by

William Arnold | Oct 22, 2013

According to media reports, JPMorgan is close to reaching a deal with the US Department of Justice to settle numerous mortgage related litigations. Investors, including government-owned mortgage agencies Fannie Mae and Freddie Mac, said JPMorgan told them loans were better than they actually were, or that the bank was negligent in accepting information from borrowers about their income and other matters at face value instead of verifying it.

Media reports indicate that the terms of the potential settlement has increased to US$13bn (US$9bn in payments and fines and US$4bn in borrower relief) from the previously reported US$11bn.

It is therefore possible that the US Department of Justice will be asking JPMorgan (without it being convicted of any crime) for the largest lump sum payment ever from an individual company.

Further to this, some 80% of the securities in the settlement were originally sold by investment bank Bear Stearns and mortgage lender Washington Mutual - entities that were later acquired by JPMorgan in transactions encouraged and assisted by the government after these banks essentially failed during the 2008-09 crisis.

To put the financial impact in context, last year the bank generated close to US$29bn in operating income and more than US$21bn in net profit. Further to this JPMorgan has already provisioned US$11bn for this matter and therefore would only need to take another ~US$2bn from earnings. In total over the last four years, JPMorgan added some US$28bn to its litigation reserves with total litigation reserves (to cover multiple possible cases) currently standing at approximately US$25bn.

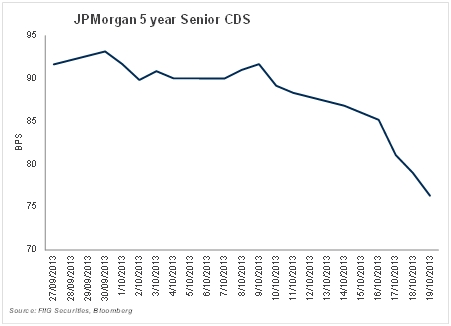

While this will be a material and record fine, a settlement will remove a significant source of uncertainty for the company and leave management to refocus on core business. Indeed JPMorgan’s Credit Default Swap spreads (a measure of credit risk) have tightened (improved) on the news:

The settlement is in relation to civil charges and therefore legal risks remain (including potential criminal proceedings), however this will depend on the details of the potential settlement and the extent of indemnities provided. So while JPMorgan can manage this record fine and is likely to manage any future litigation, clients with lingering concerns, or those who may want to benefit from the recent tightening of credit spreads (and therefore increase in bonds prices) may take this as an opportunity to switch.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.