by

Ekaterina Skulskaya | Mar 24, 2014

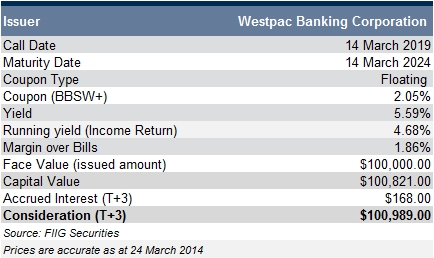

The new Westpac 2019 subordinated floating rate note was added to FIIG’s DirectBond list last week. The notes are available to wholesale clients in a minimum parcel size of $100,000 and priced at 186bps over the bank bill swap rate (see Table 1).

Table 1

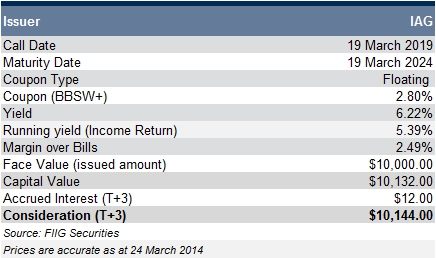

The new IAG (issued by subsidiary Insurance Australia Limited) floating rate subordinated notes with a first call in March 2019 and a final legal maturity in March 2040 were added to FIIG’s DirectBond list last week as well. The notes are available for wholesale clients in minimal parcels of $10,000 and are priced at 249bps over bills (see Table 2). This new over the counter (OTC) subordinated debt issue is viewed as a good opportunity for both new money and as a switch from Swiss Re, AXA and Rabobank Tier 1 securities that we believe are “fully priced”.

Table 2

Common terms

Call date - the date prior to maturity on which a callable bond may be redeemed by the issuer. If the issuer determines there is a benefit to refinancing the issue, the bond may be redeemed on the call date, at par, or at a small premium to par depending on the terms of the call option.

Capital price – also referred to as “clean price” and does not include any accrued interest.

Face value - is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually $100.

Maturity - this is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest of a particular security will be repaid on this date.

Running yield - uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity - the return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.

Please speak to your FIIG representative if you are interested in Westpac and IAG notes.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Westpac and IAG bonds are only available to wholesale investors.