by

Justin McCarthy | Nov 11, 2013

Key points:

- Swiss Re reported another strong set of figures with 3Q13 NPAT of US$1.1bn and solvency ratio of 227%

- Existing holders should assess their holding period returns and consider taking some profits while any wholesale clients who do not hold an exposure to Swiss Re should consider adding them to their portfolio

Swiss Re reported their 3Q13 results (to 30 September 2013) last week with a very healthy net profit after tax (NPAT) of US$1.1bn for the quarter on the back of strong property & casualty (P&C) performance and solid investment earnings from the fixed income investment book.

More important for debtholders was the continually improving shareholder’s equity, now US$31.9bn, and the very high Swiss Solvency Test (SST) ratio of 229%; both reinforcing the high capital base of Swiss Re. The company also reported on continued success in deleveraging with the following statement:

“Swiss Re made further progress in optimising its capital structure in the quarter by reducing debt, for instance by the repurchase of USD 713 million of senior notes and the maturing of USD 750 million of senior debt. These are significant steps towards Swiss Re's overall target of reducing leverage by more than USD 4 billion by 2016.”

Highlights of the result included:

- NPAT US$1.1bn for the quarter producing a return on equity of 14.3%

- P&C Reinsurance US$807m contribution and combined ratio of 80.9%

- Life & Health Reinsurance result impacted by further reserve strengthening for Australian group disability business and as a consequence the division’s contribution was just US$12m for the quarter

- Corporate Solutions reported premium growth of 34.5% and a contribution to profit US$71m

- Capital position remains strong with shareholders' equity of US$31.9bn and Group SST ratio of 229%

- Investment book rebalancing largely completed – asset allocation to high-quality corporate bonds and equities increased in the overall portfolio to 28% and 7% respectively, resulting in a positive impact on the running yield of the portfolio

- Investment income of US$1.0bn and a Group return on investments of 3.5%.

As highlighted in our recent commentary on Swiss Re, one of the main risks is the return of excess capital to shareholders, although we do not expect the company would do anything that might impact their current high credit rating. To this end, George Quinn, Group Chief Financial Officer said the following in releasing the 3Q13 results:

As highlighted in our recent commentary on Swiss Re, one of the main risks is the return of excess capital to shareholders, although we do not expect the company would do anything that might impact their current high credit rating. To this end, George Quinn, Group Chief Financial Officer said the following in releasing the 3Q13 results:

"Our priority is to achieve our financial targets while providing a sustainable, growing dividend. This growth is ultimately dependent on our ability to deploy capital profitably. We continue to see attractive opportunities. Further capital management measures such as a special dividend are possible but no decision will be made until we have finalised our year end results."

Conclusion

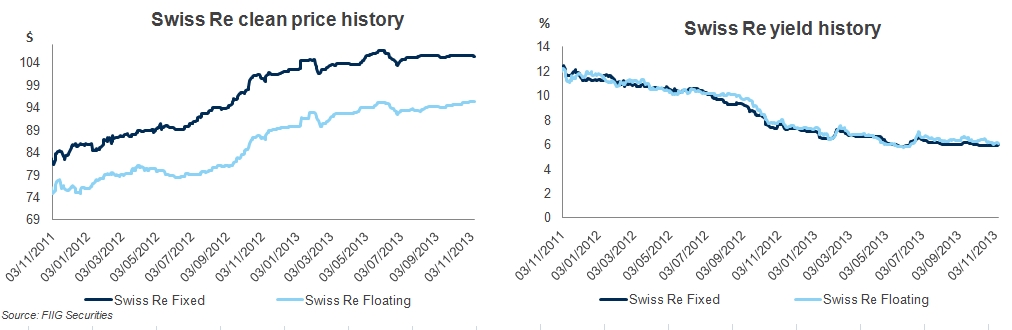

Swiss Re remains a very strong credit however existing investors may wish to assess their holding period returns and consider taking some profits in light of the very strong performance over recent years (as demonstrated by the chart below).

On the other hand any wholesale clients who do not hold an exposure to Swiss Re should consider doing so as it provides access to a very strong, global company that can add diversity to existing portfolios with a yield to expected maturity (in May 2017) of 6.15% for the floater and 5.96% for the fixed.

Swiss Re Tier 1 securities are only available to wholesale investors with minimum parcel sizes of $100,000. For further information and research on Swiss Re please contact your dealer. Yields quoted are as at 11 November 2013 and subject to change.