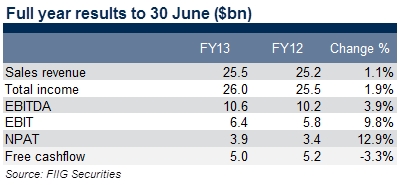

Last week Telstra posted its full year results which showed improvements across the headline numbers as well as an improvement in the company’s debt profile.

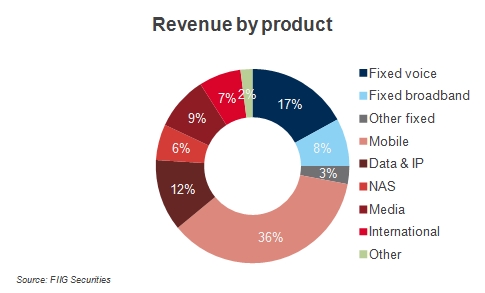

Revenue increased by $0.3bn for the year with mobiles contributing the largest increase of $0.52bn to $9.2bn with more than 1.2m new customers using Telstra’s services (largely at the expense of Vodafone who have continued to struggle with customer service and coverage complaints in the Australian market). Significant revenue growth was also achieved in Network Applications and Services (NAS) and International Business. These areas of improved revenue were offset by lower revenue from the Fixed Line, Data and IP and Media businesses. PSTN customer numbers declined by 346,000 as fixed line services continue to decline.

With an improved mix towards higher margin products, improvements at the EBITDA level outstripped the revenue however free cash decreased over the period.

Some cross business cannibalisation is present as Telstra catches significant numbers of its former fixed line service customers in other areas of the business, particularly mobile, while corporate customers are also moving from Data & IP to NAS.

Notwithstanding, the fixed line businesses remain a significant contributor to Telstra’s business, contributing 28% of FY13 revenues.

The company’s debt position improved during the year with $15.6bn gross debt outstanding at the end of FY13 compared to $17.2bn in the prior year. Importantly, near term debt improved substantially with short term debt now $0.751bn at year end compared to $3.3bn twelve months ago. Reflecting the lower debt levels, credit metrics improved with the company’s debt service ratio at 1.2x versus its target zone of 1.5-1.9x, gearing at 50.1% (the low end of its target range) and interest coverage of 12.1x.

Looking forward, the company gave guidance of low single digit income and EBITDA growth for FY14 and confirmed the firm’s commitment to its current credit rating.