by

Elizabeth Moran | Jan 14, 2014

Understanding the terms and the return of fixed income securities or interest rate securities as they are frequently named can be confusing. This article provides a guide that should help you to understand some of the different features of the investments and how to interpret the returns quoted and includes a list of key definitions.

Westpac subordinated notes example

During July Westpac launched an ASX listed subordinated debt issue seeking to raise $750m. At the time the deal was announced, Westpac indicative pricing of the subordinated notes was given at 230 to 245 basis points (bps) over the 90 day bank bill rate (BBSW). The coupon payable on the notes was without franking and cumulative and they have a 10 year non-call maturity structure. The notes can be redeemed after five years but only if early redemption is approved by APRA. The notes are also Basel III compliant which means they include a non-viability trigger and can be converted into ordinary shares.

Demand for the notes was good and the issue was over-subscribed. A total of $850m of subordinated bonds were issued. Given the demand, the coupon was settled at 230bps over BBSW.

BBSW (and thus the total coupon payable) for floating rate notes is set on the first day of issue for the coming quarter. At the first coupon payment date and each quarter thereafter it will be recalculated for the coming quarter based on the fluctuating BBSW rate. So your interest income will depend on BBSW although the margin over BBSW (of 230bps) will not change for the life of the bond.

The subordinated notes (WBCHB) started trading in August. They had a first issue or par value of $100, and if you hold the notes until maturity, this is the amount you expect to be returned to you.

Once they start to trade, the price of the bonds will move up and down and this will impact the returns investors will achieve if they purchase the bonds in the secondary market. There are two main returns quoted for bonds: “yield to maturity” (YTM) and “running yield”. Yield to maturity includes the capital gain or loss on the bond price plus the interest until maturity. So, if you buy the bond at the issue price of $100, and hold until to maturity, the YTM will be the same as the coupon rate. Whereas the running yield is the expected income if you buy the bond and hold it for a year and is dependant on the price you pay for the bond in the market. Running yield is similar to dividend yield.

The return that’s most relevant to you will depend on your investment strategy. If you buy with the intention of not trading and holding to maturity then the YTM is the figure that will matter to you. If you’re more interested in income alone and might sell prior to maturity then running yield will be your focus. Depending on market conditions and various other factors, YTM can be higher than running yield and vice versa.

Becasue floating rates note coupons fluctuate over time with the BBSW, brokers use forward expectations of BBSW to calculate estimated returns over the life of the bond. Fixed rate bond coupons on the other hand do not fluctuate.

Key definitions

Basis points (bps)

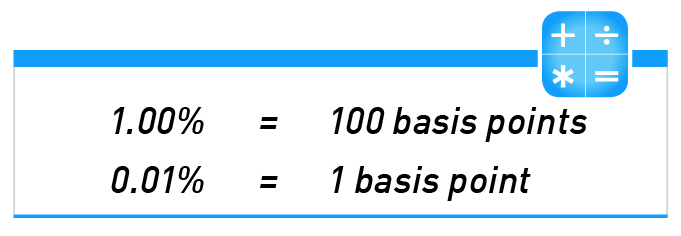

The basis point is commonly used for calculating changes in interest rates, equity indices and the yield of a fixed income security. The relationship between percentage changes and basis points can be summarised as follows:

A bond whose yield increases from 6.5% to 7% is said to increase by 50 basis points; or interest rates that have dropped by 1% are said to have decreased by 100 basis points.

Coupon

Is the rate of interest paid on a fixed income investment or bond. Coupons can be paid annually, semi-annually or quarterly or as agreed in the terms of the security. The coupon rate can be fixed or floating for the term of the security. If it is a floating rate then it is likely that it will be linked to a benchmark such as the 90 day bank bill rate. The coupon rate is set by the issuer based on a number of factors including prevailing market interest rates and its credit rating. Fixed rate bonds in Australia predominantly pay a semi-annual coupon whereas floating rate bonds predominantly pay a quarterly coupon. Indexed linked bonds usually pay quarterly coupons.

For example, a $500,000 bond with a fixed rate semi-annual coupon of 8% will pay two $20,000 coupons each year.

Cumulative / Non-cumulative

Cumulative:Missed dividend payments/distributions must be made up at a later date.

Non-cumulative: Missed dividend payments/distributions are forgone. The issuer of the security is not obliged to pay the unpaid amount to the holder.

Face value

Is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually $100.

Discount to face value

Bonds may trade at a discount to face value in secondary markets where coupon, demand and market perception of the entity influence the price of secondary trades. Bonds usually have a face value of $100. If a bond is acquired at a discount price, say of $75, then the bondholder will make a capital gain of $25 assuming the company makes a full repayment of $100 face value at maturity.

Fixed/Floating interest rates

Rates on bonds can be fixed (set at the time of issue) or floating. If they are floating then they will be set as a constant margin to a variable benchmark such as the 90 day bank bill rate expressed, for example, BBSW +3.25%. The coupon rate is set by the issuer based on a number of factors including prevailing market interest rates and the entity’s credit rating.

Maturity

This is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest will be repaid on this date.

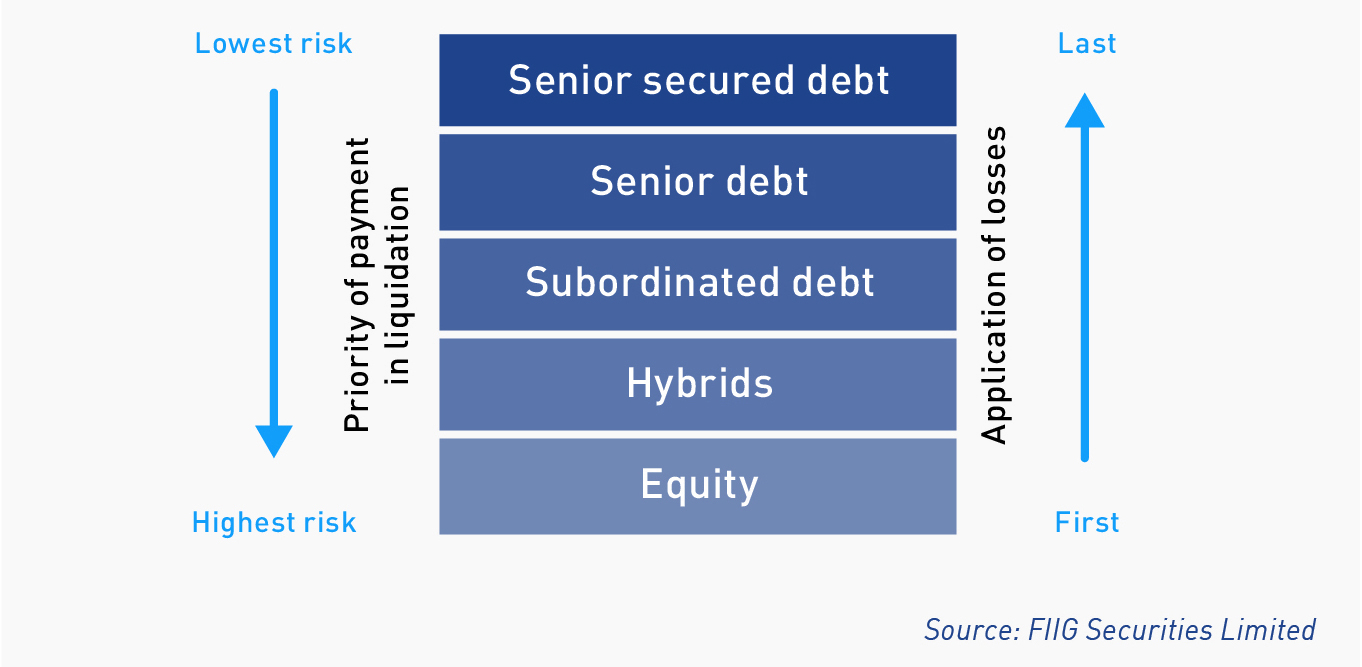

Subordinated notes /subordinated debt

A bond or loan that ranks below senior debt, loans and creditors. In the event of a wind-up (insolvency) of an issuer, subordinated debt is not paid until all senior secured, senior debt and unsecured creditors are paid first.

Step up securities

Increased penalty interest where the coupon payment is typically increased by the step up margin, subject to a specific trigger for example: a credit event, banking covenants or election by the issuer not to call or redeem a certain security. Older style subordinated debt and hybrid securities often had a step up if the issuer did not to call, however new Basel III compliant securities do not have a step up provision.

Non-viability trigger

Is a new, untested structural feature of subordinated debt and hybrid securities implemented to meet Basel III/ APRA regulations to provide loss absorbing capital for the financial institution when it is considered non-viable or requires public funds or support to survive. The point of non-viability is unknown and at the discretion of APRA. Once deemed the securities convert to ordinary shares. This could result in up to a 100% loss of capital.

Perpetual security

A security with regular periodic payments for an infinite number of periods with no maturity date.

Premium

A bond's value in the secondary market can be greater than its face value. The bond is then deemed to be selling at a premium. This will occur if the coupon is higher than the yield of a fixed income security.

Purchase price

Purchase price is the amount that a bondholder pays to purchase a bond. Price can be quoted on a ‘clean’ basis meaning that this is the capital price of the bond, or it can be quoted on a ‘dirty’ basis meaning that it includes both the capital price plus the accrued interest.

Return

The amount earned on an investment or made on a transaction (realised or unrealised) relative to the amount of money invested. Generally assessed as yield to maturity.

Running yield

Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity

The return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.