by

Ekaterina Skulskaya | Jul 08, 2014

Key points:

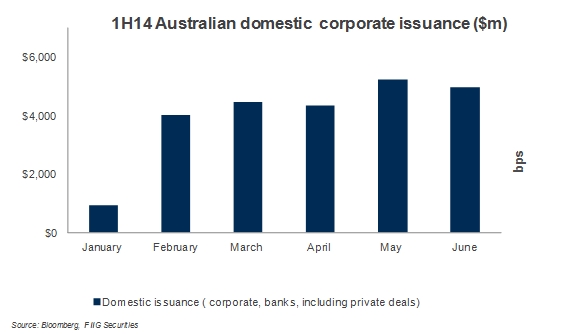

- According to Bloomberg data, a total of A$23.79n debt was issued domestically in 1H14 versus A$19.61bn in 1H13

- As the US continued to offer cheap funding opportunities, significant issuance of A$39.77bn in public and private placement deals for corporate market were achieved; 1.65 times more than that issued in the Australian corporate domestic market

Issuance activity in the debt capital markets remained steady throughout 1H14. According to Bloomberg data, a total of A$23.97bn debt was issued domestically in 1H14 (by Australian entities in AUD currency), excluding Australian government and semi-government compared to A$19.61bn in 1H13. The lowest volume was recorded in January (A$0.90bn) while May contributed the most to the first half 2014 volumes with A$5.23bn issuance. According to the Reserve Bank of Australia, private sector credit grew by 4.7% in the 12 months through May 2014, which was the fastest annual pace since March 2009. Australian corporate issuers (excluding financials) sold mostly bonds with maturities of seven years while the US dollar and Euro markets provided scope for longer dated debt in 2014.

Activity in the RMBS market was better in the 1H14 compared to 1H13. Overall, 1H14 RMBS issuance totalled 16 deals worth A$16.026bn (Australian tranches only) well ahead of 1H13 with 12 deals and A$11.61bn issued. Biggest issuers for 1H14 were Commonwealth Bank of Australia (Medallion Trust) with A$2.51bn, Westpac Banking Corporation (WST 2014-1) with A$2.5bn, Macquarie Securitisation Limited (PUMA 2014-1) with A$1.4bn, ING Bank Australia (IDOLT 2014-1) with A$1.25bn and Resimac (Resi 2013-1X) with A$1.22bn.

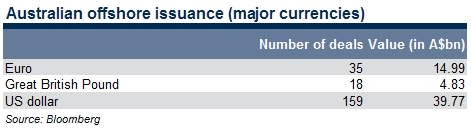

According to Bloomberg data, offshore issuance in GBP, USD and EURO currencies by Australian companies rose to (A$59.59bn) in the 1H2014, up 31% from 1H13. This was the strongest first half since 1999. Banks issued bonds offshore three times faster than local sales as demand from US and European investors cut costs. The big four banks were tapping overseas markets as credit growth in Australia accelerated to the fastest rate in the last five years, buoyed by central bank interest rates at a record low. Bloomberg’s complied data revealed that Australia’s local bond market is dominated by the big four banks that sold A$12.6bn of notes in the 1H14 versus A$11.3bn in 1H13. The cost of shifting funds from dollars and Euros into the Australian currency fell in the 1H14, while credit spreads in the US and Europe have tightened. JP Morgan noticed a very strong demand from both European and US investors for credit products and Australia is viewed very favourable as a place to invest. Australia’s central bank benchmark rate is at 2.5%, while those in Europe and the US are near zero. According to Bloomberg data Australian ten year bonds yielded 3.55% compared with 2.53% for equivalent US securities and 1.25% for similar German bonds.

As the US continued to offer cheap funding opportunities, significant issuance of A$39.77bn in public and private placement deals were achieved. Westpac was the leading offshore borrower of US dollar denominated deals from January 2014 to June 2014 and raised US$7.58bn of debt, which was closely followed by Macquarie with US$6.71bn.

However, Euro and GBP issuances were well below USD issuances with A$14.99bn and A$4.83bn volumes respectively over the first half of 2014. The biggest issuers of Euro denominated bonds were: Westpac with €2.21bn, Sydney Airport, the largest non financial borrower in the 1H14, which sold €718.27m of ten year notes in April 2014, Brambles, the world’s largest supplier of wooden pallets raised €500m selling ten year securities in June 2014. The biggest issuers of GBP denominated bonds were: CBA with A$1.20bn, followed by NAB and Macquarie with A$1.04bn and A$0.46bn respectively.

Table 1

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.