Key points:

- What are IABs?

- Why do they exist?

- The mathematics behind how they work

Why do some issuers prefer this security structure?

Some issuers would prefer credit foncier style funding where they pay regular principal and interest payments over the life of the loan agreement. This structure is common in project finance where a specified end date exists. For example, most Private-Public-Partnerships (PPPs) can’t owe any debt as of the project’s end date; hence, the arrangers of these transactions usually structure the debt component of the project’s funding such that it reduces to zero by the project’s end.

How do these securities work?

The easiest way to think of these investments is to hold the inflation component constant and think of them as fixed rate principal and interest loans, like those your bank would extend to you to purchase a home. Basically, these securities are issued at a real yield (i.e. return above inflation) that reflects the market’s views of issuer specific risk and inflation adjusted risk free return expectations at the time of issuance. Think of the issue real yield as the loan’s fixed rate (assuming no inflation over its term).

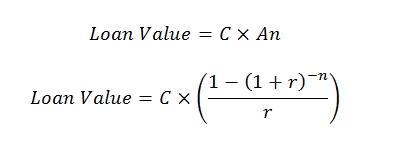

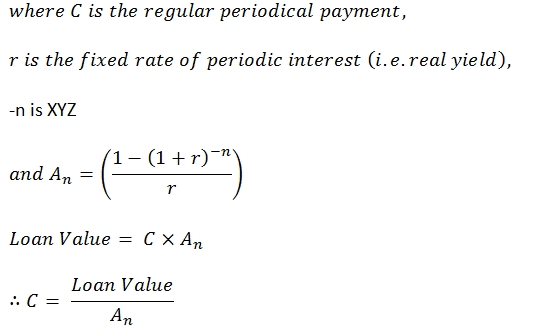

A convenient aspect of fixed rate principal and interest loans is that calculating the regular periodical payment is very simple. Basically, we’re solving the sum of a geometric series and there is a simple formula we can use to calculate this (see below).

So basically a loan’s regular payment depends on the size of the loan and the annuity factor at issuance (i.e. An).

Using the basic mathematical relationship above described, it is also possible to create a loan schedule where the outstanding principal as of each payment date is known in advance.

Now that we have our heads around how amortising loans with a constant payment work, we can consider the inflation factor.

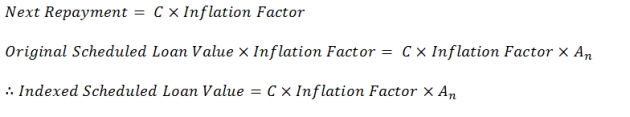

The cashflows due on an IAB are protected against inflation because they are indexed upwards by the change in CPI each payment period relative to the CPI level at issuance. Given that the relationship between outstanding principal and a fixed rate loan’s repayment are mathematically intractable, you can also think of this as if the outstanding principal is being indexed upwards by inflation on each payment date.

How does one calculate an indicative nominal return for an IAB?

To calculate a projected nominal return (that is the internal rate of return or IRR), one must model future cash flows based on the security’s current base payment for the face value being negotiated (i.e. whatever the current payment is as of its next due date) and then overlay an inflation assumption for the cashflows due after the next scheduled payment. The next step is to calculate the IRR that solves for the current market price and the series of modelled cash flows. Again, all we are effectively finding is the first positive real root of a polynomial function of the nth order (i.e. the number of scheduled future cash flows). It is often easiest to solve the calculation aforementioned using an iterative process; hence, spreadsheets are often handy when trying to calculate an IAB’s projected nominal return.

In conclusion, IABs look harder than the nominal bonds, but when you take a closer look, they are actually quite simple investments.

IABs currently available through FIIG: