by

Justin McCarthy | Mar 04, 2014

Key points:

- Rabobank FY13 results were solid, with NPAT of €2.0bn (FY12 €2.1bn).

- The capital position is excellent and amongst the highest of all global commercial banks – total capital ratio is 19.8% (FY12 19.0%) and Core Tier 1 ratio 13.5% (FY12 13.1%).

- Similar to our views on AXA and Swiss Re callable Tier 1 securities, Rabobank AUD Tier 1 securities, which are due for first call on 31 December this year, are viewed as “fully priced” and investors should consider taking profits and remove the call risk.

Rabobank reported their full year results to 31 December 2013 (FY13) last Thursday with a headline net profit after tax (NPAT) of €2.0bn, down 2% on the previous year figure of €2.1bn.

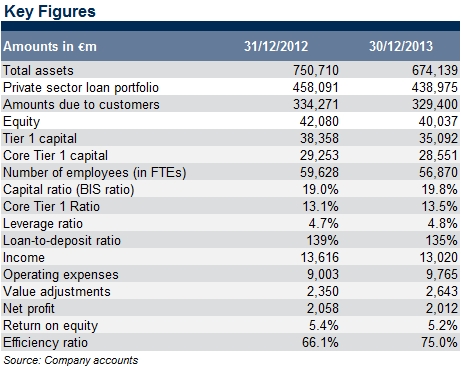

Key figures from the FY13 result included:

- NPAT of €2.0bn, down 2% from €2.1bn. Underlying profit improved but a number of one-off expenses (i.e. sale of Robeco, transition to a new pension scheme and €774m settlement for Libor fixing scandal) led to the small decline in NPAT

- An increase in impairments at Rabo Real Estate Group also had an inverse impact with the division reporting a €817m net loss for the year

- “Value adjustments” (i.e. provisions for non-performing loans) across the Group increased to €2.6bn or 0.59% of total loans, significantly above the 0.28% long term average, but still low by peer comparison. The downturn in the Dutch economy being the main contributor to the decline over recent years

- Total assets were down 10% to €674bn due to the sale of Polish Bank BGZ and low demand for loans, as well as early/pre-payment of residential mortgages

- Total equity was down 5% to €42.1bn

- Total capital ratio of 19.8%, up from 19.0% at FY12 (target >20% by 2016). Amongst the highest of any commercial bank globally

- Core Tier 1 ratio of 13.5%, up from 13.1% at FY12 (target >14% by 2016). Amongst the highest of any commercial bank globally

- Solid funding profile with an improved loan-to-deposit ratio of 135% versus 139% a year earlier (target <130% by 2016)

- Outlook is for minimal volume/revenue growth as the Dutch economy is forecast to remain flat, but NPAT expected to improve with less one-off events forecast for FY14

The following table highlights the key measures over the past two years.

Table 1

Conclusion

While the results for Rabobank were relatively solid and capital remains at world best levels, the relative value assessment of the AUD Tier 1 securities (callable on 31 December this year) are that they are “fully priced”, particularly the fixed rate securities that are trading at a premium.

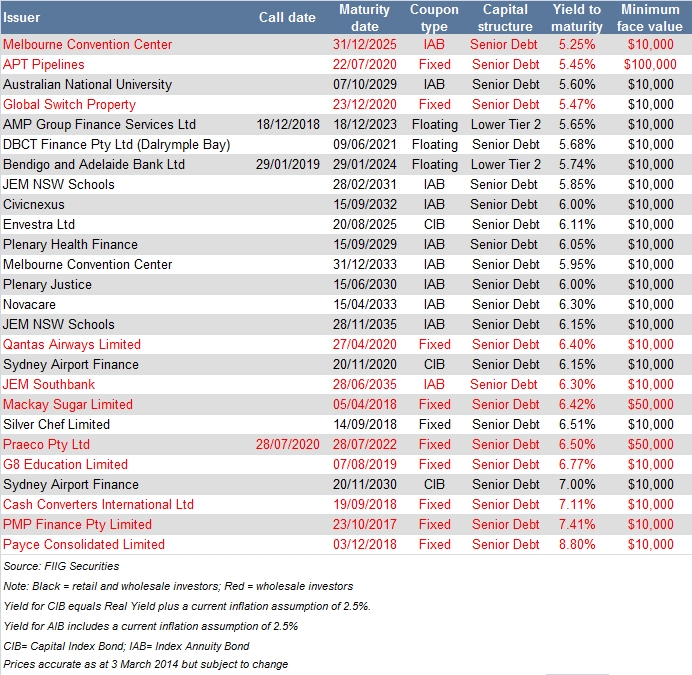

As we wrote last week with respect to AXA and Swiss Re, investors should consider the balance of their portfolio with regards to callable securities and if appropriate look to take profits, remove or reduce call risk and re-balance portfolios, remembering that many bonds are now available in parcels as small as $10,000, allowing for greater diversity of holdings.

Investors can exit the Rabobank Tier 1 fixed rate securities at circa $100.80 (yield to call of 5.39%) and the floater at circa $98.35 (yield to call 5.34%).

The following table lists a number of alternative investments with a yield to maturity/call of 5.5% or better:

Table 2