At its most basic level, the spread is simply a margin over or under a particular interest rate curve. The spread measures the perceived riskiness, as deemed by the market, of a security against the reference interest rate curve (i.e. a positive spread means that the security is perceived to be more risky than the reference source, and a negative spread means that it is perceived to be less risky than the reference source).

So in order to really understand the meaning of a spread, you need to grasp the idea of what this reference interest rate curve is (the yield curve), and more particularly the reference curve we employ in Australia: the BBSW swap curve.

What is a yield curve?

The concept of a yield curve is something that many investors struggle to understand, however it is the key to understanding any investment as it represents the time value of money (i.e. expectations of interest rate moves and the reward for delaying consumption) plus a margin for risk.

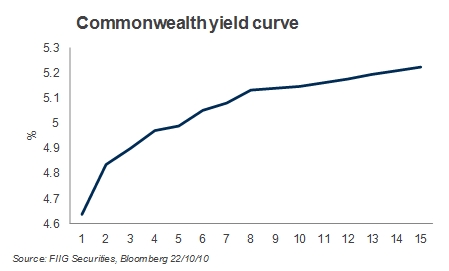

The graph below is the Australian Commonwealth Government bond yield curve from October 2010. The shape of this curve is upward sloping, which is typical of most yield curves for the following reasons:

- The slope compensates for inflation

- The longer out you go, the more a rational investor should demand on a risk free basis, as they are delaying consumption for longer

- Over a longer period, certainty around inflation and interest rates, diminishes, thus you need to be compensated for this uncertainty

- The risk that the issuer will be unable to pay increases with time, as the state of future conditions becomes more uncertain over longer periods.

In fact, the shape of the curve below is so common that it has a special name: the ‘normal’ yield curve. The yield curve can take on other shapes, and we will discuss this later.

If we extrapolate this yield curve concept to non-government issuers we can see that every issuer has its own yield curve for each section of its capital structure (i.e. NAB senior debt has its own yield curve, NAB sub-debt has its own yield curve etc), conceptually, this allows us to compare like with like when comparing various bonds with a company and across the capital structure.

BBSW – Australia’s reference curve

Previously I noted that spread is quoted in relation to a reference curve, but which reference curve? In Australia, the reference curve used is the Bank Bill Swap Rate or BBSW. In the US the reference curve is Government Treasuries. So why do we use BBSW whilst in US they use Treasuries?

The answer to this question comes down to the market’s need for curve completeness, that is, its ability to fill as many data points along the curve as possible so that an accurate picture can be drawn. There is no point basing your reference curve off a security with patchy data.

For example, we noted above that there would be NAB senior bond yield curve and NAB subordinated bond yield curve. The curve is derived from prices of various forward maturities, so in the case of NAB senior curve, we would have data points for 1, 2, 3, 4, and 7 year maturities, pretty good, but still somewhat patchy, and short. For NAB subordinated curve we would have only a single data point at 1 year. The more patchy the data, the less reliable it becomes as investors have to ‘interpolate’, or guess what happens to the curve between the data points. As such it does not make sense to use a patchy curve as your overall reference curve.

The BBSW swap curve answers our need for data points by being the most complete curve available in the market, and offers the further benefit of being based on highly liquid securities and market contracts (i.e. swaps on bank bills). BBSW also covers a very broad period with rates being quoted from 1 day (i.e. the cash rate), right through to 30 years (i.e. 30 year swap). The actual BBSW is used for dates up to 1 year, with the BBSW swap rate providing data from 1 year out to 30 years.

Next week we will address some key logical extensions of the above subject: what are BBSW and Swap exactly, and what are some alternative yield curve shapes.