by

Justin McCarthy | Sep 19, 2012

Let me start by saying we still have a constructive view on the AXA Tier 1 securities, including an expectation that they will be called at the first opportunity in October 2016 (subject to regulatory approval and market conditions at that time). However, a very strong rally in price over recent months may be enough for some investors to consider taking profits and switching into an alternative investment.

The rally in price has in part been driven by more forthright language coming out of Brussels on direct intervention in the European bond markets and to a lesser extent the expectation and then announcement of QE3 in the US. These developments have seen the markets turn to “risk on” mode, pushing prices in the AXA Tier 1 securities higher. With the potential that markets have overplayed their hand – given the fundamentals in both Europe and the US have remained weak despite previous interventions – now is perhaps an opportune time for holders of AXA to book some profit.

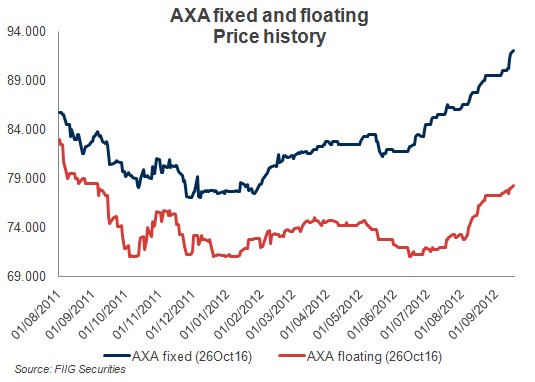

Figure 1 plots the price history of the A$ AXA Tier 1 securities since 1 August 2011. The blue line depicts the fixed rate securities and the red line the FRN. As would be expected given the sharp fall in outright interest rates/swap rates, the fixed has outperformed the FRN.

Figure 1

Many investors, particularly those that purchased the fixed rate securities would be well in the money.

We can also see from the graph the previous run (in the FRN in particular) in AXA Tier 1s, before the problems in Europe came to the fore and the subsequent drop in prices. With this peak being reached again it may be time to lighten investor holdings in AXA to avoid the risk of another European stumble.

As we have mentioned before in our coverage of the AXA Tier 1, the key price risk remains the assessment of call risk for the securities. Whilst we remain confident in issues being called at the first opportunity, it is worth noting these issues remain cheap funding for the company and with AXA no longer operating in Australia, there remains a risk that AXA will not call their A$ Tier 1 securities in October 2016. A non-call would likely see the capital price drop in these securities.

AXA is heavily exposed to the European economy (approximately two-thirds of its business is done in Europe and a large portion of its investment portfolio is European sovereigns and banks) and more particularly the ups and downs of sentiment from that region. If, or more likely when, the “risk off” trade comes back in Europe, we would expect the AXA Tier 1 securities to fall back in price.

Two other risks that loom include a possible downgrade under Standard and Poor’s revised rating methodology for insurance companies (to be completed late 2012/early 2013) and the uncertain impact of new regulation, including the impact on callable securities, under Solvency II that is expected to commence in 2014.

Whist our constructive view on AXA considers all these risks, the strong rally in price has presented an opportunity for investors to lighten their exposure to AXA if concerned with any of the credit, European, regulatory or call risks detailed above. Moreover, there is a strong bid in the market at present which provides liquidity for those looking to move in size. It may even be an opportunity to sell now and buy back in later, however timing the market is always tricky.

Portfolio diversification remains the key

AXA and Tier 1 securities in general have experienced a significant rally over the course of 2012 and current strong bidding interest in the market place may be an opportunity to reduce risk exposure and lock in performance gains. Portfolio diversification is the key and the starting point in assessing switch alternatives.

Where investors are overweight in: product structure, product type, or industry type, there are various switching opportunities available that may improve their exposure diversification and targeted risk/ reward profile. Some example switches for those contemplating diluting AXA exposure, either fixed or floating, include:

- Product structure - If already overweight Tier 1 securities, consider diluting AXA Tier 1 exposure into bonds higher in the capital structure, be they subordinated (Lower Tier 2) or senior debt, such as the Genworth subordinated debt FRN or the Silver Chef senior unsecured bond. If not overweight Tier 1, consider switching from AXA into alternate Tier 1 names such as issues from the major domestic banks or the global reinsurer, Swiss Re.

- Product type - If overweight fixed rate assets, consider switching some exposure to floaters, either in the same product (Tier 1 assets) type or industry type. Alternately the switch could be into CPI linked bonds, although there are no T1 CPI linked bonds issued in the Australian market currently. If not overweight fixed, switch fixed for fixed.

- Industry type - If overweight insurance assets, consider switching into other sectors, be they corporate, financial or even lower yielding government assets. If not overweight insurance, switches from AXA into the global insurer Swiss Re, or the domestic insurers Genworth and Suncorp could be considered.

Consideration of risk appetite when pursuing high yield investment strategies is paramount.

At the time of writing, we see the market in AXA Tier 1 fixed and floating securities at $90.25/91.75 and $77/78.5 respectively.

If you’d like to discuss diversification strategies please call your local FIIG dealer. They can use our portfolio construction switching tool and send you a range of options to consider.