IAMGOLD (as we all know) has rallied since we started putting it into client portfolios, and is capped somewhat at current levels....

This has been prepared by FIIG Investment Strategy Group. Opinions expressed may differ from those Of FIIG Credit Research.

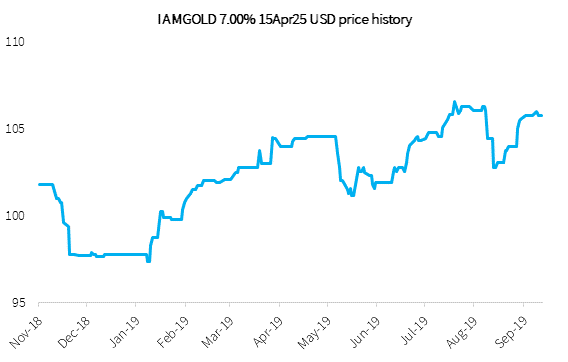

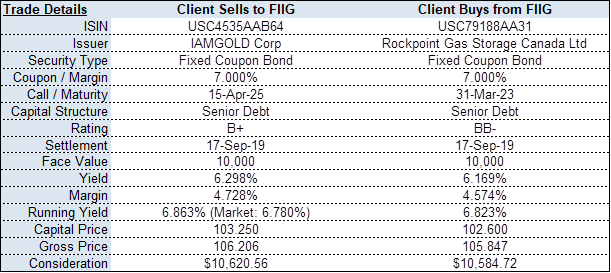

IAMGOLD (as we all know) has rallied since we started putting it into client portfolios, and is capped somewhat at current levels by the upcoming call on the 15th of April 2020 at 105.25 (the red line in the below chart). Rated B+ it is also towards the lower end of the ratings spectrum we prefer to look at given where we are in the credit cycle.

As a Canadian-based issuer, IAMGOLD has also been available to clients who do not currently have a W8 BEN certification.

In line with our theme of increasing credit quality, the switch into the Rockpoint Gas 2023 makes sense.

The switch moves 2 years shorter in tenor, improves credit quality by one notch, the bonds have the same coupon and therefore income, and yet you only reduce yield by 0.15%. Rockpoint, also being a Canadian issuer, does not require a W8 BEN form.

Source: FIIG Securities