Key points:

- Seven year corporate maturities are the theme of the year

- Yield curve steepening offers higher returns

- Recommended 7 year bonds include: Cash Converters, Downer, G8 Education and Qantas

An emerging theme in credit markets over the last 12 months has been the emergence of seven year terms for corporate issuers. There has been a significant number of issuers (see the Table 2 for a full list of issuance) offering bonds with seven year maturities, many of which are new names for our market.

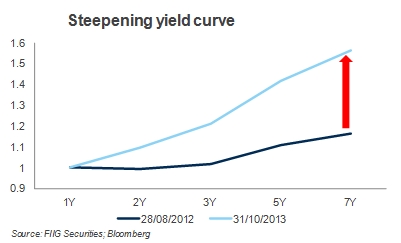

I have written about the steepening of the yield curve previously, but Figure 1 shows it graphically. When I wrote about the flat curve back in August last year I noted that it initially dipped, and that investors weren’t getting value for going long. Fourteen months on and we can see that there is a dramatic increase over the length of the curve (note that the y-axis on the graph is not the interest rate, but rather have been indexed against the respective one year yield for comparison sake).

Figure 1

Back in August last year, investors were receiving just 0.532% more for investing for seven years than they were receiving for investing for one year. With the steepening of the curve investors are receiving 1.474% extra for going long. This increase of almost 1% gives a better reflection of the risk/return for investors taking longer maturities.

This movement in the curve, combined with the flurry of new issues targeting maturities in this range, means that some of the best value currently available to fixed income investors sit in the five to seven year timeframe.

So which bonds are offering the best value?

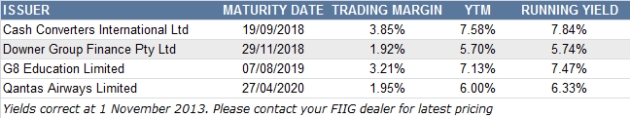

Qantas and Downer are offering the best returns for investment grade senior credit in this space with running yields of 6.33% and 5.74% respectively.

Table 1

Beyond the rated issues, we also like the extra returns on offer for investors in the unrated issues by Cash Converters and G8 Education. Adding these two names to the mix gives investors the opportunity to earn stronger returns on their fixed income portfolio.

Were you to invest in a portfolio of these names in equally weighted portions, the portfolio would return a running yield of 6.33% and a yield to maturity of 6.44% and be diversified across five completely non-related sectors.

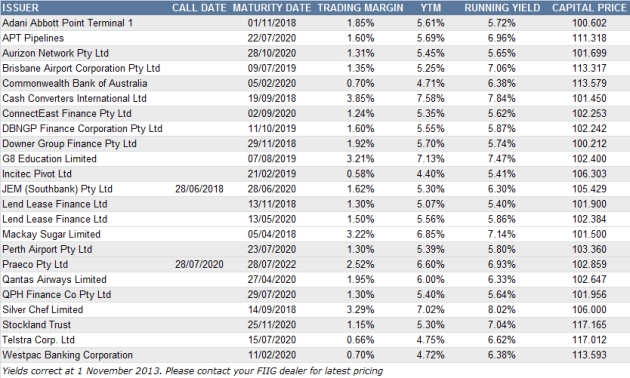

Full list

Below is a list of all the bonds with maturities in the targeted range from which we chose our preferred options. All of these bonds are available to wholesale investors (bonds will gradually season and may become available to retail investors depending on issue date and prospectus). We have chosen our favorites based on a mix of yield and industry diversification; however speak to your FIIG representative if you are interested in any of the options listed below.

Table 2

Note: Yields quoted are accurate as at 1 November 2013 and subject to change.