by

Dr Stephen Nash | Aug 27, 2013

Introduction

Financial markets often accurately reflect prevailing economic conditions, but they can, and often do, “get it wrong”. In fact, markets spend most of their time chasing shadows; responding to incorrect perceptions about growth and inflation. In this article we’ll assess if the optimistic gloss is justified by the performance of the US economy, by what major central banks are indicating, or what the RBA is signalling.

If market indicators suggest growth, then the implied rate rises, as supported by current financial market pricing, would be justified. In the alternative, if these indicators suggest low growth, then financial market pricing may be erroneous and a large fall in rates may well lay ahead in September; typically problematic for equities. Accordingly, this article will seek to find whether, or not, there is any substance behind recent increase in bond yields by looking at the following three topics:

- Briefly assessing US economic performance

- Looking at some commentary from the major central banks

- Reviewing what the local economic situation is, and what the prospects are for rates

1 US economy

A constant stream of data is coming out about the US economy and the following observations can be made:

- Growth: US economic growth is proceeding at a steady pace; and can described as somewhat “weak”, with real GDP growth coming in a little around 2%. Most forecasters have an optimistic assessment, based on the need to sell risky asset cash flows, whose sale depends on higher growth, so most forecasters are making a leap of faith, and transforming rather weak data into stronger data

- Employment: US employment is improving, from an average of roughly 141k, for the period between March 2012 and August to 2012, to around an average of roughly 192k, for the period September 2012 to July 2013. However, broader measures of employment, like the labour force participation ratio, the employment to population ratio, and hours worked, remain disappointing. Hence, the message appears to be one of a superficial improvement in labour market conditions. In other words, the non-farm payroll report comprises only part of the story; the average worker still remains outside the system, not even trying to obtain work, while overall hours worked are not growing

- Inflation: The core PCE inflation reading remains much lower than the Fed would like, and is near the lower bound of acceptability. The Fed has no adequate explanation of this reading and is concerned that it might breach the lower bound, where the economy would be experiencing disinflation. Although the Fed expects the inflation reading to increase, that expectation is subject to bias.

If growth is only moderate, inflation is worryingly low and employment growth is barely adequate in a narrow sense, then forecasts look optimistic. Accordingly, we feel that the reduction of quantitative easing (QE) is more a story for equity pricing, especially if the economy is growing at a tepid pace, as opposed to bond pricing.

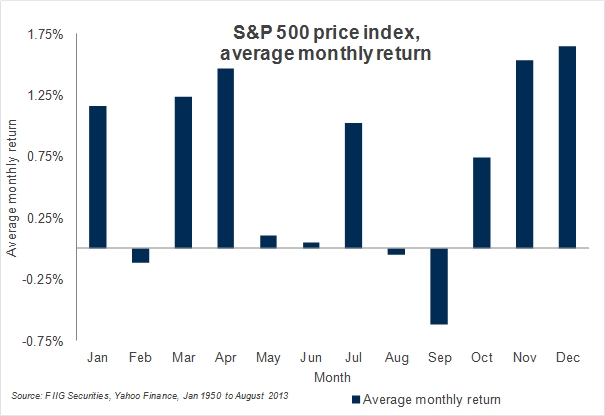

The current conditions in the US represent an improvement in some respects from the recent past but the key factor remains expectations, which have proven to be overly optimistic. Also, historically that market has a habit of coming back from the northern hemisphere summer only to be disappointed as Figure 1 shows the average monthly price return for the S&P 500, from January 1950 to August 2013. Optimism that builds into the summer break is often dashed as financial sector workers return from summer holidays to the cold hard reality of the forthcoming winter. This means, apart from other things, that optimism in bond pricing may well be overdone, which means that rates have become higher than they either need to be, or should be, based on the activity in the US economy. That optimism should soon be eliminated, and rates should settle back lower; somewhat closer to what is suggested by the underlying activity in the US economy. In terms of the timing of this anticipated decline in interest rates, the typical decline of equities in September needs to acknowledged, as shown in Figure 1 below. Specifically, lower equity prices are typically associated with lower bond yields, and September seems to most likely time for a decline in equity prices, based on long term seasonality in US equity pricing.

Figure 1

Figure 1

On top of all this, Congress resumes on 9 September, and the two major parties have a history of disagreement on budgetary issues, especially the debt ceiling, and the funding of health care or “Obama-care”. We anticipate that both parties want to make ground ahead of the forthcoming mid-term elections in November 2014, so that the debt ceiling debate should soon “boil over” into financial market volatility. With volatility comes lower equity prices and, typically, higher bond prices. All this tends to ignore the growing tensions in the Middle-East, especially the Syrian war, and possible US involvement. While the US has been reluctant to intervene for many reasons, the problem for the US intervention is the impact on the already elevated oil price. If the US did intervene, then it would pay a hefty price in terms of economic growth, as the rise in the oil price that would accompany a US intervention would depress emerging economic growth in the US, even though the US is moving towards greater self sufficiency of energy in the medium term, through recent gas finds.

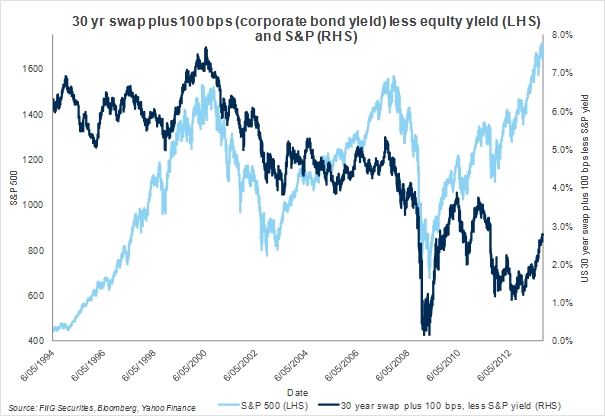

Recent rises in bond yields also have implications for asset allocation. Specifically, as bonds yields have risen, investors are faced with an asset allocation decision and that decision is summarised by the dark blue line in Figure 2 below, which is the difference in yield between 30 year corporate debt, as estimated using 30 year US swap plus 100bps, and the yield on the S&P 500. The wider the spread, the more attractive the senior debt is, relative to equity, since the debt yields more than the equity the higher the spread. Notice how the spread has contracted since 1999, indicating a growing preference for senior debt, relative to equity, in our view. If the trend is downwards, which has been evident since 1999, the spread is currently getting close to a level that will inspire switching back to bonds, as was evident in 2010, around May, and 2011, around July. On the left hand axis, the price index for the S&P 500 is charted, where large declines were recorded in the S&P 500, when the spread widened in 2010 and 2011; when bonds became too cheap, relative to equities.

Figure 2

2 Global central bank views

Since we have briefly sketched the main aspects of what is going on in the US economy, we now look at what the major global banks have to say, regarding the current economic situation.

US (the Federal Reserve, “the Fed”)

Many Fed speakers have been making many statements about the probable course of US monetary policy, and we think the following recent comments by Bullard are worth highlighting, even though much debate exists within the Fed. Specifically, Bullard has emphasised that tapering too early might well push inflation below the lower bound of acceptability, as he commented in a recent presentation, in the following question and possible two answers:

- Will current low levels of PCE inflation naturally move up toward 2 percent in the coming months and quarters?

- If yes, then current low inflation readings are an aberration and the Committee can reduce the pace of asset purchases without worrying about pushing inflation even further below target,

- If no, then inflation may be pushed even lower by a decision to taper and hence the risk of deflation may increase (An Update on the Tapering Debate, James Bullard President and CEO, FRB-St. Louis 15 August 2013 Louisville, Kentucky).

Europe (European Central bank, ECB)

While global bond markets follow the leads provided by the US, the ECB is reluctant to agree, and we agree with the ECB. Specifically, the ECB sees the recent rate increases in money markets as “unwarranted”, given that the ECB sees only a very modest recovery with significant risks to the “downside”, in terms of economic growth. To substantiate this view, the ECB provided forward guidance on interest rates, so as to settle the longer end of the yield curve at lower interest rate levels, and thereby stimulate longer term lending throughout the economy. These ideas are evident in the following questions, and subsequent responses, by Mario Draghi, in a recent press conference,

Question: Mr Draghi, ... My second question is regarding forward guidance. You have just confirmed the forward guidance you gave in July, and the market impact you had in July has fizzled out by now. It had an impact, but then the impact weakened. Now, other central banks started off like the ECB – they had a vague form of forward guidance and then progressed further and introduced a more explicit form of forward guidance. I would like to ask you whether you would rule out that the ECB could go down a similar path.

Draghi: Incoming information has confirmed our previous assessment. Underlying price pressures remain subdued, as does money and credit growth. Incoming survey data in July showed some further improvement from low levels and tentatively confirmed the expected stabilisation. So, against this background, our monetary policy stance will remain accommodative for as long as necessary. Basically, we have unanimously confirmed the forward guidance we gave last time ... rate hikes in money markets are, according to our assessment unwarranted. As I have said, current data confirm our baseline scenario, and risks are on the downside. So, developments have to be significantly better than our current baseline scenario for an outlook for price stability in order for us to change our guidance [Emphasis added] (Introductory statement to the press conference (with Q&A), Mario Draghi, President of the ECB, Vítor Constâncio, Vice-President of the ECB, Frankfurt am Main, 1 August 2013)

Bank of England (BOE)

The BOE is now following the Fed as well as the ECB and providing forward guidance with a view to moderating longer yield levels, so as to ensure economic recovery. They have committed to keep short rates constant as long as the unemployment rate stays above 7%, so that implies a tightening of monetary policy is something to consider in the fullness of time; some years away, according to the BOE forecast of unemployment. Such a sentiment is illustrated by the new chairman of the BOE, in some recent comments,

Today’s Inflation Report contains for the first time, in Chart 5.10 on page 47, the MPC’s projection for unemployment. It shows that, with the Bank Rate remaining constant at 0.5% throughout the 3-year forecast period, the MPC’s best collective judgement is that the median unemployment rate at the end of the projection period is 7.3%. Chart 5.11 on page 48, also new in this Report, shows that unemployment is judged by the MPC to be as likely to reach the 7% threshold beyond the three year forecast horizon as before (Inflation Report Press Conference, Wednesday 7 August 2013, Opening Remarks by the Governor, Bank of England)

In other words, each central bank retains major reservations about growth, and the ECB and the BOE have only recently begun to follow the Fed, and provide forward guidance on interest rates. Importantly, that forward guidance suggests that rates are not going anywhere in the short to medium term; probably for three years or more. Despite all these reservations, bond and money markets have adopted a much more optimistic interpretation; pushing rates to levels that all central banks are uncomfortable with, since these higher rates will pose threats for each economy, and for global growth. One is reminded, again and again, of the Japanese experience, where the market could not come to terms, and just could not accept, ten year rates falling through 2% in 1999. Although we all hope we are not following the Japanese deflationary experience, we would argue that we are somewhere between the “normal” situation for growth and rates, and the Japanese experience.

3 RBA policy and the local economy

Local economic conditions remain subdued, as the economy struggles to adjust to a decline in the mining sector of the economy. Mining, as inspired by rampant Chinese growth, has been insulating Australia from the malaise in growth that has swamped developed markets for many years. These concerns, among others, are reflected in a recent statement from the Australian Treasury, where forward GDP growth was revised down, while forward estimates of unemployment were revised up,

While prospects remain favourable, the economic outlook has softened further since the Budget, particularly for nominal GDP. The outlook for world growth has weakened, including in China, and the world price of key commodities has fallen leading to lower forecast terms of trade. This, along with lower forecast real GDP growth and a weaker outlook for wage growth, has led to a substantial downgrade to nominal GDP growth over the forecast period (Economic Statement, Australian Treasury, August 2013, ISBN 978-0-642-74924-6, p.1).

RBA guidance has been towards easier policy for some time, and given the above Treasury view, the prospects for continuance is strong. However, we have to assess the impact of the post-election rush of activity, which can be expected in the wake of the long election campaign. In particular, sub-trend economic growth, slowing wages growth, a high AUD, a soft consumer, combined with sub-trend employment growth and a declining level of business investment, all supported the general background behind the easing in August. While the RBA had seen that there was scope for further easing in monetary policy, such scope was seen as intact, as the RBA indicate,

At recent meetings the Board had held the cash rate steady, but had judged that the inflation outlook might afford some scope to ease policy further, should that be necessary to support demand. The forecasts for this meeting suggested no lessening of that scope, but did show a weaker outlook for activity overall (RBA Board Minutes, 6 August 2013).

Conclusion

Markets have envisaged strong growth and consequent rate rises, all painted in an optimistic hue. In searching for substance, in terms of justifying current market pricing, we generally find little; much more noise than substance is apparent. In other words, markets seem extraordinarily complacent as we approach the typical soft performance period for equity returns, not to mention growing divisions in the US Congress and the ongoing war in Syria.

In conclusion, market optimism is somewhat difficult to accept in the light of the generally cautious assessments of global central banks who generally view rate rises as something that is not on the agenda for many years. In the case of Australia, we have already suffered in terms of a slowdown in regional growth (which probably has more to run), which makes the challenge for lifting growth all the more serious, as the Australian treasury have recently reminded us.

In this context, there seems that optimism has already run its full course, and that a re-assessment of growth, and rates is most probably on the agenda. As part of this re-assessment, we anticipate that bond yields have considerable performance potential, while the prospects for further optimism in equity pricing remains somewhat limited.