Sydney Airport delivered another strong result for the first half of the 2012 financial year with revenue, EBITDA and passenger numbers all up and room for further growth going forward.

Revenue and EBITDA have continued to outstrip passenger growth for Sydney Airport as the airport continues to enjoy benefits of the scalability of existing assets. We note however that passenger growth continued, with a particularly strong result (PAX up 5%) from the more lucrative international market. Since the privatisation of Sydney Airport in 2002 passenger growth has grown every year with EBITDA growing every half year. Since the start of the GFC, compound passenger growth has averaged 3%, with EBITDA achieving a compound average growth rate of 7% (for the period 2007-2011). The outperformance of EBITDA (over passenger numbers) is primarily driven by the economies of scale resulting from astute capital investment.

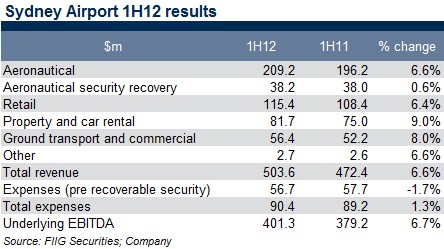

For the half year to 30 June 2012 total revenue has grown by 6.6% (compared to the comparative period for 2011) to $503.6m. Importantly, Sydney Airport was able to decrease expenses (excluding recoverable security expenses which are EBITDA neutral but out of the control of the airport) over the same period by 1.7%.

As a result of the improved revenue and cost constraint, underlying EBITDA for the airport improved 6.7% for the half year to $401.3m (compared to the prior corresponding period). Capital expenditure for the period was particularly focussed around aeronautical capacity projects including aircraft parking bays and wide body gates which should continue to be reflected in increased passenger efficiency. Two new international low cost carriers, AirAsia X and Scoot also joined Sydney Airport during the period providing further opportunity for passenger expansion. The airport noted that there remains significant room for further growth in capacity (with 61% of slots currently utilised) through the utilisation of existing facilities.

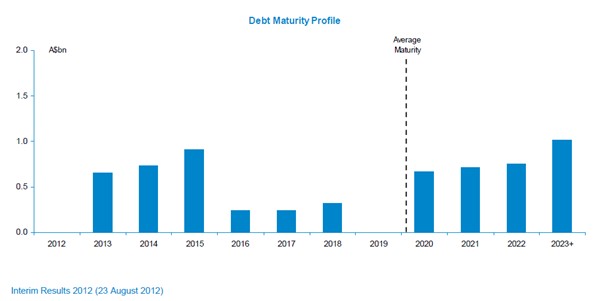

Funding

The funding profile for Sydney Airport remains well diversified with management noting the focus of the second half of the 2012 financial year will be the refinancing of the 2013 maturities ahead of schedule. We note that Sydney Airport has continued to enjoy the confidence of finance markets throughout the GFC giving investors comfort in the company’s ability to refinance on a timely basis. The Debt Service Coverage Ratio (DSCR) for the period remained at a relatively strong 2.1x.

Figure 1

Sydney Airport has senior ranking ILBs available with maturities of 2020 and 2030, both of which offer strong value currently. For those prepared to take the longer maturity, we feel the 2030 bond more than adequately compensates with its higher return of CPI + 5.15%. For those seeking a shorter investment timeframe, the 2020s are also providing a solid return of CPI + 4.55%.

FIIG research on Sydney Airport is available here.