by

Justin McCarthy | Dec 03, 2013

Payce Consolidated Limited (Payce) announced to the ASX on Monday that it had completed a $50m five-year, fixed rate, senior secured note issue (the Notes) with an interest rate of 9.50% p.a. (paid quarterly), arranged exclusively by FIIG Securities Limited.

Payce were seeking to raise up to $50m to diversify debt funding sources and lengthen their debt maturity profile.

The offer opened on 20 November 2013 and settled on 3 December 2013 fully subscribed.

While applications for the Payce initial offering have closed, wholesale clients can now transact the Notes on the secondary (OTC) market, having commenced trading yesterday and closing last night at $100/$100.25.

The Notes are tradable with minimum parcel sizes of $10,000 and provide investors the opportunity to further diversify their fixed income portfolio and lock in a high fixed rate of return.

FIIG was the sole lead arranger for this transaction and this represented the sixth issue FIIG has brought exclusively to our clients, following the successful raising of:

- $30m for Silver Chef Limited (SIV)

- $50m for Mackay Sugar Limited (MSL)

- $70m for G8 Education Limited (G8)

- $60m for Cash Converters International Limited (CCV), and

- $50m for PMP Limited (PMP)

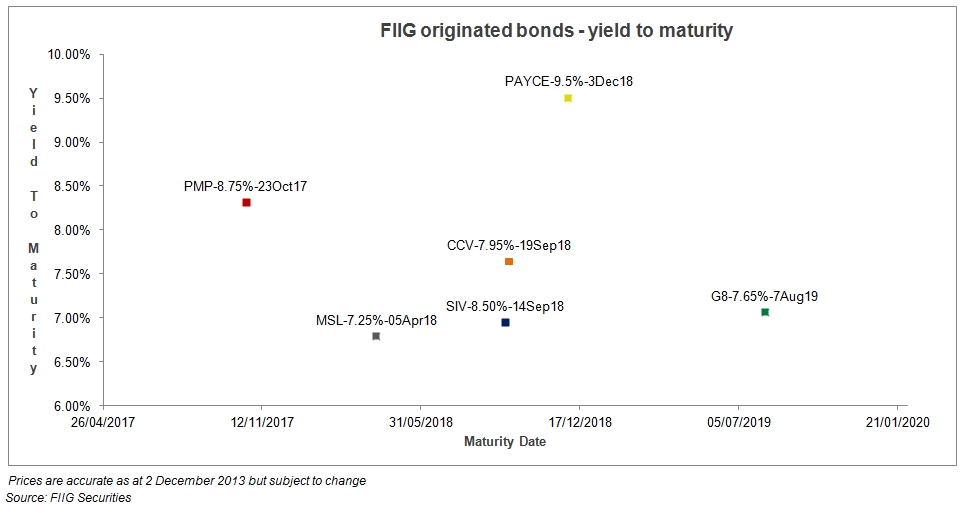

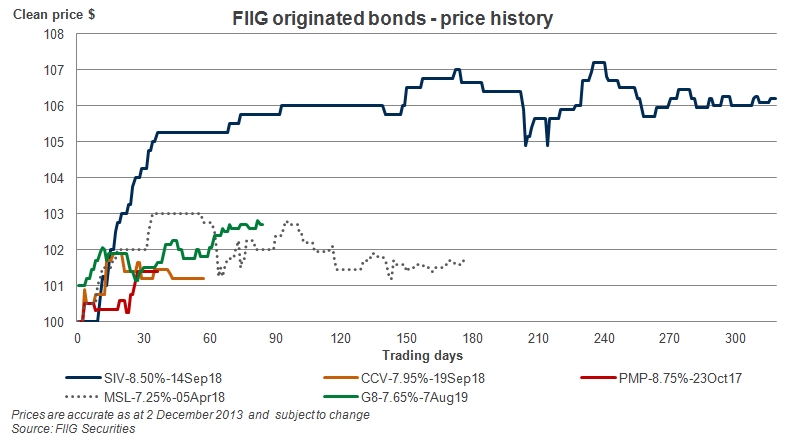

Figure 1 below plots the current yield to maturity for each of the six FIIG originated bond deals (with the initial coupon or interest rate specified in the label for each). Figure 2 below then provides the (clean) price history for the first five bonds with Payce only having one day of trading history. Note that each is trading at a premium to its issue price of $100.

Payce is a Sydney-based property development group and has been listed on the ASX since 1978. The company’s core business has been the development of Sydney medium density apartments. More recently Payce has been developing communities where there is both residential apartments and mixed use (retail and commercial) space, with a strategy to maintain select mixed use property to create an ongoing rental portfolio.

For further information on Payce please click here to view the detailed research report or contact your FIIG representative.

FIIG received fees from the Issuer of the Payce Notes.