by

Dr Stephen J Nash | Dec 19, 2012

In this article we briefly review the various factors that could impact longer term expectations of the Australian dollar (the AUD) and Australian inflation. Then, we examine various scenarios for both the AUD and for inflation, including:

- Low scenario, where a confluence of factors could lead the AUD, or inflation, lower than expected

- Expected scenario our estimate of the AUD and inflation rates

- High scenario, where a confluence of factors could lead the path of the AUD, or inflation, higher than expected

AUD forecast

In the short term, the main influence on the AUD will be both the prospects for global growth, and commodity prices, as well as the level of domestic interest rates. If the global economy remains weak, then the level of the AUD will remain firm, as the major currencies that the AUD trades against should also remain weak. However if growth expectations slump too much, then the commodity outlook will collapse and the AUD may suffer. If prospects for global growth improve, and the major currencies, like the USD strengthen, then the AUD may weaken against these currencies. A list of specific factors that might impact the AUD, as they occur in the various scenarios, are listed below:

Low scenario

- Expect that growth continues to be on the softer side of expectations, and that the transition from mining led investment continues to be problematic, meaning that rates will be biased lower over 2013 and beyond, which will lead the AUD toward the low scenario

- Chinese growth remains hostage to its export market, which remains depressed in Europe and barely positive in the US, meaning that commodity prices will remain contained, thereby constraining the level of the AUD

- Middle Eastern issues continue to elevate oil prices, with Syria a potential crisis area along with Gaza and Iran. Higher oil to depress global growth in major economies, thereby constraining strength in major currencies. A new crisis will see the oil price increase towards USD 150 (West Texas Intermediate, WTI), which will depress growth in the major economies, cutting demand for commodities and lowering the AUD to some extent

Expected scenario

- Easing in monetary policy to occur in AUD, yet possibly a little more slowly than the market currently expects, which should bring the AUD more towards the expected scenario

High scenario

- Search for reliable and liquid sources of yield (AAA rated Commonwealth government bonds) continue to support the AUD in the short term, which will lead the AUD towards the high scenario

- AUD to be eventually impacted by a gradual lift in global activity, and the consequent firming of major global currencies, especially the USD, around 2015-16. This should lead to a decline in the AUD, towards 2015-16, as reflected in most scenarios

- Continued sub-par growth in US, leading to firming of the AUD against a weaker USD, supporting the high scenario

- Delay of budget cuts in the US, which will continue to weigh on investment and growth of the USD, thereby holding down the USD and enhancing the AUD

- Ongoing European recession fuelled by dysfunctional government and fiscal austerity, with the ECB holding everything together, which will depress the EUR and boost the AUD

- Europe to endure continued credit difficulties, where the threat of issuer default elevates spreads and depresses the EUR and STG, while supporting the AUD

AUD forecast - summary

These factors are supportive of the following three scenarios. Note how the expected scenario has the AUD appreciating until 2015-16, when the global economies are expected to lift output and rates. As global rates rise, the AUD will become less attractive on a yield basis and should, at that point, moderate in value.

Figure 1

Inflation forecast

In the short term, the main influence on the rate of inflation will be the level of the AUD and the fortunes of the current government in the election year of 2013. Most agree that a change of government will occur, and the implication of that will be a reversal of the carbon price legislation and some moderation in inflation in the June 2013 to June 2014 financial year (in the absence of other factors). No large decline in the AUD is expected in the short term, unless either a recovery in the major economies, such as the US occurs or a decline in growth causes further large declines in commodity prices. A list of specific factors that might impact the AUD in the various scenarios, are listed below:

Low scenario

- Expect that growth continues to be on the softer side of expectations, and that the transition from mining led investment continues to be problematic, meaning that inflation trends towards the low scenario

- Continued sub-par growth in US, to lead inflation lower

- Delay of US budget cuts to continue to weigh on investment, leading demand lower, as well as inflation

- Reversal of the carbon price legislation as implemented by the labor government, under a coalition government should also lead to some unwinding of current carbon price related inflation, meaning inflation may trend towards the low scenario

- Ongoing European recession fuelled by dysfunctional government and fiscal austerity, with the ECB holding everything together, once more leading inflation lower through very low levels of demand

Expected scenario

- Savings rate to remain high, controlling asset price growth and credit rationing to the property sector will constrain construction, in the absence of Federal infrastructure initiatives, meaning inflation should be constrained in the expected scenario

- A lift in global growth, around 2015-16 should lead the rate of inflation higher, as reflected in the rise in expected inflation, in the longer part of the forecast

- Chinese growth to remain hostage to the export market, where Chinese domestic consumption cannot quickly be increased, meaning over-supply in China should translate to lower inflation, all else being equal

High scenario

- Concerns in the Middle East may force the oil price up and lead the rate of inflation higher than 3%, as oil price rises flow through into the general level of prices as reflected in the high scenario

- A slump in global growth forces down the AUD and the lower AUD increases domestic inflation

Inflation forecast - summary

These factors are supportive of the following three scenarios. The high inflation scenario is mainly driven by the threat of escalated conflict in the Middle East, driving oil prices to around USD150 (WTI).

Figure 2

While our expected scenario is not for high inflation, a higher scenario can be foreseen, especially if tensions in the Middle East spill over into oil prices. Syria remains a major global concern, and the Syrian conflict threatens stability on many borders, including the Turkish border and further escalations of the conflict are highly likely. Also, Israel remains very concerned, not only about Hamas in Gaza, but about the nuclear capabilities of Iran. Specifically, Iran has been subjected to severe economic sanctions by the US and the EU, and is now suffering as a result. It would be quite reasonable to assume these tensions, from a somewhat paranoid Israel and a weakened and increasing desperate Iran, could spill over into a conflict that would lift global oil prices and spread inflation across the globe.

Conclusion

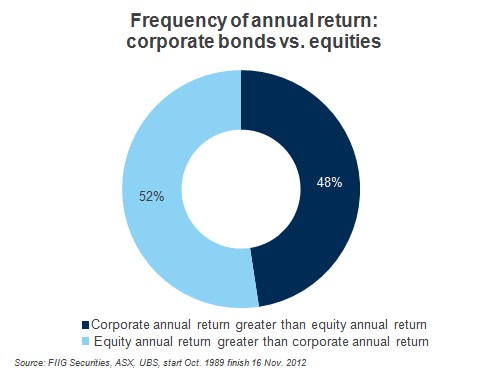

If you can insure against a high inflation scenario, by buying ILBs, at a real return of over 4%, then you are getting well paid to cover a central investment risk. Given that 4% over inflation is very close to the expected long run return of equities, the opportunity in ILBs is quite significant for many investors. Even if the higher than expected inflation scenario does not play out, the underlying value of ILBs (current discounts to face value) will probably be competed away over 2013, as the low return and low growth environment sees any higher yield instrument aggressively bought, leading to the eventual elimination of 4% real yields.