by

Elizabeth Moran | Dec 13, 2013

None of us can predict where the markets will be in coming months and years but this week we’ve seen a small number of bond yields trade at over 7%, a key return hurdle.

While we typically focus on yield to maturity to compare returns of different bonds, I think investors should also consider bonds with high running yields. Dividend yields on shares only provide an indication of income and so, if you want to compare equity investment to bond investment, running yield is more appropriate as it also shows income.

A legitimate strategy in this current low rate environment is to buy securities with high running yields (and not necessarily the same high yields to maturity) with a view to taking the higher income on offer and selling down the bonds as they near maturity.

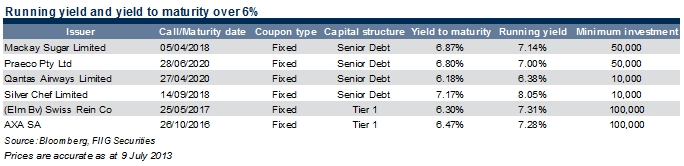

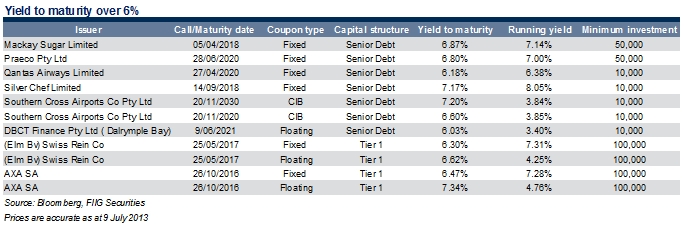

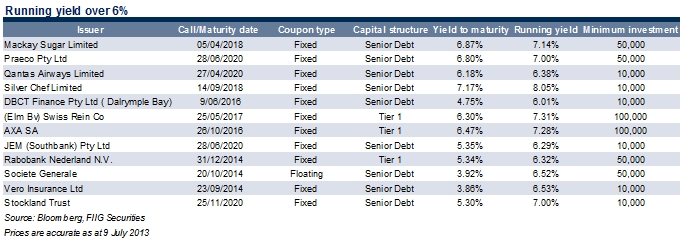

Thus I’ve drafted three tables: Table 1 shows bonds with a yield to maturity and a running yield of over 6%, Table 2 shows bonds with a yield to maturity of over 6% and Table 3 shows bonds with a running yield of over 6%.

Table 1

Table 2

Table 3

Three bonds show a yield to maturity of over 7%: the fixed rate Silver Chef bond, the AXA SA floating rate note and the Sydney Airport 2030 inflation linked bond. If you consider bonds with a running yield over 7%, i.e. the magical number, we can add another four bonds to the list: the fixed rate Mackay Sugar, Praeco, Stockland and Swiss Re.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

For more information, please call your local dealer.