by

Elizabeth Moran | Dec 09, 2013

Key points:

1. Because rate rises are already factored into bond prices, interest rate rises themselves don’t impact the price of bonds. It’s the changes in expectation which impact bond prices.

2. No matter what happens to interest rate expectations, if you are a hold to maturity investor, fixed rate bond income and final overall return will be known when you purchase the bonds.

3. Some favoured fixed rate bonds are: Qantas, Stockland, Dampier Bunbury Natural Gas Pipeline and Downer EDI.

Consciously or unconsciously investors make decisions about the direction of interest rates when they invest. For example if you have $100,000 to invest for a year in a term deposit, do you take the best rate for the coming year which might be for 90 days and hope that interest rates rise in the meantime, so that when you come to reinvest you will earn more income, or do you invest for the whole year at a lower rate?

The way in which institutional investors assess likely changes in interest rates is by analysing the bank bill swap rate (BBSW) yield curve. This curve constantly changes. Every business day, a panel of banks project their forward interest rate expectations for periods from one day out to 30 years and by joining these expectations over time the market builds the yield curve. This yield curve, therefore, represents the banks’ forward expectations of interest rates.

The current curve is positive, meaning interest rates are expected to rise gradually over time. In fact the current curve shows that interest rates are projected to rise by just 1 per cent over the next three years and 1.34 per cent over five years. In ten years’ time the banks forecast the swap rate at 4.67 per cent, a rise of 2.17 per cent over the cash rate. What most investors don’t realise is that these forward rate expectations are already built into the price of fixed rate and floating rate bonds that are trading in the secondary market.

Because rate rises are already factored into bond prices, interest rate rises themselves don’t impact the price of bonds. It’s the changes in expectation which impact bond prices.

If we consider the current curve, and the expectation that rates will increase by 1.34 per cent in five years, this increase is already factored in. If interest rates do not rise as expected and are lower, the price of fixed rate bonds would rise (resulting in higher returns if investors sell the bonds prior to maturity). The opposite is also true. This function is similar to share prices when news of a loss “wasn’t as bad as expected” and so the share price rises; despite bad news.

No matter what happens to interest rate expectations, if you are a hold to maturity investor, fixed rate bond income and final overall return will be known when you purchase the bonds. Fixed rate bonds pay the same dollar income every year regardless of what happens to interest rates. It will just cost more to buy the bond in the future if interest rates don't go up as currently expected.

If your individual expectations of interest rates differ from those shown in the curve, you can then weight your portfolio accordingly.

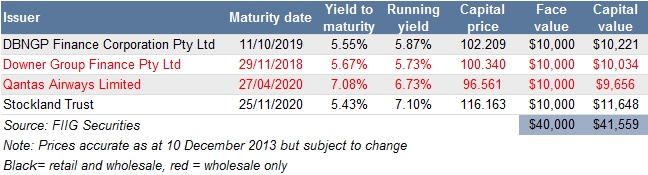

Like any market, it comes down to where you see the risks: do you think there is a bigger risk of disappointing economic news (in which case the yield curve will fall or flatten). If so, then you should have a higher allocation to fixed rate bonds. Our current favourite fixed rate bonds are listed in Table 1.

Table 1

Key terms

Bank bill swap rate (BBSW)

A compilation and average of market rates supplied by domestic banks in regard to the specific maturities of bank bills. BBSW is calculated at ten o’clock every morning and compiled by AFMA.

The purpose of BBSW is to provide independent and transparent reference rates for the pricing and revaluation of Australian dollar derivatives and securities.

Yield curve

A graph showing the relationship between yield to maturity and time to maturity