by

Elizabeth Moran | May 27, 2014

There’s something innately attractive about property. It’s tangible; it can be beautiful or have cultural, historical or sentimental value. Coupled with attractive negative gearing benefits for high income earners, the asset class has a lot going for it. However, direct property investment might not always be the best way to have property exposure in your portfolio. The fixed income asset class offers alternatives.

For example, investors can acquire a senior bond in Stockland, Mirvac or Lend Lease offering a known return and a known maturity date. There is no guesswork in trying to locate growth hotspots or uncertainty regarding return on investment as it is known from the outset. Investors at all times are beneficial owners of the bonds and can buy and sell at their discretion.

Another way to gain property exposure through fixed income is via Residential Mortgage Backed Securities (RMBS). According to the Reserve Bank, as at 31 December 2013 RMBS on issue totalled A$104 billion. For the year to 15 April 2014, there has been over A$6 billion of new RMBS issued.

Investors in individual residential properties face concentration risk, illiquidity (it’s hard to sell 10% of the value of a property to fund an overseas holiday or family emergency) and unknown returns given vacancies, unplanned maintenance and expenditure and variable interest rates.

However, by combining many mortgages into a large and diversified pool via a trust and then breaking the combined pool into smaller, marketable classes, the RMBS become attractive to investors.

Different classes of RMBS offer a spectrum of risk although they are typically low risk due to high underwriting standards, conservative loan to value ratios (averaging around 70%) and the fact that loans retain full recourse to the borrower if selling the property can’t recover the borrowed funds.

RMBS pass through the principal repayments from the pool of mortgages, unlike bonds that pay interest and principal at maturity, so RMBS terms can be quite short.

The concept of breaking the pool into varying classes of securities allows investors with specific risk appetites to target the appropriate class and returns they are seeking.

In this way, the classes act like a normal company capital structure, where investors with the lowest risk appetite target the senior bonds (or in the case of RMBS, the highest classes) and those with a higher risk appetite target the lower ranked capital, like hybrids or shares (or in the case of RMBS, the lowest ranking classes).

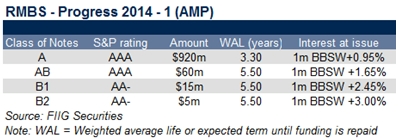

The example shown was an RMBS issued by AMP in March 2014, which originally targeted capital of $500m, but due to strong investor demand was upsized to $1 billion. The loans on average have been operating for three years, providing comfort to investors of the ability of the borrowers to meet repayments. All of the loans have lenders mortgage insurance, which completely covers any losses experienced by the lender.

RMBS developed due to the need of banks and other financial institutions to source funding for their lending activities. RMBS provide another source of funding for lenders in addition to customer deposits and corporate borrowings. Virtually all Australian Prudential Regulation Authority (APRA) regulated lenders use RMBS as a source of funding. Investors in RMBS include super funds, insurance companies, high net worth investors, and occasionally, the Commonwealth government. Prior to the financial crisis around 25% of housing credit in Australia was funded through RMBS, and while this level has decreased, RMBS still represents around 10% of housing credit funding in the Australian market.

RMBS are low risk investments that are in high demand and tightly held. If you are interested in these securities you need to contact your bond broker, they are only available in the over-the-counter market. FIIG Securities occasionally buys parcels which it then sells to wholesale investors from $50,000.