by

Justin McCarthy | Sep 12, 2012

Anyone reading the newspapers over the last few weeks would have been hard pressed not to be concerned by the deteriorating outlook for the Australian economy, particularly mining or anything connected to China. International investors and fund managers are also expressing that opinion via selling down Australian stocks and credit default swaps (CDS).

In contrast, the recent supportive comments made by the ECB’s Mario Draghi in his “Whatever it Takes” sovereign debt plan and rising expectations of QE3 in the US are having a positive impact on European and US equities and credit spreads, particularly for financials in those regions (notwithstanding the fact that the need for such intervention is a function that those economies are doing so poorly).

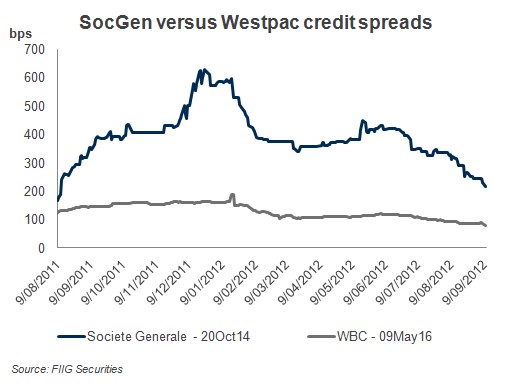

The impact of this divergence of news flow can be seen in the credit spreads of a number of international banks versus the Aussie majors. The chart below plots the credit spread for the Societe Generale Oct 2014 senior FRN and Westpac May 2016 senior FRN (the latter used as a proxy for all the Aussie major banks) since August 2011. As can be seen, international banks such as Societe Generale are experiencing a period of significant tightening while the Aussie banks are relatively unchanged.

We have seen this before when the international market formed a view (predominately via CDS) that the Australian residential property market was over-valued and primed for a crash. As a result the overseas dominated CDS market priced in an increase in the risk premium for the four major banks which are heavily exposed to property.

It appears that signs of major bank CDS weakness may be returning together with a greater risk priced in for a China-led slowdown.

In the past, a prolonged widening of CDS will eventually be matched by widening of bond spreads. There are even signs of this in recent offshore primary market issues with CBA raising three year senior debt in US$ and € at the equivalent of BBSW+ circa 120bps and five year debt at a swapped back rate of BBSW+ circa 160bps in recent days. These levels are significantly above where the equivalent maturity A$ bonds are trading.

If international bank spreads continue to tighten (with names such as Societe Generale already in as much as 400bps from their wides) and if Aussie bank spreads widen, we would recommend a switch into longer dated senior debt of the Aussie majors (and regionals). We are very comfortable with the creditworthiness of all Aussie major and regional banks and believe they are very well placed to whether any China-led slowdown. Further, the prospect of a residential property crash is remote in our opinion. Rather a slow and manageable decline in property prices is seen as the most likely scenario.