Hybrids and Subordinated Debt: What is the issue?

Since Basel III standards were implemented last year, the terms and conditions on subordinated debt issues – Tier 2 (T2) and Additional Tier 1 (AT1) – have included “non-viability” clauses that allow regulators to force issuers to convert these securities into equity in a worst case scenario. These securities have come to be known as “bail-in” hybrids or Contingent Convertibles (Cocos) and over time there has been a divergence of trends in these markets: commentary from professional participants has been increasingly cautionary on the risks, but simultaneously new issuance has been executed at increasingly tighter margins.

This paper is not intended to serve as a detailed source for Basel III standards or the specific amendments to standard T2 and AT1 issuance. It is instead a summary of the resulting trends and a call for investors to make your own assessment of the risk in these securities and act accordingly.

Beginning in December last year we started seeing new style T2 debt issuance in Australia, with margins offered between 2.65% and 2.80% over the bank bill swap rate (BBSW). More recently, we have seen issuance from Westpac at BBSW+2.05% and from ANZ at BBSW+1.93%. Trends in AT1 (listed hybrid) issuance have been following a similar trend.

Below is a timeline of some of the relevant commentary and events surrounding these securities, which is progressively cautionary:

- January 2014: FIIG prints three articles on the introduction of Cocos: here are links to Part One, Part Two, and Part Three.

- February 2014: Credit Suisse offers to buy back an old-style hybrid early, citing the change in regulation. The bonds were trading as high as $107 and were bought back at $103, which clearly would have been a very bad outcome for anybody who recently acquired the bond.

- 05 August 2014: FIIG research highlights the risks in new-style subordinated debt and hybrids.

- 05 August 2014: The Financial conduct Authority (UK regulator) bans the sale of Cocos to retail investors, deeming them inappropriate risk for the mass retail market.

- 26 August 2014: FIIG’s Head of Markets, Craig Swanger, publishes an article in The Wire warning of the risks in bail-in hybrids.

- 13 September 2014: The Economist prints an article warning of the risks of new style bank hybrids (Cocos).

- 15 September 2014: FIIG senior management issues internal ban on marketing of Cocos, on the basis the risks more closely resemble equity than fixed income.

- 19 September 2014: Standard & Poor’s warns that many Cocos can expect to be downgraded in the coming weeks on higher risk of losses, with 65% of all existing AT1 Cocos expected to fall by 1 notch, 15% by 2 notches and the remaining unchanged. This would see only a very small percentage of all AT1 Cocos worldwide remain in the investment grade category.

One salient quote from the Economist article is “Cocos take multiple forms, but all are intended to behave like bonds when times are good, yet absorb losses, equity-like, in a crisis”. This is important, because in essence it is saying that these instruments provide all the downside of fixed income (lower returns) with all the downside of equities (higher risk).

You can glean from the above that our view on the topic is clear. But the investor must form his/her own view and act accordingly.

Hybrids and Subordinated Debt: How does it affect me?

These trends affect investors who hold new-style Contingent Convertible T2 bonds and AT1 listed hybrids (also known as “bail-in” hybrids), as these are the securities that contain the non-viability clauses. However, it should also serve as a wake-up call to those who hold old-style T1 hybrids as well; while those securities do not contain the non-viability clause, many still resemble equity more than fixed income in their terms, and will trade with equity-like volatility in times of crisis. As a case in point, the Swiss Re May 2017c T1 hybrid, which is currently trading at a capital price of around $105, was trading below $50 during the GFC.

The securities held by our clients that could be affected are specifically as follows:

New Style T2 Securities (unlisted)

- Insurance Australia Ltd 19Mar19c floating rate note

- Bendigo and Adelaide Bank 29Jan19c floating rate note

- ANZ Banking Group 25Jun19c floating rate note

- Westpac 14Mar19c floating rate note

New Style T2 Securities (listed)

- AMP Subordinated Notes II (AMPHA)

- Suncorp Subordinated Notes (SUNPD)

- Westpac Subordinated Notes II (WBCHB)

Old Style T2 Securities (listed)

- ANZ Subordinated Notes (ANZHA)

- Colonial Group Subordinated Notes (CNGHA)

- NAB Subordinated Notes (NABHB)

- Westpac Subordinated Notes (WBCHA)

New Style AT1 Securities (listed)

- ANZ CPS3 (ANZPC)

- ANZ Capital Notes (ANZPD), ANZ Capital Notes II (ANZPE)

- Bendigo/Adelaide Bank CPS (BENPD)

- Bank of Queensland CPS (BOQPD)

- CBA PERLS VI (CBAPC), CBA PERLS VII (CBAPD)

- IAG CPS (IAGPC),

- Macquarie Group Capital Notes (MQGPA)

- NAB CPS (NABPA), NAB CPS II (NABPB)

- Suncorp CPS2 (SUNPC), Suncorp CPS3 (SUNPE),

- Westpac CPS (WBCPC), Westpac Capital Notes (WBCPD), Westpac Capital Notes II (WBCPE),

Old Style T1 Securities (unlisted)

- Swiss Re 25May17 fixed coupon bond, Swiss Re 25May17 floating rate note

- AXA 26Oct16 fixed coupon bond, AXA 26Oct16 floating rate note

- National Capital Instruments 30Sep16 floating rate note

Old Style T1 Securities (listed)

- ANZ CPS2 (ANZPA),

- Bendigo Bank Peps (BENPB)

- CBA PERLS III (PCAPA)

- IAG RES (IANG)

- Westpac TPS (WCTPA)

Income Securities

- Macquarie Bank Income Securities (MBLHB)

- NAB Income Securities (NABHA)

- Suncorp-Metway (SBKHB)

Hybrids and Subordinated Debt: What should I do?

As an investor, if you hold any of these securities you first need to consider whether the risk/reward trade-off is acceptable. Are the securities paying enough return to your portfolio to accept the inherent downside risks? If the answer to that is “yes”, then there is no action required on your part.

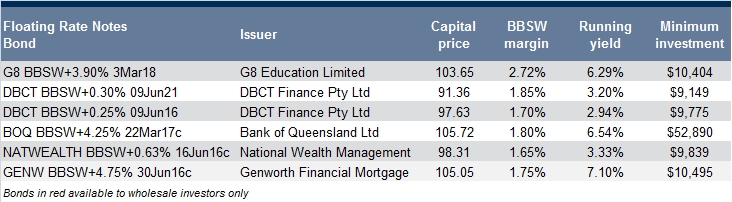

If, however, you decide that the securities are not appropriate for your fixed income portfolio, the decision needs to be made as to what represents a suitable replacement. With only a few exceptions, these T2 and AT1 securities are all floating rate notes (FRNs), and finding FRNs that offer good relative value and don’t fall into one of these risk categories is currently quite difficult. Some of the few bonds in that space are as follows:

Without exception though, all of these can be troublesome to find at times, as supply is only sporadic. However, alternatives to these may lie in the inflation linked bond universe, with a range of capital indexed bonds and indexed annuity bonds offering good spreads over the rate of inflation. There is a school of thought that maintains these instruments are suitable replacements for a portfolio of fixed and floating rate bonds, as they contain a fixed element (the yield over CPI) and a floating element (the actual CPI rate).

There is a broad cross-section of inflation linked bonds in the Australian market to choose from, with varying degrees of availability. Some of the securities we see frequently are as follows:

For investors less concerned about asset allocation into floating rate or inflation linked securities, there are a wide range of fixed coupon alternatives that could be considered. Further information can be provided on these or most other bonds upon request.

Please contact your FIIG representative if you wish to discuss measures that can be taken to reduce this or any other portfolio risk you may have concern over.

The various bonds prices or yields referred to in this email are the market prices available through FIIG as at the date of this email and subject to change without further notice.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.