by

Ekaterina Skulskaya | Jul 01, 2014

Key points

1. Qantas 2021 offers a strong 7.26% running yield and 6.90% yield to maturity.

2. Investors can enhance and diversify their portfolio by investing in Qantas high yield bonds backed by strong assets

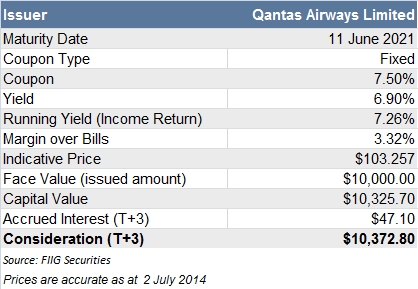

The new high yield Qantas fixed rate bond was added to FIIG’s DirectBonds list last week. The bond is available to wholesale clients in a minimum parcel size of $10,000 and offered at 6.90% (Table 1). The new Qantas 2021 bond matures in seven years and has a similar structure to the 2022 bond, with the same step up clauses. This new over-the-counter senior secured debt issue is viewed as a good first bond for new investors and offers excellent relative-value returns.

Table 1

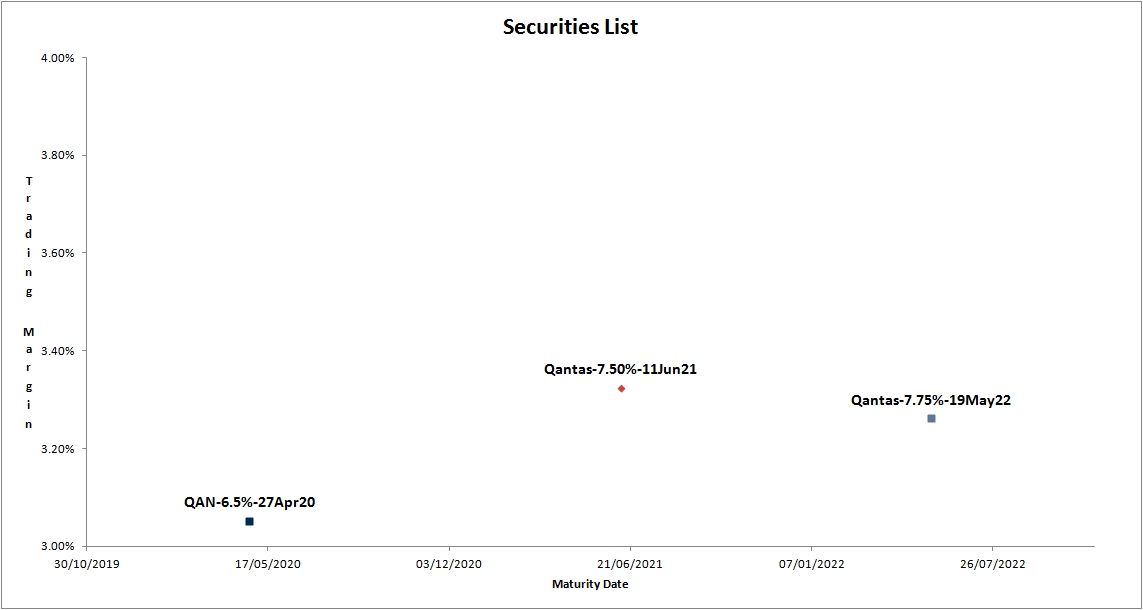

Figure 1

Qantas remains one of our favourite high yield bonds. The strength of the Qantas credit lies in the significant asset base of the company, the market capitalisation of the business (over $2.93bn at the time of writing), its leading position in Australia’s domestic market and the value of the Qantas brand as one of Australia’s best known brands internationally. For the latest Qantas research report, please click here.

Retail and wholesale investors can purchase the 2020 bonds in $10,000 parcels. While the 2021 and 2022 bonds can only be accessed by wholesale investors in $10,000 minimum face value parcels.

Table 2

Please speak to your FIIG representative if you are interested in any of these bonds. All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

Common terms

Call date - the date prior to maturity on which a callable bond may be redeemed by the issuer. If the issuer determines there is a benefit to refinancing the issue, the bond may be redeemed on the call date, at par, or at a small premium to par depending on the terms of the call option.

Capital price – also referred to as “clean price” and does not include any accrued interest.

Face value - is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually $100.

Maturity - this is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Running yield - uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity - the return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.