by

Elizabeth Moran | Oct 01, 2013

Sunsuper is due to launch a lifecycle component to its balanced fund this weekend. Once a 100% balanced fund investor turns 55 years, the fund will automatically start selling down the balanced allocation on a yearly basis, while contributing the funds to a “retirement pool” and a “cash” allocation, over a ten year period. Investors can choose to opt out but unless they do so, the portfolio will transition to a lower risk allocation. International and domestic shares will decline and the allocation to fixed income will increase.

The Sunsuper balanced fund has a 55 per cent allocation to Australian and International shares, 13 per cent to fixed income and 4 per cent to cash. If members do not opt out, the allocation will transition over ten years to a lower allocation of 31.5 per cent Australian and International shares, a higher weighting to fixed income of 27 per cent and cash also rises to 18.1 per cent. The “lifecycle component” broadly follows government guidelines introduced through the MySuper legislation. Here, the theory behind the lifecycle component being, that as investors’ age, their remaining working life declines as does their ability to recover from losses to their portfolio. So, exposure to risk should decline with age.

Sunsuper should be applauded for their efforts. They aim to maximise capital and minimise downside risk for older members. If your superannuation is invested in a retail or industry scheme, do you know how it is allocated? Are you comfortable with the level of risk involved? A good indicator is the number of “loss” years expected based on past performance. For example international shares have a far greater frequency of loss years than fixed income.

If you hold an SMSF you probably know your asset allocation, but how often do you review it and rebalance? Are you conscious of lowering risk as you age and your investment horizon declines? One common rule of thumb for fixed income investors is to own your age in fixed income. Like lifecycle investing, as explained above, the theory being that you need to be more protective of capital as you age, and the investment horizon shortens. So a 70 year old should have a 70 per cent allocation to fixed income.

Default “balanced” allocations of most Australian superannuation funds are still overweight shares by global standards. In fact, in the 2012 OECD Survey of Pension Funds from 29 countries, the average allocation to bonds and bills was 53.2 per cent, significantly higher than the 9 per cent held by Australian pension and superannuation funds.

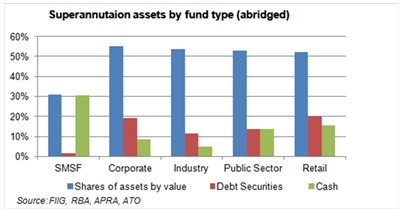

The chart shows corporate, industry, public sector and retail funds all hold an allocation to Australian and international shares of over 50 per cent and excludes allocations to “other”. SMSF investors, as at June 2013 hold a much lower allocation to shares, primarily due to very low holdings of international shares. While the allocation to debt securities (including bonds) remains low across the board, relative to OECD comparison, SMSF investors remain particularly underweight debt securities.

Interestingly, SMSFs hold a very high cash component of 30 per cent, however, cash does not offer the many benefits that bonds provide. Some of these benefits are as follows: (i) fixed rate bonds provide a hedge in a declining economic environment, (ii) inflation linked bonds provide a 100 per cent hedge against inflation, (iii) floating rate bonds’ income will rise in a rising interest rate environment (iv) bonds generally provide higher returns than cash.