Yesterday's CPI suggests RBA may raise rates in August

by

Philip Brown, Head of Research | Jun 27, 2024

- The early signs are that the RBA is more likely than not to raise rates in August. We expect rate cuts in early 2025.

- The CPI print was disappointingly high. The RBA is more likely than not to raise rates in August.

- The decision is not yet set in stone, as future data (2Q CPI) could change things. However, we expect the tax cuts starting 1 July will also start to show in liaison.

- The underlying economy is under pressure and rate hikes will only add to that. Rate cuts are likely to come in early 2025.

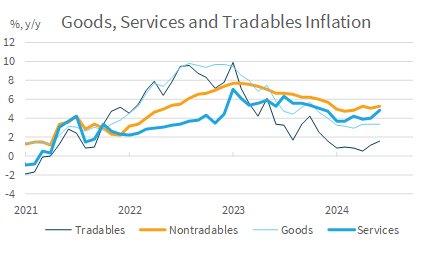

- After the RBA statement earlier this month we said, “The RBA is closer to raising rates than generally understood”. After yesterday’s Monthly CPI, we think a few other people are clueing in. The monthly CPI indicator was expected to rise from 3.6% in April to 3.8% in May, and instead rose to 4.0%. May is an unusual month because there’s lots of seasonality and movements in prices, but the trimmed mean measure rose even faster, up from 4.1% to 4.4% per annum. Inflation is not “moving sustainably towards the target range” as the RBA wanted; in fact, it is moving away from the target. At this point we think that, if the RBA meeting was tomorrow, the RBA would raise the cash rate. There are a number of important data releases to come over the next six weeks, so the move is not yet locked in, but we think a rate rise is more likely than not. The key point, for us, is that as part of the RBA statement, the board said, “While recent data have been mixed, they have reinforced the need to remain vigilant to upside risks to inflation.” The upside risks are no longer risks; they are factual data. During the post-meeting media conference last week, Governor Bullock said she wanted to better understand the momentum of services price inflation. The best data won’t come until the full quarterly CPI release on 31 July, but the current monthly signals suggest momentum in services inflation moving up, not down (see chart). Inflation in non-tradables, a broader category that includes a lot of services, is also trending slightly upwards at present.

Source: FIIG Securities, ABS

- The August meeting is not yet locked in as a rate rise. There are two paths that could see the RBA knocked off the rate-hike trajectory. The first is that we only have two months’ worth of the full 2Q data, not all three months. It’s possible, but doubtful, that the full quarterly data will tell a different story for CPI. It would need to be materially better, however. The RBA has drawn attention to services inflation, which is mostly measured in the middle month of the quarter, i.e. the May data that was just released, so we’re not hopeful the split between services and goods will change materially. It’s also worth pointing out that the seasonal adjustment in May is quite large, which means the scope for a statistical oddity is increased. However, the data shown in the chart above are all annual rates of change, which should be robust to that effect. The second path to knock the RBA off the rate hike trajectory would be if other parts of the economy materially weaken. When we characterised the RBA as being closer to a rate rise than generally understood, we said they were closer to a rate cut as well. The weakening in the labour market and the truly weak growth in GDP per capita are also important. There is another labour force result (for June, released 18 July), another retail sales release (for June, released 26 July), and many more pieces of second tier data before the August RBA meeting. If there is a sign of material cracking in the economy, then the RBA may forestall on the anticipated August rate rise. It would need to be very bad though.

- The tax cuts start on 1 July. There will be some amount of bring-forward as more savvy consumers understand the coming increase in pay, but we expect the largest increase in consumption to come in mid-July as the tax cuts move through the system as actual cash. Pay cycles vary, of course, but we’re likely talking early-to-mid July for most people to receive their first pay at the new tax rates. There won’t be any official data covering mid-July by the time the RBA decides the cash rate on 6 August. However, there will be time for anecdotes and business liaison to begin to show. The data coming across August and into September will likely be stronger. The RBA knows this and explicitly forecasts it. If the Australian economy and particularly prices are heating up as we move into July then that is a concerning trend. Our previous discussions of the impact of taxation had assumed a generally slowing backdrop when the tax cuts hit; that doesn’t appear to be the case. The labour market is slowing but the inflation pressure in the economy is not.

- A November rate cut now seems difficult to achieve, but we expect a turnaround by early 2025. The inflation side of the question is suggesting higher rates but, as we discussed, many other parts of the economy are showing weakness. If the RBA does proceed to raise rates in August, then the parts of the economy already suffering will only weaken further. That makes a future rate cut likely to occur earlier. A six-month turnaround between the last hike and the first cut would be relatively short, but far from unprecedented. The peak was six months in 2000, and in 2008. There’s also the question of how you consider the fact that since June 2023, the RBA raised rates only once. That would be twice if the RBA does raise in August, but it would also show the current cycle has a different underlying structure than the 2010 cycle.