by

Justin McCarthy | Dec 10, 2013

Key points:

- QBE announced a significant profit downgrade, with a full year loss of USD250m.

- We consider the news “slightly negative for debtholders, but not good for shareholders”.

- We remain comfortable with the credit and call risk of the “old style” QBE step-up securities and expect QBE to continue to call at first opportunity. Yields range from 5.67% to 6.15%.

On Monday, QBE announced a significant profit downgrade, with a full year loss of USD250m predicted. QBE shares fell 22% on the news and bond yields were slightly higher. We believe the news creates an opportunity for investors with capital ratios actually expected to improve year on year and a new USD subordinated issue likely in coming weeks. Further, much of the expected loss is due to non cash write downs and lower growth expectations; neither of which are major concerns for bondholders.

Back in August this year when QBE missed market consensus for 1H13 profit to 30 June 2013, I wrote that “despite the negative headlines in the press, the results were another example of good for debtholders but not so good for shareholders”. At the risk of repeating myself I see similarities with Monday’s announcement, although I would amend my observation to be “slightly negative for debtholders, but not good for shareholders” given the extent of the downgrade.

The announcement on Monday was the third straight profit warning/miss for QBE and as such the equity market reacted aggressively.

The key points from the announcement are summarised below:

- FY13 (to 31 December 2013) guidance for NPAT revised downwards with expectation now for a USD250m loss (compared to FY12 NPAT of USD760m)

- Profit downgrade is primarily due to a lower insurance profit margin (6% margin versus 11% guidance) as a result of further reserve strengthening (i.e. increases in reserves for insurance losses), goodwill impairments relating to the US operation (circa USD600m) and higher than expected US crop claims

- However, backing out non cash items including goodwill write downs and provision increases, the cash profit is expected to be USD850m (compared to FY12 USD1,042m). It is the cash profit that debt investors are focused on as this is what repays interest and principal

- QBE also lowered FY14 guidance with gross written premiums anticipated to reduce by around 5% in 2014 and a lower combined operating ratio (circa 93%). Further, the insurance profit margin is expected to take a hit with the guidance provided of 10%, well short of the equity market consensus of around 12.5%

- Regulatory and rating agency capital ratios at 31 December 2013 are expected to be above the 30 June 2013 level of 1.61x and 31 December 2012 level of 1.57x (APRA’s prescribed capital amount or PCA multiple) with a proposed new USD500m subordinated convertible debt issue to help achieve this. This issue is expected to be launched within the next two weeks and qualify as Tier 2 capital, be APRA compliant and achieve 50% S&P equity treatment

- QBE Chairman, Belinda Hutchinson, to stand down in March 2014 after three years as Chairman and 16 years as a Director of QBE, to be replaced by Marty Becker

While the recent history of both declining profitability, missing market consensus and a deterioration in the US operation is not a positive story, it is of far more consequence for equity investors than debt investors.

Throughout this 18 month period of disappointing results, the balance sheet of QBE has remained relatively solid and the capital position, as measured by PCA (formerly the minimum capital ratio or MCR) has improved. As a debt investor, this is one of the key measures to look at and it has increased from 1.57x at 31 December 2012 to 1.61x at 30 June 2013 and is expected to be higher than 1.61x as at 31 December 2013 (based on Monday’s announcement). It is the balance sheet strength and improving capital position which is of greater importance to debtholders.

Over the same period leverage has also been declining with debt/equity ratio down to 40.8% at 30 June 2013 versus 43.4% at December 2012. Management had a target of 40% or lower by year end which they have not updated the market on in their most recent statement but it is anticipated to be close to the 40% mark. Including the repayment of USD211m of subordinated debt on 1 July 2013 (once again called at first opportunity), debt fell USD381m between December 2012 and July 2013 to USD4.6bn. At 30 June 2013, the latest figures available, total assets were USD42.5bn, including USD9.7m of cash and short term money market investments and a further USD6.0bn in highly liquid government bonds were held, providing comfort to debtholders.

The announcement on Monday also suggested a continuation of a low dividend payout ratio of 50-60%, which is another example of something not popular amongst shareholders but a policy that has lead to an increase in shareholder’s equity (and PCA) and is of direct benefit to the debtholders that sit higher in the capital structure.

QBE do not have any AUD bonds in the market but there are a number of subordinated bonds and Tier 1 hybrid securities in non-AUD, mainly USD, which we believe exhibit strong relative value (available to wholesale clients only). The recent profit downgrade has resulted in some mild price weakness with falls of $1-$3 depending on the issue. Further, the proposed new issue in coming weeks may also present a buying opportunity both in the primary market as well as existing issues, depending on the issue margin.

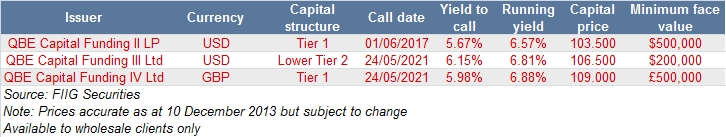

The following table sets out the current price and yield for the most common issues:

We remain comfortable with the credit and call risk of the “old style” QBE step-up securities and expect QBE to continue to call at first opportunity (subject to regulatory approval and market conditions at the time of first call date).

For further information on the available non-AUD QBE securities, please contact your dealer or call 1800 01 01 81.