Key points:

- SMSFs in Australia are overweight cash and term deposits

- Short dated bonds offer an alternative

- Investing in investment grade issuers can add 1.5% return over comparable term deposits (TDs)

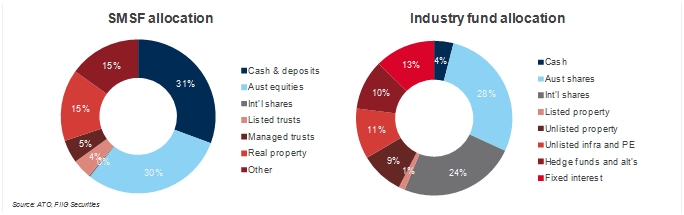

The Australian Tax Office recently looked at asset allocations of SMSFs against industry funds. Whilst most of the focus in the media has been whether or not SMSFs are over-exposed to property, the ATO also noted SMSFs over exposure to cash and deposits.

As Figure 1 below shows, the average allocation to cash in SMSFs is 31%, significantly higher than the industry fund allocation of just 4%.

Figure 1

Figure 1

There is no doubt there would be a number of reasons for this level of allocation to cash including continued fear of fluctuating markets in the post-GFC environment and importantly, a lack of knowledge around alternative fixed return options.

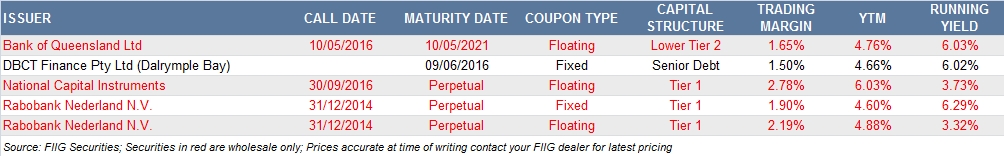

Short dated bonds are a good alternative to TDs. Table 1 shows a number of short dated bonds which offer better returns than term deposits. Being short dated lowers the credit risk in investing in bonds (as there is greater certainty that the company will be able to repay) and whilst a number of these issues have call risk, they are from suitably strong companies which we expect they will repay at first call. There are also fixed and floating alternatives for investors who may have differing views on rates over the next 12-18 months.

Table 1

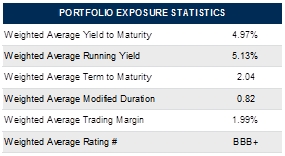

Whilst an investor may choose to invest in one or more of these bonds, it is worth noting that an equally weighted exposure to all five bonds would produce a running yield of 5.13% and a yield to maturity of 4.97%. The portfolio return with a weighted average term to maturity of 2 years compares favourably to the best 1 year term deposit rate currently available at just 3.4285%.

While a term deposit is a very low risk investment, the extra 1.5% (yield to maturity) on offer from short dated bonds with an average BBB+ rating is a compelling reason for SMFSs to investigate the alternatives to cash.

Source: FIIG Securities

Table 2

Key terms

Call risk

The risk that a bond with a call option/call date will not be called at the first opportunity.

Running yield

Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity

The return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.