by

Elizabeth Moran | Mar 17, 2014

Returns tend to be an investor’s main focus; they help investors assess future income, enabling them to plan future cash flows. But, high returns are offered to compensate investors for the underlying risks involved. The higher the risk, generally, the higher the return.

While high returns are attractive, investors need to focus on the risks to ensure their portfolios can remain robust in the worst case scenarios.

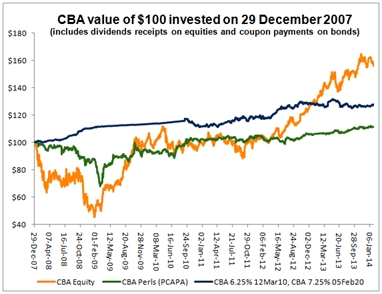

Exposure to too much risk has the potential to wipe out capital and thus impact future income. To illustrate, consider performance of three different Commonwealth Bank investments: a senior bond (shown as the blue line in the graph), the Perls III hybrid (the green line) and the shares (yellow line). If we invest $100 on the 29 December 2007, we can then track performance throughout the global financial crisis. The returns shown include interest payments on bonds and dividend payments on shares, but not franking as not all investors can claim it.

Source: FIIG Securities, Bloomberg

The purpose is to show a worst case scenario and the volatility the various investments showed during the crisis. The senior bond shows a fairly gradual upward trend increasing in value. The GFC does not impact its value, enabling investors to sell if needed and recoup their capital. The returns are stable and consistent, in fact boring, but in bond investment we think “boring is good” as it is what protects your portfolio. In this example we use two senior bonds as they are issued for five years and assume on repayment of the first bond, the proceeds are invested in another senior bond.

The hybrid, being higher risk than the bond, shows increasing volatility. In the worst case scenario, an investor selling in March 2009, would have lost approximately 30 per cent of the capital value. The hybrid recovers somewhat, but has yet to catch the lower risk bond in terms of return.

The CBA shares, are the highest risk of all of the securities, and thus show the highest volatility. A forced seller in February 2009 would have lost over 50 per cent of their investment. That is a very high loss of capital in the worst case scenario, assuming the investor has nothing else to sell. It’s worth remembering that all four major banks cut their dividends during the GFC, so investors also lost anticipated income, which may have forced them to sell down capital if they had planned their cash flow needs around the dividends. One of the interesting points to the graph is that, as an analyst, I would rank CBA as the lowest risk company on the ASX. Imagine the sort of risk and thus volatility you would observe in a miner with a single commodity. The shares have now caught the bonds and are outperforming as you would expect over the long term.

Investors should be rewarded for uncertainty due to volatility and that is why shares should offer the highest returns. Equally it is why bonds, being lower risk offer lower returns.

If there is one single rule that holds true, it’s that markets are cyclical. Many professional investors spend much time assessing trends, extrapolating data and using historical facts to try and predict future markets but few are canny or, maybe lucky enough to call the market at the right time. Mangers of large investment funds know the best way to combat uncertainty and to protect capital and income is to diversify investments.