Given US banks reported 4Q12 and FY12 headline results last week, now is a good time for investors who either own US bank debt or are considering their bonds to assess their relative value. We completed a summary of US bank results in last week’s Wire which can be accessed here.

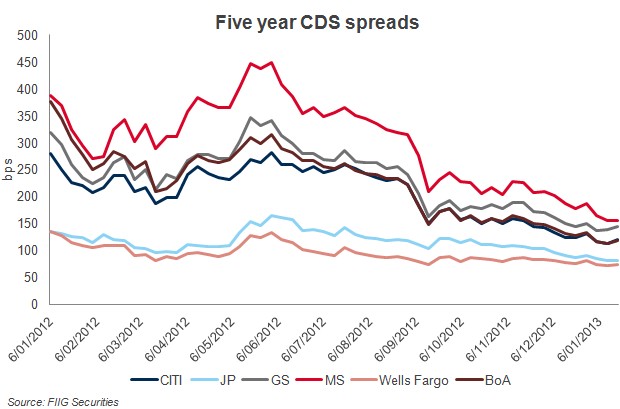

Figure 1 details the credit default swap (CDS) spreads for senior debt of US banks over the past twelve months. This graph primarily shows spreads increasing mid-year as concerns over European tail risk events came to the forefront leading to a ‘risk off’ stance. Then as backstops were implemented and progress was made spreads tightened as investors became more confident the European Union would not break up.

The chart shows the separation between what the market considers higher and lower risk credits. Perceived stronger credits in this sample (JPMorgan and Wells Fargo) command lower risk premiums and exhibit lower volatility than perceived riskier names such as BoA, Citi, Morgan Stanley and Goldman Sachs. The divergence in credit profile and underlying unpredictability, of these two groups stems primarily from differences in business mix, revenue base, potential future impact of legacy issues and exposure to the Eurozone.

A major trend however is the rally over the second half of the year contracting spreads considerably. Despite this rally there are still considerable risks in 2013.

Items to note

- Europe’s circumstances may not be good, but they look much better than they did only a few months ago. Considerable fiscal austerity having already been implemented and is generally expected that fiscal drag in 2013 will be lower than in 2012. Also, the ECB announcement of its Outright Monetary Transaction (OMT) program has stopped the domestic capital flight that had severely tightened financial conditions in several countries, most notably Spain

- The US is in a different cyclical and policy situation. Housing and car sales are starting to show some responsiveness to the low interest rate environment. However just as the consumer side of the economy has begun to show some growth, the business sector has again begun to show some weakening. Exports have been hampered by the global environment, as have the profits of major American multinational corporations. Capital expenditure has weakened after leading the economy in the early recovery of 2010 and 2011. The US may face a tougher year in 2013 than 2012

- Concerns also exist regarding the US political management of the ‘fiscal cliff’. While the House passed a bill to suspend the debt ceiling until 18 May 2013, agreement by both the House and the Senate is still needed - a budget resolution is required to be passed by 15 April 2013

Conclusion

Global financial sector securities have been trading to some extent as though the crisis is over. This however is more a reflection that investors no longer feel the need to plan for worst case scenarios such as a break-up of the union or a chain reaction of countries loosing market access with no effective backstop. In this regard clearly the situation has changed substantially. However Europe continues to struggle with low economic growth, high unemployment and weak overall fundamentals. While the US shows signs of weakness in the corporate sector and political uncertainty.

It may therefore be an opportune time for investors to switch out of securities which have benefited from this rally and maybe also to think about diversification away from volatile global financials. However it is also possible that 2013 could be the pivotal year.

Depending on your stance and view of the market in 2013 investors could consider the following:

- If you believe that the above mentioned factors are already priced in or will have little future impact, then over allocate to the high Beta US banking names such as Morgan Stanley and BoA. They will continue to strengthen and the ‘risk premium’ between them and their competitors will continue to narrow. Beta describes the relationship of individual returns with that of the financial market as a whole. High Beta means that the individual return is riskier than the market as a whole and conversely low Beta is less risky than the market as a whole

- However if you believe that the market may be a little ahead of itself and that there are still significant risks in 2013, then consider allocating out of the high Beta names take profits and switch into the low Beta names such as JPM and Wells Fargo. These bonds have shown lower volatility during periods of stress and as such have historically maintained value well in downside scenarios as well as providing a springboard back into the high Beta names when risk premiums look more attractive