by

Ekaterina Skulskaya | Feb 25, 2014

Key points:

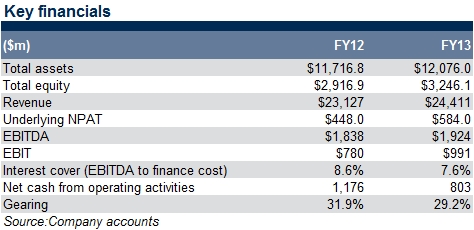

- Underlying Net Profit after Tax (NPAT) was up 30% from $448m in FY12 to $584m in FY13. Record revenue of $24bn was recorded, 6% up on FY12.

- Gearing, including operating leases was reduced to 29.2% in FY13 compared to 31%.9% in FY12 and is within Leighton’s target range of 20-35%.

- Leighton’s AUD July 2014 line is thinly traded due to its short term to maturity and is unlikely to see any further price appreciation. From a relative value perspective, the Leighton USD November 2022 bond generates a high income of 5.82% and has a yield to maturity of 5.63%.

Last week Leighton reported their FY13 results, headlined by an increase in underlying NPAT to $584m versus $448m in FY12, while the underlying NPAT margin of 2.4% of revenue was up from 1.9% in FY12. Leighton Holdings Chief Executive Officer, Mr Hamish Tyrwhitt, commented, “Through driving down costs, increasing efficiency and lifting productivity, the Leighton Group delivered a 30% increase in underlying net profit after tax in 2013”(see Table 1). Group revenue was $24.4bn, an increase of 6% on FY12. According to the company’s CEO, “Despite tough macroeconomic conditions, the 6% increase in revenue was a positive result and reflected the resilience provided to the business via diversification by brand, sector, geography, client, contract type and contract size”.

Table 1

Gearing was down to 29.2% in FY13 compared to 31.9% in FY12, while gearing excluding pre-operating leases was 11.1% in FY13 down from 20.5% in FY12.

Net capital expenditure outflow during FY13 was $0.8bn, down 27% on $1.2bn in FY12. Work in hand during FY13 was $42bn but was 3% lower than $43.47bn in FY12. However, new contracts increased by 5% to $23.09bn in FY13 from $22.05bn in FY12 on the back of the challenging contract mining environment.

The company continued to focus on improving its tendering discipline and on increasing its win rate to reduce tender costs. The overall win rate improved from 19% to 27% in FY13.

On the Group level, the Thiess division had a strong contribution to the Group’s overall result with an underlying profit of $434m compared to $299m in FY12 from domestic construction and mining. The John Holland division reported a profit of $138m (including $10m impairment on John Holland Aviation Services), up 116% from FY12, due to strong performance across infrastructure construction especially in WA and rail transport services. Leighton Contractors (LCPL) division results ($393m compared to $290m in FY12) were impacted by profitless revenue in infrastructure and mining.

Exposure to the Middle East through Habtoor Leighton Group (HLG) stabilised throughout the year and recorded a profit of $1m compared to an underlying loss of $67m in FY12. Leighton Asia, India and Offshore performance was down from $174m profit in FY12 to $1m loss in FY13, with Hong Kong and Macau performing well; however the results were impacted by Offshore, Indonesian mining and India underperformance. Commercial and Residential was showed a loss of $44m (including $81m impairments), a greater loss than the $26m reported in FY12.

While there are industry concerns (reports of mining contract cancellations) and corporate governance concerns, improving results, an improving residential market and an extension to the debt maturity profile support the Leighton fixed rate bonds.

The AUD July 2014 line is thinly traded due to its short term to maturity and is unlikely to see any further price appreciation. From a relative value perspective, the Leighton USD November 2022 bond generates a high income of 5.82% and has a yield to maturity of 5.63%, they are available to wholesale clients from US$50,000.

Please speak to your FIIG representative if you are interested in Leighton bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Leighton bonds are available to wholesale and retail investors.