by

Elizabeth Moran | Dec 09, 2013

Key points:

1. If you are worried about a correction, it might be worth increasing your defensive asset allocation.

2. A short dated bond portfolio will offer better returns than term deposits and greater certainty than shares. We highlight five bonds that have first call or final maturity dates from nine to 21 months.

Christmas is a time to unwind and relax and reflect on the year just gone while taking time to plan for the year ahead. I think it’s a good time think about the direction of markets and the likely main themes for 2014 and then revise your portfolio allocations accordingly.

Just this week, gross domestic product (GDP) grew at a lower than expected rate of 0.6 per cent, compared to forecasts of 0.8 per cent for the September quarter, for an annual rate of 2.3 per cent. The figures support our expectation that interest rates will be low in 2014.

However, 2013 has been good for many investors with excellent share market returns and rising property prices particularly in Sydney and Melbourne. The questions with any strong performing market is if there’s any remaining value and whether there’s any chance of a correction. One thing is certain and that is markets are cyclical.

If you are worried about a correction, it might be worth increasing your defensive asset allocation. Investors’ predominantly holding term deposits have had steady but lower returns this year and allocating some of this cash to a slightly higher risk bond portfolio could increase your level of income for 2014. While those investors with high allocations to growth assets might sleep easier over the holiday season by taking some profit and risk off the table and rebalancing their portfolios to have higher defensive allocations.

A low risk bond portfolio is very much the middle ground between cash and shares, but definitely closer in terms of risk and reward to cash.

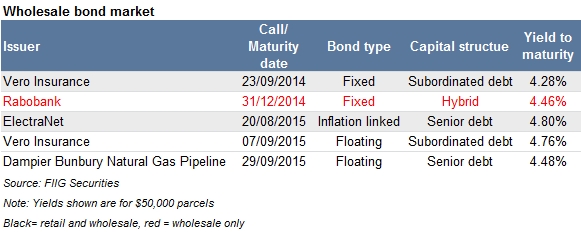

The table shows a sample of short dated securities intended to provide certainty compared to growth assets and better returns than term deposits. The expected maturity dates range from nine to 21 months and given the short timeframes give investors a lot of certainty that they will be repaid on those dates. The Vero 2014 fixed rate bond also has a floating rate option with the same call date, and vice versa with the Vero 2015 floating bond. The Electranet inflation linked bond won’t provide long term inflation protection but if inflation is 2.5 per cent (the RBA target mid-point) then its return will be close to 5 per cent, which is excellent given the very low risk of this investment. None of the issuers are listed on the ASX (although Vero is an insurance subsidiary of Suncorp Metway) providing diversification to portfolios with high allocations to shares.

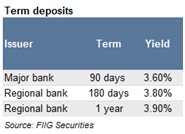

The best term deposit rates for the next year are all under 4 per cent. A major bank is offering 3.60% for 90 days while regional banks are offering 3.80% for 180 days and 3.90% for a year (minimum investment $100,000). To achieve over 4 per cent you’ll need to commit to a two year term.

Christmas holidays are a time to recharge your batteries and take stock. I also think there comes a point where you shouldn’t have to worry day to day about the performance of your investments. Finding a balance between the certainty of fixed income and more volatile growth assets should help you sleep at night.

Note: Rates are accurate as at 10 December 2013 but subject to change