by

Justin McCarthy | Aug 26, 2014

Key points

1. QBE announced its half year results to 30 June, 2014 last week with a headline net profit after tax of $392m, down 18% from 1H13.

2. While the results were disappointing for equity holders...again, debt investors received a significant boost with the news that QBE has undertaken a capital plan to strengthen regulatory capital and deleverage.

3. The QBE USD 6.797% “old style” step-up Tier 1 security with a first call date of 1 June 2017 is considered excellent value and is currently offered at an indicative yield to call of 4.08% (which equates to a credit margin of circa 300bps). Alternatively the QBE USD 7.25% re-settable subordinated debt issue with a first call date of 24 May 2021 and final maturity date of 24 May 2041 is currently offered at a higher indicative yield to call of 5.08%, given the longer term to first call, however this equates to a lower credit margin of circa 295bps due to the higher ranking in the capital structure.

QBE released its 1H14 results last week and they were in-line with expectations, which is not surprising given the company provided an update/profit warning to the market just three weeks prior.

The full investor presentation can be viewed by clicking here:

The key figures from the release were as follows:

- Net profit after tax $392m (1H13: $477m)

- Cash profit $416m (1H13: $590m)

- Gross written and net earned premium of $8.5bn (1H13: $9.4bn) and $6.9bn (1H13: $7.3bn) respectively

- Prescribed Capital Amount (PCA), which is the key APRA measure of regulatory capital, 1.56x (FY13 1.59x)

- Debt to equity ratio 38.4% (FY13: 44.1%)

While recent operational performance has been disappointing, QBE remains profitable with cash profit numbers that are ‘good enough for debt’ despite being a major disappointment to the equity market.

However, the results did come with a significant announcement for debt investors in the form of a capital plan. This is bordering on a game changer in our view as it is expected to see a sizeable improvement in regulatory capital and more importantly leverage.

The two most important statements in the 55 page results presentation were the following:

“Capital targets:

- Target PCA multiple of 1.7x-1.9x

- Target debt to equity of 25%-35%”

These are important for debt investors for two very important reasons.

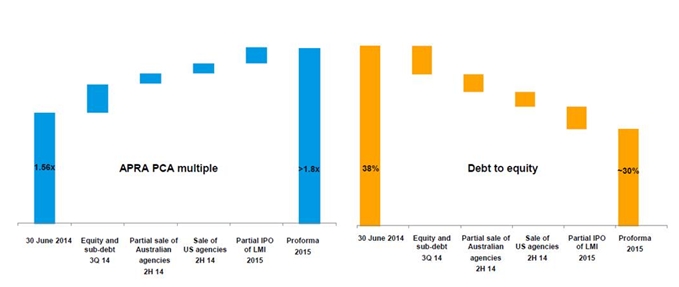

Firstly, the achievement of those absolute targets would clearly result in an improvement of credit quality. The Prescribed Capital Amount as at 1H14 was 1.56x. Through equity raisings, asset sales and a partial IPO of the lenders mortgage insurance business, this crucial indicator of capital strength is expected to be over 1.8x by calendar year 2015 (as demonstrated by the chart below). This is a very meaningful increase.

The same events (and reduction in debt) are expected to see the debt to equity ratio fall from the current 38.4% at 1H14 to around 30% over the same short period. As recently as December 2013, debt to equity was 44.1%, demonstrating the considerable deleveraging that has been a focus of management.

The most significant and immediate of these announcements is the raising of $650m in equity which has essentially been completed already. Asset sales are expected this year and the partial IPO of the lenders mortgage insurance business at some point in 2015.

The second reason is the clear statement that QBE has made to the market that it is focusing on deleveraging and building capital and not looking for growth. QBE has been renowned in the past for acquisition-led growth and hence being more aligned to equity investors. These two announcements suggest QBE is becoming a debt centric, as opposed to equity centric company as it consolidates after years pursuing growth. Such visible and defined capital and leverage targets also give management a very clear focus.

As mentioned previously, operational performance has been disappointing but QBE remains profitable with cash profit numbers that are ‘good enough for debt’. However, the capital plan and sizeable improvements expected in the two key measures of PCA and debt to equity ratio are the real news for debt investors in QBE. Further, the improvement is expected to be rapid with the $650m equity raise essentially completed and a number of other asset sales planned for this year.

The QBE USD 6.797% “old style” step-up Tier 1 security with a first call date of 1 June 2017 is considered excellent value and is currently offered at an indicative yield to call of 4.08% (which equates to a credit margin of circa 300bps). Alternatively the QBE USD 7.25% re-settable subordinated debt issue with a first call date of 24 May 2021 and final maturity date of 24 May 2041 is currently offered at a higher indicative yield to call of 5.08%, given the longer term to first call, however this equates to a lower credit margin of circa 295bps due to the higher ranking in the capital structure. We continue to expect QBE to call these securities at first opportunity as they have consistently done in the past.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Both QBE USD securities mentioned in this article are available to wholesale investors only.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.