ALE Property Group (ALE) announced last week that it was conducting a capital raising to simplify its existing hedging arrangements. The company raised $40m in equity and $40m in unsecured debt to replace an existing CPI hedge with a nominal interest rate hedge. The net result for investors in the 2023 CIB Notes is credit neutral/slightly positive. The capital raising strengthens ALE’s balance sheet and the new nominal interest rate hedge will capture rates at historic lows, improving cashflow dynamics in coming years, which will offset the cost of terminating the CPI hedge today.

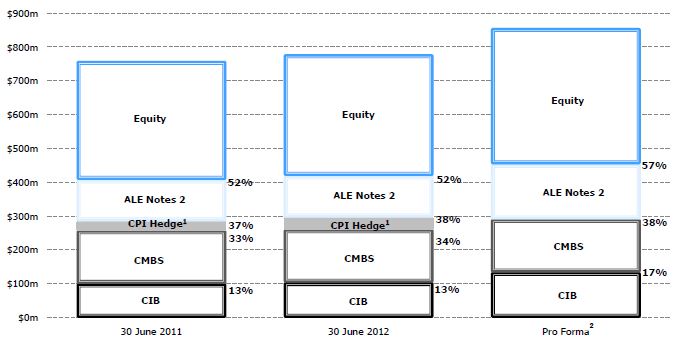

The movement in long term interest rates and inflation rates has prompted ALE to conduct a review of its existing hedging arrangements. As a result ALE has proposed to restructure existing hedging arrangements with the termination of existing CPI hedge’s and the implementation of a nominal interest rate hedge. Funding the significant break costs for the hedge liability has been sourced from existing cash, new unsecured debt and new equity. The new capital structure, pro-forma for the transaction, is detailed below.

New capital structure

- CPI hedge refers to CPI hedge accumulated indexation

- 30 June 2012 pro forma for the impact in the Capital Raising and CPI hedge restructure

The key take-away for investors is that the CIB accumulated indexation is now captured within the nominal value of the CIB Notes, rather than separately. Furthermore, ALE would not be conducting the transaction unless the present value of future cashflow benefits derived from the transaction significantly outweighed the large break costs associated from the removal of the CPI hedge. The net result of changes in the capital structure will have little impact on the CIB Notes. They benefit from being at the highest point in the capital structure are still supported by a strong asset base, with net assets pro-forma for the transaction of $813m, long term leases to a very high quality tenant with a portfolio enjoying 100% occupancy rates. This provides significant asset and cashflow coverage for Noteholders. ALE also maintains significant headroom within its existing debt covenants and the nature in which investors supported the debt and equity raising demonstrates that ALE has strong access to both the debt and equity capital markets.