by

Elizabeth Moran | Mar 24, 2014

Key points:

- Floating rate securities, because of the way they are structured, typically protect a portfolio when expectations of interest rates are rising.

- Forward interest rate expectations are already built into floating rate notes and other fixed income investments if you purchase them in the secondary market.

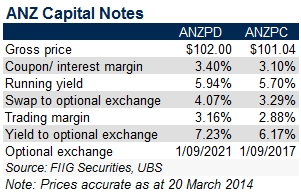

Last week a client asked me, “How can the ANZPDs that pay a coupon (interest payment) of 3.4 per cent and have a running yield of 5.94 per cent, show an expected yield to maturity of 7.23 per cent?” It was an excellent question and I think worth explaining to the larger audience.

The ANZPDs are floating rate securities, which pay interest linked to a variable benchmark; in the case of the ANZPDs, it is the 180 day bank bill rate swap rate (BBSW). The BBSW rate is fixed each business day and is used by Australian financial institutions to lend short term cash to each other out to six months. Projections are made for 30, 60, 90, 120, 150, and 180 days.

Interest on the ANZPDs is calculated by adding a margin of 3.4 per cent (which was fixed when the security was first issued) to the 180 day BBSW rate at the start of each interest period. The underlying benchmark rate will rise and fall over time based on prevailing interest rates. The last time interest was paid, the 180 day BBSW rate was 2.6367 per cent, so the interest rate for the current period is 6.0367 per cent. The running yield, which is indicative of the current income received on the investment, is calculated by dividing that interest rate by the capital price paid for the investment.

A gross price of $102.00 (including accrued interest) translates to a capital price of $101.62 (without interest), so the running yield for the coming six month period is (6.0367 per cent / 101.62) x 100, or 5.94 per cent.

The bank bill benchmark is projected for the coming six months, but in fact interest rates are forecast out to thirty years and the rates associated with these longer periods are known as “swap rates”. A swap rate is the rate at which banks would be indifferent between paying or receiving interest for that period. Analysts use these swap rates to project the anticipated return on floating rate notes.

Based on the price paid for a floating rate security, it is possible to calculate a “trading margin”, which is the margin above BBSW the investor can expect to receive over the life of the bond. While the maths behind the calculation is somewhat complex, it is useful for comparing value between different securities, and I think of it as a risk premium an investor needs to accept the risk of investing in the security over the swap rate.

Further, by adding the trading margin to the swap rate, we can estimate a yield to maturity for the investment (although it is important to note that this is merely an estimate, and the actual yield to maturity for these instruments is incalculable due to the variability of BBSW).

In the table below, I compare the ANZPDs with the ANZPCs. The income (or running yield) on both securities is similar, with the ANZPDs earning just 0.24 per cent more, yet the combined differences in trading margins and swap rates to optional exchange (optional exchange terms and conditions differ for the two securities, it can mean conversion to shares amongst other possibilities, see the prospectuses for details) are significantly greater, and therefore the yield on the ANZPD is 1.06 percentage points higher than that of the ANZPC.

Floating rate securities, because of the way they are structured, typically protect a portfolio when expectations of interest rates are rising. Forward interest rate expectations are already built into floating rate notes and other fixed income investments if you purchase them in the secondary market.

Common terms

Basis points (bps)- The basis point is commonly used for calculating changes in interest rates, equity indices and the yield of a fixed income security. A bond whose yield increases from 6.50% to 7.00% is said to increase 50 basis points; or interest rates that have dropped by 1.00% are said to have decreased by 100 basis points.

Maturity - this is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Running yield - uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity - the return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different