by

Philip Brown, Head of Research FIIG Securities | May 22, 2025

Earlier this week, in preparation for the WIRE Newsletter, I wrote an article talking about the US bond markets and compared the spike in US yields around the tariff wars to a single engine failure on a large modern aircraft – both incredibly important and yet perfectly safe, for the moment. That engine failure is not a catastrophe, as long as an appropriate course correction is made. It’s both massively important and humdrum at the same time – so long as the warning messages are heeded.

Last night, the US tried to sell 20Y Government bonds and found that although there were plenty of bidders, the bidders were no longer prepared to accept ultra-low yields. The yield on US bonds immediately rose by 8bp for longer-dated bonds. Think of this rise in yields as the second warning light on that aeroplane dashboard. The situation is getting more serious, and a course correction is now needed more urgently.

The change needed is a reduction in the US budget deficit and the US budget is currently being debated. Unfortunately, the US hasn’t been following proper budgeting processes for decades now, so all the negotiations are happening behind closed doors inside the Republican party. The general shape of the package is a very large tax cut, with some moderate savings by cutting health spending, leaving a larger deficit than before. In other words, the current political arguments are about how much to increase the deficit with tax cuts, not to reduce the deficit. The warnings do not appear to be breaking through.

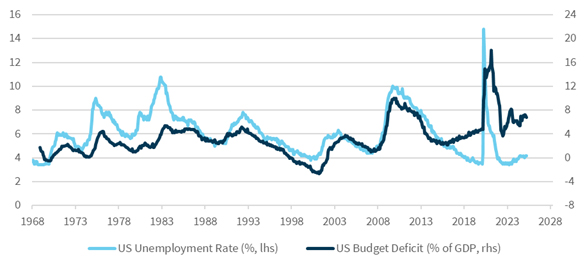

The markets are very clearly sending the message that if the US wants to keep increasing the deficits, they probably can, but that markets will no longer be funding that approach without much greater compensation for the risks involved. The US now needs to actively induce investors to lend to it, rather than simply ask for money. Remember, the US deficit is currently very large by historical standards, and incredibly high when you consider that the underlying US economy is quite strong at present (as evidenced by the low unemployment rate).

US deficit is incredibly high for a non-crisis period

Source: FIIG Securities, Bloomberg

The market is very delicately poised. If the policymakers acknowledge that the deficit has to fall and take steps in that direction, things could calm down quickly and normal service could be resumed. However, things do look brittle at present. There is also a risk that the US pushes ahead with tax cuts and markets – both bonds and equities - react very poorly, including in Australia.