by

Elizabeth Moran | Sep 24, 2013

Last week the Commonwealth Bank issued US$3 billion of bonds in the US corporate bond market. The majority, US$2bn, were floating rate notes for a three year term with an interest rate of 3 month US LIBOR plus 50 basis points (bps). The 3 month US LIBOR rate is the benchmark rate which will fluctuate over the life of the bond, and the 50 bps (equals 0.5%) is the fixed margin. With 3 month US LIBOR at 25 bps, the total cost of the bonds for the first quarter will be approximately 75 bps or 0.75%, a very low cost for CBA.

The other US$1bn was fixed rate at 2.5% for a five year term. You might wonder how the bond issue impacts term deposit interest rates. Well, the CBA, like other major Australian banks must raise funds for operations and it has many markets it can access to do this: international and domestic over the counter wholesale bond markets, the ASX listed fixed income market, share markets and of course deposits. It makes sense to seek the lowest cost of funds (although there are many considerations in funding) to maximise profit and issuing bonds in international markets at the moment is cheap.

It’s interesting to note CBA issued the “floaters” for three years, perhaps that’s about the time span that they think interest rates will stay low. However, CBA was prepared to fix for longer, possibly expecting interest rates to rise in the medium term. Whatever happens to interest rates, the CBA, like most other bond issuers, hedges the different outcomes by issuing both fixed and floating rate bonds.

CBA have given us some clues about their US interest rate expectations. Having an opinion about the direction of interest rates is important in fixed income. That way you can best decide how to weight the defensive portion of your portfolio; that is the split between fixed and floating rate investments.

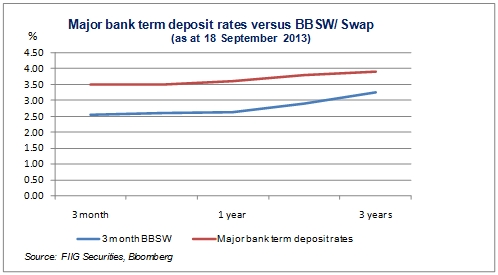

There are many interest rate indicators and the most common is the bank bill swap rate (BBSW) which becomes known as Swap after six months. The chart shows BBSW/ Swap (the banks’ expectations of interest rates) and this is known as a yield curve. Over the next three years banks expect rates to remain low and climb gradually. BBSW is virtually unchanged in a years’ time and after three years the expectations are that it has risen by just 0.75%.

The chart also shows major bank term deposit rates for $25,000 out to three years. The margin over and above BBSW is approximately 1.0% or 100 bps for the next year (3.60% return), but then narrows and is just 65 bps (3.90% return) for a three year term.

The implication is that investors should not expect term deposit rates to improve for at least a year and then expect a slow rise, assuming the yield curve holds true. If you are reliant on term deposits for income, then there has never been a better time to consider alternatives. A low risk corporate bond portfolio, including fixed and floating rate bonds would be an excellent way to increase return.