Background

The Australian Prudential Regulation Authority (APRA) has released a paper which presents a snapshot of the Authorised Deposit-taking institution (ADI) industry and reviews key risks to which it is exposed. This paper summarises their findings.

The ADI industry in Australia remains strong, profitable and well capitalised, supported by a domestic economy that has not experienced a recession for over 20 years. However, the outlook for the industry is clouded by an uncertain operating environment, driven primarily by concerns external to the Australian economy.

These concerns focus on the risks around sovereign debt and bank restructuring in the Euro area, and uncertainty around the growth trajectory of the US and Chinese economies. Such risks impact on ADIs in Australia through a number of transmission mechanisms:

- Direct exposures. The direct risk is low, since ADIs have limited credit exposure to the troubled economies in the Euro area.

- Funding markets. Volatility and heightened risk aversion in global financial markets is generating higher funding costs and, at times, interruptions to market access

- Flow-on effects of slower global growth on the domestic economy. Domestically, the low credit growth environment poses a structural challenge for ADIs, as they seek to maintain shareholder returns without sustained high asset growth

Capital

ADIs have continued to strengthen their capital positions in response to market expectations, and in anticipation of higher requirements required under the Basel III framework. The ADI industry aggregate Tier 1 ratio increased 60bps to 10.5% over the year to 30 June 2012.

Key drivers of ADI capital ratios include (1) changes in the level of regulatory capital (2) growth in risk-weighted assets (RWAs) and (3) profitability as a source of organic capital growth.

Tier 1 capital levels for the ADI industry have increased by $14.6bn in aggregate (10%) over the year. Although Tier 1 capital has strengthened, there has not been a commensurate increase in Total Capital, because of a decline in Tier 2 capital. This reflects the emphasis placed on higher quality capital, and the reluctance of ADIs to raise Tier 2 until the detailed eligibility criteria for these instruments under Basel III has been finalised. APRA expects this trend to reverse as ADIs transition to Basel III.

RWAs have been impacted by both subdued growth in credit and by changes in risk models. Growth in RWAs was 4.5% over the year.

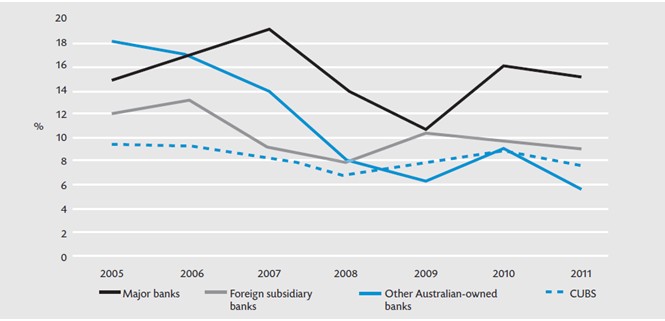

Net profit after tax for the ADI industry totalled $26.5bn in the year, a slight decrease of 3% over the prior year. ADI profitability has been supported by broadly stable net interest margins, cost constraints and further reductions in charges for bad and doubtful debts. The return on equity (ROE) at an industry level was 14%, around the average level over the previous decade. There is however differences by type of ADI as detailed in Figure 1.

Return on equity

Source: FIIG Securities, APRA. Note: CUBS; Credit Unions & Building Societies

Figure 1

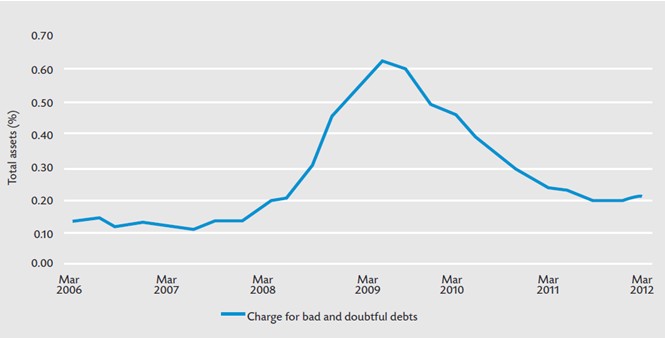

Reductions in charges for bad and doubtful debts have also supported profitability. At an industry level, charges for bad and doubtful debts have fallen from a recent peak of around 0.60% of average assets in 2009 to 0.20% as detailed in Figure 2.

Charge for bad and doubtful debts

Source: FIIG Securities, APRA

Figure 2

Credit risk

Credit is the dominant source of risk for the ADI industry, with credit exposures comprising over 85% of total RWAs. Credit quality is broadly following a recovery path since the global financial crisis, and ADIs have relatively strong credit quality compared to banks in many other countries. Impairments, however, are still well above their levels prior to the global financial crisis. A key risk in this area is that, given low credit growth and a competitive retail banking environment, ADIs seek to gain or maintain market share by relaxing underwriting standards.

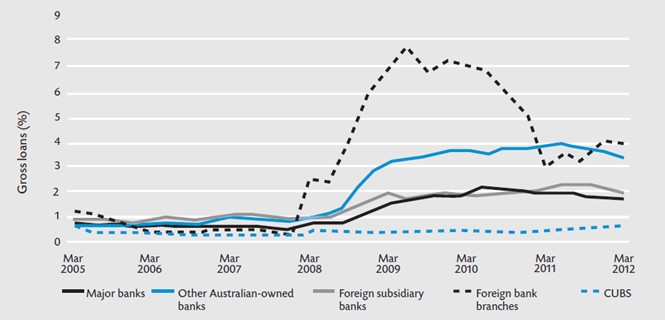

Non-performing loans have declined from 2.2% to 1.9% of total loans over the past year. Credit quality also differs across ADI types (Figure 3). For the major banks, non-performing loan ratios have fallen marginally, mainly due to improvements in their business loan portfolios. However, the inflow of newly impaired assets remains relatively high, indicative of weaknesses in a number of industries outside the resources sector.

Non-performing loans

Source: FIIG Securities, APRA. Note: CUBS; Credit Unions & Building Societies

Figure 3

Liquidity and funding risks

Funding conditions

In late 2011, funding conditions were challenging for the larger Australian banks issuing offshore. While overseas short-term funding remained accessible (albeit at an elevated cost), long term unsecured funding markets were effectively closed to banks, whatever their origin. Funding conditions improved in early 2012, enabling Australian banks to increase their bond issuance and reduce wholesale funding costs from their 2011 highs. Despite further funding market volatility during 2012, Australian banks have retained access to offshore term funding, though with limited further improvement in spreads.

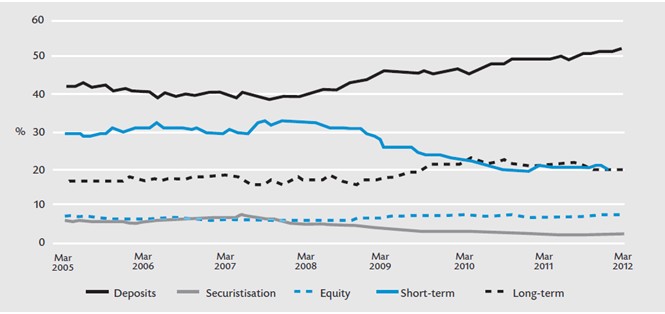

The combination of higher wholesale funding costs and the prospective Basel III liquidity standards has increased incentives for ADIs to focus on domestic deposit funding. More intense competition for deposits has raised deposit rates relative to benchmark wholesale rates and, in turn, has added to pressure on interest rate margins.

Structural change

Since 2008, banks have increased their deposit funding and markedly reduced their reliance on short term wholesale funding (Figure 4).

Bank funding composition

Source: FIIG Securities, APRA

Figure 4

Given investor preference for security, the majority of term issuance by Australian banks in early 2012 was in the form of covered bonds (Figure 5).

New debt issuance

Source: FIIG Securities, APRA

Figure 5

Securitisation markets remain subdued. The Australian Office of Financial Management (AOFM) has been a key participant in the residential mortgage-backed securities (RMBS) issues of smaller ADIs and non-bank lenders. Although the AOFM has a mandate to invest further, its funds are finite. While new RMBS transactions are occurring, issuance comes at a significantly higher cost than before the crisis. Reflecting these developments, ADIs have reduced the extent to which their funding comes from securitisation.