by

Ekaterina Skulskaya | Oct 15, 2013

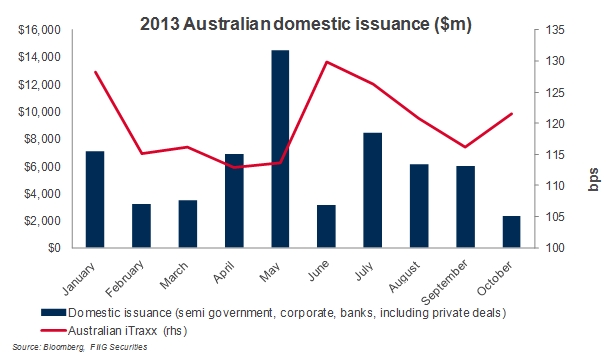

Issuance activity in debt capital markets varied throughout the year; while the very large issuance in May of $14.51bn ensured 2Q13 issuance volume for the quarter it was also the largest for the year to date . This was closely followed by 3Q13. According to Bloomberg data, a total of A$61.17n debt was issued domestically for the nine months to 8 October 2013 (by Australian entities in AUD currency), including Australian government and private placements. The issuance volume for the year to date is 23.6% less than the total A$80.07bn debt issued in the first three quarters of 2012. The Australian corporate credit bond market (excluding government guaranteed and private placements) recorded A$14.57bn less issuance for the year to date than A$46.38bn issued during the same time in 2012. Government bond issuance was somewhat weak as well, with only A$29.947bn issued for the year to date compared to A$45.15bn in 2012.

Issuance for the start of 3Q13 was well ahead of the first two quarters. July 2013 recorded the second largest monthly issuance volume of A$8.41bn for the year to date, (A$6.09bn less than May 2013) (see Figure 1). Issuance by month varied with the lowest volume recorded over June (A$3.132bn) when credit spreads (Australian iTraxx Index) were highest, as depicted by the red line (see Figure 1). The outlook for financial markets improved in 3Q13, which significantly outperformed 1Q13 with July recording the biggest number and greatest value of deals for the quarter.

Figure 1

Figure 1

Activity in the RMBS market remained strong for the 3Q13. Overall, 3Q13 RMBS totalled A$7.46bn (Australian tranches only) well ahead of 1Q13 with A$5.76bn and 2Q13 with A$3.98bn on issue. The biggest issuers for 3Q13 were Commonwealth Bank of Australia (Medallion Trust) with A$3.2bn, ING (IDOLT) with A$1bn and BOQ (REDS) with A$1bn. Among the largest issuers for 4Q13 were Westpac Banking Corporation (WST) with A$2.25bn, Macquarie (PUMA) with A$1.25bn and AMP (PROGS) with A$0.65bn.

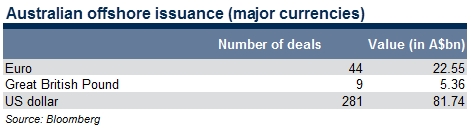

Australian financial institutions and corporations remained active in offshore markets. As the US continued to offer cheap funding opportunities, significant issuance of US$81.74bn (A$86.79bn equivalent in public and private placement deals were achieved; 1.4 times more than that issued in the domestic market. However, Euro and GBP issuances were well below US$ issuances with equivalent A$22.56bn and A$5.36bn volumes respectively for the year to date. The biggest US dollar issuers were Commonwealth Bank of Australia with US$12.11bn and BHP Billiton which raised US$5bn. Euro issues were: Origin A$3.56bn, Telstra A$1.43bn and Macquarie raised A$1bn. Nine deals were issued by Australian companies in Great British pounds totalling equivalent A$5.36bn for the year to date. CBA was the largest issue with A$1.701bn; NAB and ANZ followed the lead with equivalent A$1.62bn and A$1.21bn respectively (see Table 1).

Table 1

In comparison, British sovereign and corporations were leaders in US dollar bond issuance (including private placements) with US$149.32bn issued so far this year. The largest deals were recorded by Lloyds and RBS Group PLC with US$3bn and US$2bn issues respectively. The second largest US dollar issuance was recorded by Canada with US$110.419bn for the year to date. France and Australia followed with US$103.31bn and US$97.17bn respectively. Among the biggest issuers in France were Societe Generale (US$5.6bn), BNP Paribas (US$3.05bn) and Credit Agricole AG (US$1.35bn). Macquarie (US$4.65bn), Commonwealth Bank of Australia (US$2bn) and Leighton Finance (US$0.5bn) were the largest Australian domestic issuers of US dollar bonds. .

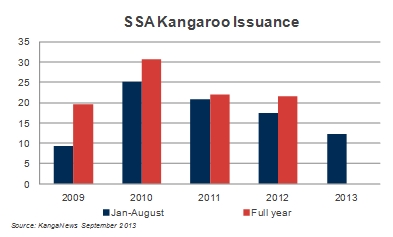

The Kangaroo market (Australian dollar bonds issued by non domestic issuers) was dominated by the supranational, sovereign and agency (SSA sector) in the 2013 year to date. Australian domestic issuance from offshore SSA issuers continued the steady easing since 2011 and reached only A$12.3bn by the end of August 2013 (see Figure 2).

Figure 2

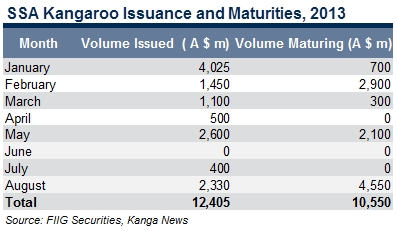

Kangaroo SSA issuance in August 2013 was $2.3bn making it the third busiest month of the year to date behind January and May at A$4.0bn and $A2.6bn respectively (see Table 2). Among the biggest issuers were Rentenbank and World Bank. In the year to August 31 2013, Rentenbank issued A$2.5bn compared to A$1.4bn for the whole last year. World Bank also outstripped its 2012 Australian dollar issuance, bringing A$1.2bn in the year to August 31 2013 versus A$1.1bn for full year 2012.

Table 2