by

Elizabeth Moran | Mar 15, 2013

This article was submitted to the Eureka Report on Monday. It discussed the recent strong results by Swiss Re.

Summary

- Swiss Re, the big Swiss reinsurer has an AUD Tier 1 hybrid currently providing a yield to first call of 6.67%

- Strong FY12 results with a net profit of US$4.2bn and an ever improving business profile mean that it’s AUD hybrid is a “buy” representing excellent relative value

Company Background

Swiss Re is a leading and highly diversified global reinsurer. The company operates through offices in more than 20 countries. Founded in Zurich, Switzerland in 1863, Swiss Re offers financial services products to corporate, government and private customers. The company is focused on accessing, transferring, and transforming insurable risks. Listed on the Swiss Stock Exchange, Swiss Re has a market capitalisation of circa US$30bn and is the world’s second largest reinsurer behind Munich Re.

The company’s operations are well diversified by both product line (with Property and Casualty and Life and Health representing 56% and 44% of premiums) and geographically (with Americas contributing 44% and Europe, Middle East and Africa 40% of premiums).

Swiss Re also operates Asset Management (i.e. management of its own investment assets/excess premiums) as a separate division. This division is charged with managing the assets Swiss Re generates though its insurance activities and ensuring assets and liabilities are matched.

Key points to note:

- In October 2011, Standard & Poor’s upgraded Swiss Re’s credit rating by one notch from A+ to AA-, confirming the progress made by management, particularly in capitalisation levels with total equity increasing from US$20.4bn at December 2008 to US$34.0bn at December 2012 (consistent with “AAA” level of capitalisation). At AA- Swiss Re is rated the same as the four Australian major banks

- Sustained improvement in profitability and equity since the GFC have underpinned the improvement in credit fundamentals, and the FY12 results (net profit after tax US$4.2bn and total equity US$34.0bn) exhibit a continuation of those trends. However, the recent results did come with one negative for debt holders being the return of excess capital by way of increased ordinary dividends and a special dividend which will see US$2.8bn returned to shareholders

- Regulatory changes, namely Basel III (for banks) and Solvency II (for insurers), are forcing financial institutions to jettison insurance risk to improve capital. This has created a “buyers market” for reinsurers where they can cherry pick the most attractive reinsurance contracts

- Swiss Re maintains a very strong balance sheet with a high quality investment book. Recent reductions in overweight sovereign debt positions, particularly US Treasuries, into corporate bonds have been perfectly timed to maximise the performance of the investment book

- The main risk for Swiss Re remains the unpredictable nature of natural catastrophes. However, its strong underwriting discipline, massive levels of capital and the fact it has been in existence for almost 150 years suggests that it can manage those risks

Financial results

Last year saw a continuation of very strong premium growth, with premium and fee income up 14.7% to US$25.4bn for the year. After some major claims in 2011, with the Japanese earthquake and tsunami, Swiss Re saw an increase in demand for insurance and price to insure last year (that’s always the catch with an insurance company, they may suffer significant losses in any one year yet can claw back the loss in future years by increasing premiums), helping with the outstanding result.

Natural catastrophe premiums for 2012 were US$2,530m while payouts totaled just US$1,152m, demonstrating a very profitable year. Profitability was aided by the lack of major insurance payouts, with the exception of an estimated US$900m payout for Hurricane Sandy.

Another highlight was that the investment portfolio continues to perform despite the low yield environment. Investment income for FY12 was US$5.3bn (FY11 US$5.5bn), which represents a return on investment of 4.0% (FY11 4.4%) for a very low risk portfolio, supported by falling interest rates/yields and gains on fixed income investments.

A large balance sheet with total assets of US$215.8bn and total investments of US$152.8bn (plus cash and cash equivalents of a further US$10.8bn); Swiss Re has a very small US$19m in direct exposure to Portugal, Italy, Ireland, Greece and Spain. The vast majority is in high quality, low risk Government bonds, particularly US Treasuries and other low risk fixed income assets.

Swiss Re looks to be reaping the rewards of the economic conditions and regulatory changes facing both banks (i.e. Basel III) and insurers (i.e. Solvency II) that encourages those financial institutions to seek to remove assets/risk from their balance sheets via reinsurance, creating a very attractive environment for Swiss Re to grow and cherry pick high yielding business.

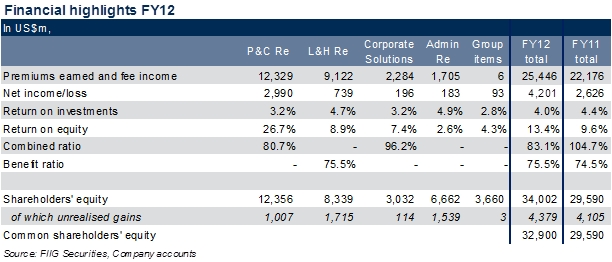

At the end of December 2012 shareholders' equity was US$34.0bn (US$32.9bn common shareholders’ equity and US$1.1bn contingent capital instruments), up from US$29.6bn at December 2011 (see Table 1 below for financial highlights for the full year ended 31 December 2012).

Table 1

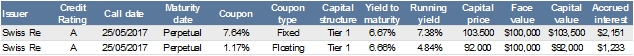

Swiss Re have both a fixed and a floating rate AUD hybrid, both with a first call of 25 May 2017 (see Table 2). These hybrids were first issued in 2007 with the old style “step-up” penalty should they not call at the first opportunity. This feature coupled with the very strong financial standing of the Group give us confidence that the company will call in May 2017. The new style listed major bank equity hybrids do not have this feature.

Table 2 shows that the estimated yield to maturity for both hybrids is almost the same. However the way the payments are made is different. The fixed rate bond pays a high fixed interest payment until maturity and given the $103.50 purchase price, the running yield (your effective interest payments made for a year) is 7.38%, providing a high income. Whereas the floating rate hybrid is trading at a discounted purchase price of $92.00 and the running yield is lower at 4.84%. However, you make a capital gain when the hybrid is repaid as you receive $100 at maturity. The fixed rate bond will show a loss at maturity of $3.50, but this is compensated by the high fixed interest payments in the meantime.

Swiss Re fixed and floating are two of the best relative value hybrids available and would make a great addition to a portfolio as they provide:

- Excellent diversification with a large, well-regarded international company away from Australian domestic names

- An opportunity to fix returns, providing certainty of income. Very few ASX listed hybrids offer this feature. All the major bank hybrids are floating rate

- Very low risk with the hybrids being rated two to three notches higher than our major bank listed hybrids

Swiss Re hybrids

Note: Yield for floating rate notes is the swap rate to maturity/call plus the trading margin.

Wholesale investors only, minimum face parcels $100,000

Table 2

If you’d like more information please call 1800 01 01 81. All prices and yields are accurate as at 1 March 2013 and are a guide only, subject to market availability. FIIG does not make a market in these securities.