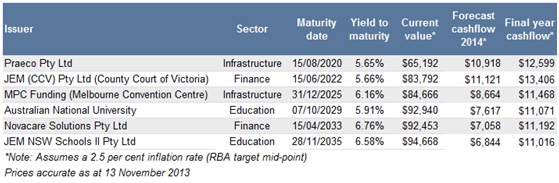

IABs offer investors a cash stream that will increase with inflation, so are perfect for investors in retirement as well as investors seeking a known cashflow over time. The table shows some of the IABs available in the over-the-counter market.

All of the bonds make quarterly payments and the estimated returns are based on an assumption of 2.5 per cent per annum inflation rate (the Reserve Bank target mid-point). The bonds have different maturity dates and expected cashflows in coming years given the term to maturity and the return.

One of our favoured bonds is the Australian National University IAB. The final payment is due in October 2029; 16 years from now. If you were to invest $92,940 in this bond, estimated principal and interest payments to you in 2014 would be $7,617. The estimated payments in the final year would be $11,071, but could be higher or lower depending on inflation over the 16 years. Based on 2.5 per cent inflation per annum the total cashflows would be $147,901, providing a yield to maturity of 5.91 per cent. The ANU IAB is the lowest risk investment shown in the table, but offers a high relative value return.

While the table shows high investment amounts, these bonds are available from $10,000 each with a minimum initial investment of $50,000.