by

Elizabeth Moran | Sep 16, 2014

When Qantas recently announced a full-year loss, its long-suffering shareholders who haven’t received a dividend in five years were so excited they drove the stock up 19 per cent.

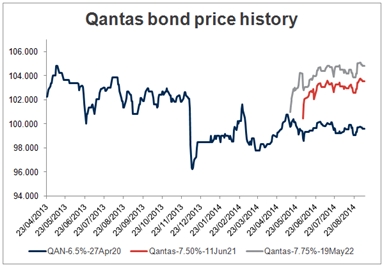

By contrast, the bond rally was small as the bonds, which are lower risk and less volatile than the shares, still pay interest regardless of Qantas’ performance; same company, very different experience.

Qantas currently has three fixed rate bonds maturing in 2020, 2021 and 2022 which presents investors with a bit of a dilemma about which one to buy.

There is little separating the bonds if you compare them on a yield to maturity basis with the 2020 bond yielding 6.72 per cent, the 2021 6.98 per cent and the 2022 7.03 per cent.

Both the 2021 and 2022 bonds were issued after the credit rating agencies downgraded Qantas’s credit rating late last year so these bonds showed greater price appreciation than the 2020 bond when Qantas announced that it would try and regain an “investment grade” credit rating.

When Qantas was downgraded the 2020 bond price fell sharply by 6 per cent but since then it has increased and settled at just under its $100 value at $98.97. The other two bonds are now trading at a premium of $102.74 and $104.20 respectively.

Source: FIIG Securities

Prices accurate as at 9 September but subject to change

Key to any assessment of corporate bonds is an understanding of the company’s “survivability”. Qantas has assets that it can sell to pay interest and repay debt such as airport terminal leases. In the latest set of results it had a large positive operating cash flow of $1.1 billion which enabled it to add $600 million to cash on hand, taking it to $3 billion. The sum, combined with undrawn bank facilities of around $600 million, provides financial flexibility and adds weight to the company’s survivability.

Even though the Qantas share price has been erratic and it faces headwinds being a commodity style service where price is a key differentiator, investors have still bought Qantas bonds for the certainty they provide.

Qantas must pay interest half yearly and must return the $100 face value of the bonds at maturity. The high fixed rate of return compensates for higher risk. Small allocations to high risk bonds will boost your overall portfolio return.

One-eyed bond fans will invest in high yield bonds instead of shares and the known rate of return on these bonds of over 6.5 per cent will trump dividend yields on many shares.

The range in yield to maturity returns of all three bonds is small. The 2020 bond maturing first is lowest risk, so offers a yield to maturity of 6.72 per cent, 26 basis points or 0.26 percent less than the bond maturing in 2021. This is also the only bond available to retail investors. The increment of 5 basis points for extending the term for an extra year to 2022 is too tight, perhaps signalling that the market too is confident that Qantas is a survivor.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.