by

Justin McCarthy | Aug 13, 2013

Swiss Re reported 2Q13 results (to 30 June 2013) last week with another solid performance given the higher occurrence of natural catastrophes. However, despite an increase in premium volumes, pricing declined suggesting that the market may have turned or “softened”.

Key figures from the 2Q13 results included:

- Net income of US$786m for the 2Q13 compared to US$83m in 2Q12

- Property & Casualty (P&C), net income declined to US$468m from US$717m in 2Q12 due to a higher number of natural catastrophe losses than expected (mainly claims from flooding in Europe and Canada – US$300m and US$177m respectively). As a result there was a material decline in the combined ratio to 100.7% from 81.0% in 2Q12

- Premiums for P&C increased 12% to US$3,170m

- Life earnings declined to US$141m compared with US$248m in 2Q12 primarily due to lower investment income and an increase in reserves for the Australia business

- Premiums for the Life business increased 16% to US$2,499m

- Admin Re reported a net income of US$109m which was unchanged from the corresponding quarter last year after removing the one-off loss on the sale of the US business in 2Q12

- Corporate Solutions posted a quarterly profit of US$55m, up from US$26m in 2Q12. Premiums earned rose by 28.0% to US$686m

- Annualised return on investments of 3.8% was down from 4.5% in 2Q12. Net realised gains from investments totalled US$309m compared with US$486m in 2Q12

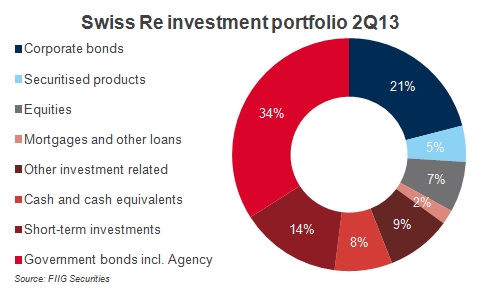

- Swiss Re continued to rebalance its investment portfolio by shifting out of government bonds and mainly into corporate bonds and other credit investments and, to a smaller extent, into equities which is viewed as appropriate (see Figure 1 below for the current portfolio mix)

- Management reported that the July renewals saw premium volume increase 12% but a 5% fall in pricing

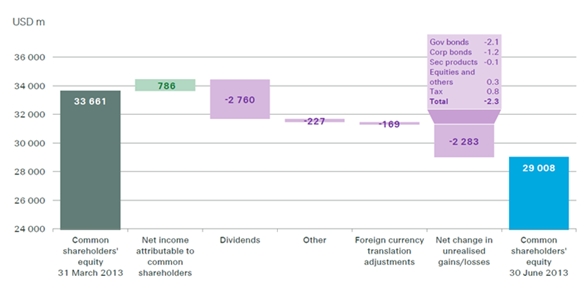

- Decline in common shareholders’ equity from US$33.6bn at 1Q13 to US$29.0bn at 2Q13, predominately due to the higher dividend payment of US$2,760m and a US$2,283m decline in unrealised capital gains from rising yields and the negative impact on fixed income investment valuations (see Figure 2 below)

- Swiss Re will celebrate its 150th anniversary this month, a reminder of its longevity

Company presentation 2Q2013

Figure 1

As previously written, the one negative for Swiss Re from recent results has been its desire to return capital to shareholders. Similar to Suncorp, Swiss Re has built capital to such excessive levels that it can afford to return a portion to shareholders via an increase in regular and special dividends. As Figure 2 below shows, this trend continued in the 2Q13 with shareholders’ equity down US$4.7bn for the quarter.

Common shareholders’ equity Q2 2013

Company presentation 2Q2013

Figure 2

While any reduction in capital levels below the Tier 1 hybrid holders is negative as it reduces the buffer below debt investors, it is important to note that Swiss Re had built capital up to an extremely high level and that management would not pay out an amount that would compromise the credit rating.

The other development of note is an apparent change in reinsurance pricing. Based on the July renewal data reported by management, it appears that after a sustained period of improving prices, the excess supply of capital in the reinsurance market (and stagnant demand for reinsurance) has resulted in a “softening” of the market. In such an environment, it is important to maintain strong underwriting discipline to ensure unprofitable business is not taken on in the name of growth and this will be a focus of our analysis in coming quarters.

Swiss Re's investment portfolio quality remains strong with little exposure to stressed European sovereign debt and as detailed above, the company has continued to sell down its overweight position in government bonds (particularly US Treasuries) and increase its exposure to corporate bonds and to a lesser extent equities which is viewed as appropriate.

Conclusion

Swiss Re continues to perform well and its AA- senior rating is representative of its credit strength, the same as the Australian major banks.

While capital returns and a fall in July renewal pricing are slight concerns, we remain very comfortable with the credit

With respect to the Swiss Re Tier 1 hybrid securities we continue to believe they represent amongst the most compelling risk-return investments in the market. Swiss Re Tier 1 securities are rated two to three notches above ASX listed Tier 1 hybrid securities issued by the major banks, however they continue to trade in line or even wider due to the market’s perception of call risk and exposure to Europe, both of which we believe are overstated. Moreover, we prefer the structure of the “old style” Swiss Re Tier 1 hybrid securities to the more equity like “new style” listed bank hybrids.

We also view Swiss Re as a far superior credit compared to AXA SA and with only a 39bp differential between the two A$ fixed rate Tier 1 hybrid securities, we prefer Swiss re on a risk/reward basis (see the conclusion in the “AXA SA 1H13 results review – good results but better value elsewhere” article for further details)

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Swiss Re Tier 1 hybrid securities are only available to wholesale investors.