by

Ekaterina Skulskaya | Jun 10, 2014

Key points:

- There have been six new securities added to the USD DirectBond list.

- FIIG offers 12 USD denominated bonds in small parcels ranging from $10,000 to $200,000. Yield to maturity ranges from 2% to over 8%.

Hedging foreign currency risk plays an important part in wealth preservation. Thus strong investment strategies such as investing in foreign currencies or investing in USD bonds issued by familiar Australian issuers will protect investors’ savings from such risks as a Chinese “hard landing”. Please click here to view the previous WIRE article “USD bonds – a higher yielding way to invest in USD”.

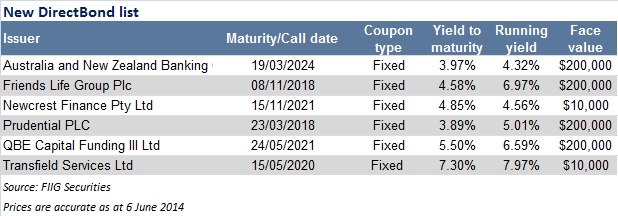

The list below outlines six securities that were added to the DirectBond list recently and had their minimum face values reduced from $500,000 to $200,000 and $10,000.

Table 1

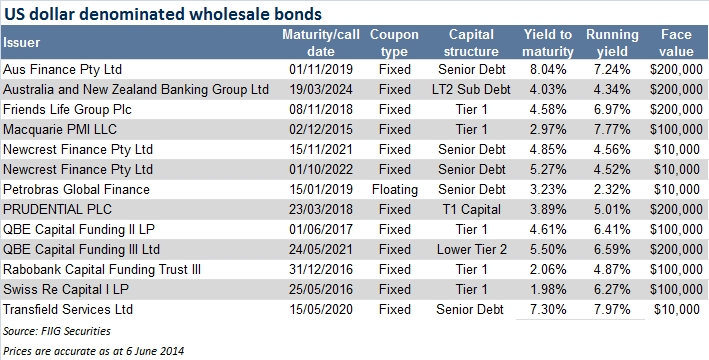

The list below details the 12 US dollar securities available. It shows the diversification possible with securities across industries and bond type. Six securities are Tier 1 hybrids (that contribute to regulatory capital), four are senior debt and two are subdebt issued by ANZ Banking Corporation and QBE Capital Funding.

Six were issued by financial companies such as Aus Finance Pty Ltd, Newcrest Finance Pty Ltd, Petrobras Global Finance and Rabobank Capital Funding Trust, a further four are issued by insurance companies: Swiss Re, Prudential and QBE; the remaining two belong to major banks such as ANZ Banking Corporation and Macquarie.

Table 2

All investors are presumed to be retail investors unless they can prove they are wholesale (sophisticated or professional). Please see the “Are you retail or a wholesale Investor” article.

If you would like to learn more about bonds, or to discuss possible strategies, please contact your local dealer.

Note: Prices and yields are accurate as at 6 June April 2014, and are guide only and subject to market availability. FIIG does not make a market in these securities.

Common terms

Call date - the date prior to maturity on which a callable bond may be redeemed by the issuer. If the issuer determines there is a benefit to refinancing the issue, the bond may be redeemed on the call date, at par, or at a small premium to par depending on the terms of the call option.

Capital indexed bonds (CIB) – CIB’s pay a predetermined coupon based on a capitalising principal amount where the capitalisation is a function of inflation. At maturity the investor receives the capitalised face value

Capital price – also referred to as “clean price” and does not include any accrued interest.

Face value - is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually $100.

Indexed annuity bond (IAB) – an IAB is an annuity structure where each periodic payment includes a combined coupon and principal component, known as the “base payment”. The base payment is adjusted for inflation.

Maturity - this is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Running yield - uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity - the return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.