by

Elizabeth Moran | Apr 15, 2014

Key points:

1. Indexed annuity bonds (IABs) are an inflation linked investment, that pay principal and interest quarterly known as a “base payment” and it is this base payment which is linked to inflation.

2. IABs provide a regular quarterly payment that helps to match quarterly school fee bills.

The cost of education has been rising rapidly in recent years forcing parents to consider what investments they can make to cover school and university fees for their children many years down the track.

Education expenses have risen at an average of 5.8 per cent per annum over the past three years, more than double the rate of inflation, and show no signs of slowing down.

Funding an education is now a long term proposition, in many cases spanning decades, that requires serious investment planning.

For example, I had a friend who studied dentistry after school, then medicine and further specialised with a year in the UK and only completed her studies when she was 31. In these situations, longer term investments with surety of income and principal are needed to ensure students can reach their full potential.

While there are a number of investments that are specifically designed to provide an income for education, they often require minimum fixed terms and have high fees. In addition, early withdrawal from some investments can result in the fund not paying any gains.

An alternative to specific education investments and managed funds is indexed annuity bonds (IABs). Investors invest a lump sum up front then are repaid principal and interest, known as the “base payment” on a quarterly basis until maturity.

The base payment is indexed to inflation and thus helps protect the purchasing power of the up-front investment and in this instance the rising cost of education. Assuming that inflation remains positive, there is a steady increase in the payments over the term to maturity.

Therefore, the regular quarterly payment of principal and interest helps to match quarterly school fee bills.

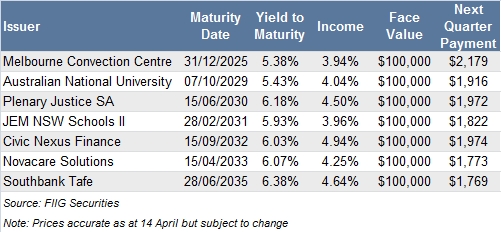

The table shows seven IABs, all of which are very low risk. The companies issued the IABs to match inflation linked income.

The expected yield to maturity is modelled using 2.5 per cent per annum inflation, which is the Reserve Bank mid-point target. Income is the margin paid over inflation.

The first to mature, the Melbourne Convention Centre, is in December 2025 or in nine years’ time. This bond would suit investors seeking to fund a six year secondary education and provide possible tertiary assistance. Running down the list, the term until maturity lengthens and the next quarterly payment generally declines as the bond has longer to run. The Southbank Tafe IAB has the longest term to maturity of around 21 years and if acquired could help fund child care, primary, secondary and tertiary education for a newborn.

Indexed annuity bonds are available through over-the-counter bond brokers from a minimum $50,000. Brokers earn brokerage on the transaction by matching buyers and sellers in the market and it is usually a small margin between the two.

The yield to maturity quoted is the projected return based on a 2.5 per cent inflation assumption, but may rise or fall subject to inflation. There are no management or ongoing fees and there is no penalty for selling prior to maturity.