by

Ekaterina Skulskaya | Oct 22, 2013

Last week, Mercer and the Australian Centre for Financial Studies in Victoria released its latest Melbourne Mercer Global Pension Index report 2013 ranking Australia’s pension system third among its international peers. The highest ranking was assigned to Denmark followed by the Netherlands with scores of 80.2 and 78.3 respectively. Denmark’s retirement income system comprised of a public basic pension scheme, a means-tested supplementary pension benefit, a fully funded defined contribution scheme, and mandatory occupational schemes appeared to be the most efficient according to the index results. The UK and the United States were ranked 9 (score of 65.4) and 11 (score of 58.2) out of 20 countries assessed.

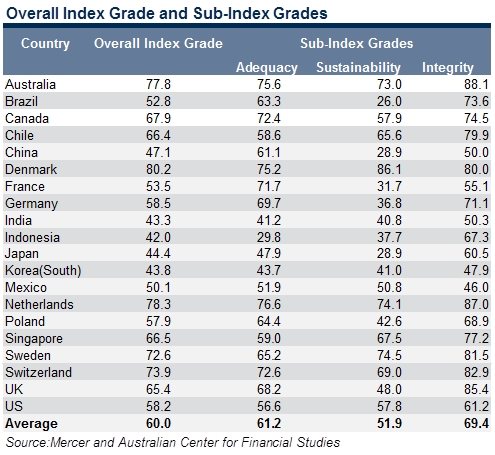

The overall index value for each country’s system was calculated as the weighted average of the three sub-indices: adequacy (40%), sustainability (35%) and integrity (25 %). Each country’s index value takes into account more than 40 indicators. The study confirmed that there is a great diversity between retirement income systems around the world with scores ranging from 42.0 assigned to Indonesia to 80.2 for Denmark (see Table 1).

Table 1

The report highlighted that “the conversion of defined contribution (DC) benefits into adequate and sustainable retirement incomes remains a largely unresolved problem in many countries”. Mercer suggests that there is an “urgent need” for a “fundamental change” to global pension systems in response to the fast growing significance of DC. Overall, the report argued “We must focus on the provision of retirement income – after all, that is the purpose of pensions”.

The data revealed that Australia was among a group of just eight countries including Japan, US and Switzerland that has no mandatory conversion of benefits into a lifetime annuity. Further, Australia scored just two out of ten with respect to requirements/incentives for retirees to take their pension in the form of an income stream, with Australian pension schemes converting only 30-40 per cent of retirement benefits into income products. Australia was also assigned one of the highest ratings on the proportion of total pension assets invested in growth assets (i.e. property and shares) which is significantly higher than “the reasonable level of exposure to growth assets”.

Put simply, the typical Australian retiree is overweight equities and property and underweight defensive assets such as fixed income, resulting in a lower (and less reliable) income streams. The report concludes that the greatest weakness of the Australian pension system is insufficient incentive or mandate to convert retirement benefits into income streams.

Overall, the Australian index value improved by 2.1% in 2013 from 75.7% in 2012. The improved Australian score was primarily due to the introduction of stronger regulatory requirements (the “Stronger Super” reforms) leading to improved governance and an increase in the net replacement rate. However, the index report highlighted five areas where the Australian retirement income system could improve its mark:

- introduction of a requirement that part of the retirement benefit must be taken as an income stream

- increase in the labour force participation rate amongst older workers

- introduction of a mechanism to increase the pension age as life expectancy continues to increase

- increase in the minimum access age to receive benefits from private pension plans so that retirement benefits are not available more than five years before the age pension eligibility

- elimination of legislative barriers to encourage more effective retirement income products

Despite the decrease in Danish index value from 82.9 in 2012 to 80.2 in 2013,Denmark’s pension system remained the most efficient for a second consecutive year.

FIIG Securities has often written that Australian investors need to move closer to world best practices with regards to pension asset allocation, both professionally managed superannuation and SMSFs. Further, a reliable income stream is a crucial component for an effective, and stress free, retirement. A portfolio of bonds that includes indexed annuity bonds can be structured to provide this low risk, reliable income stream while also achieving a high rate of return.

For further information on indexed annuity bonds, please contact your FIIG dealer.