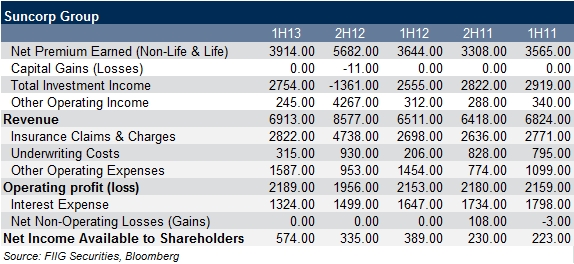

Suncorp 1H13 – solid results on lower insurance claims and stronger markets

Group NPAT increased 71.3% over the half to $574m. Suncorp attributed the result to lower insurance claims and stronger financial markets in the six months to the end of December. The company said the cost of claims from floods and bushfires since the end of December total up to $417m, which is still below its allowance of $520m for the full 2012/13 financial year.

Insurance

General Insurance posted an NPAT increase of 70.4% to $564m for 1H13. The Insurance Trading Result (ITR) was $669m (up 75.1%), representing an ITR ratio of 18.6%. The result was driven by operational efficiencies, positive investment markets and fewer natural hazard events. On an underlying basis, the ITR ratio was 13.4%, up from 11.1% in the prior corresponding period. This reflects the benefits from the delivery of the Building Blocks program and a continued focus on margin improvement. Gross Written Premium (GWP) increased 9.6% to $4.22bn.

Ex-Tropical Cyclone Oswald caused considerable damage across Queensland and New South Wales in late January 2013. The current estimate is that the event will cost between $200m to $220m. Other natural hazard costs during January were $50m, meaning that at 31 January, the Group’s natural hazard claims for the year to date were between $397m and $417m, against a full-year allowance of $520m. Suncorp Bank has conducted a preliminary assessment of the impact of ex-Tropical Cyclone Oswald on its portfolios and there is no material financial impact.

Banking

The Core Bank reported NPAT of $144m for 1H13 (up 8.3%). The net interest margin reduced to 1.83% (from 1.90%) as the market-wide impetus to increase retail deposit funding continues to restrain margins but remains near the top of the Bank’s target range of 1.75% to 1.85%. The bad debt charges were steady at $32m with losses to credit risk weighted assets also stable at 27bps.

The Non-core Bank recorded a loss after tax of $140m (a reduction of 28%). The portfolio reduced by $1.1bn or 24% over the half to $3.4bn and is on track to reach a target of $2.7bn in outstanding balances by year end.

Suncorp Life’s NPAT reduced 56.8% to $51m due to market adjustments. Impairment losses fell to 1.40% from 1.97%.

Capital levels have improved with more than $1.2bn of capital held in excess of operating targets. The General Insurance Group MCR coverage increased 9bps to 1.70 times and the Bank Net Tier 1 ratio increased 45bps to 10.1%. Under Basel III the bank had a common equity Tier 1 ratio of 7.39%. A total of $776m of core capital is held at the Non- Operating Holding Company level.

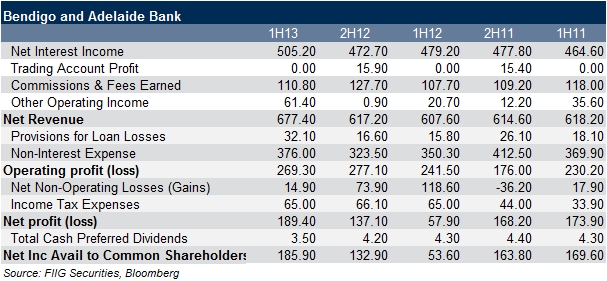

Bendigo and Adelaide 1H13 – solid franchise with a focus on improving capitalisation

Bendigo and Adelaide Bank (BEN) reported NPAT of $169.7m 1H13 (an increase of 5.8%). The bank has a stable and solid domestic retail banking franchise, acceptable profitability, sound funding and liquidity position as well as strong and strengthening capitalisation.

Net interest income increased 7.7% to $504.9m. The net interest margin increased 9bps over the six months to end December primarily due to pricing and hedging; as interest rates decreased over the course of this year. The reduction in price of the total liability portfolios has exceeded the reduction in price of the total asset portfolios.

Fees increased by $1.8m or 2.1% primarily due to the inclusion of Delphi Bank ($1.4m). Homesafe trust contribution was $14.4m higher than the prior corresponding period, primarily due to an increase in the housing price index over the last six months.

Commissions increased by $2.1m or 6.5% due to increased volume of third party products sold. Dividend income has decreased $3.8m due to the sale of the IOOF shares.

Net impaired assets fell 24% to $193.8m over the half. The impaired loans to gross loans ratios fell 14bps to 0.59%. The bank raised its Bad & Doubtful debts expense to $32.1m from $16.6m. The fall in impaired asset and the increase in bad debt expense resulted in coverage increasing strongly from 73.4% at YE12 to 90.4% 1H13.

The group's Tier 1 capital ratio has increased 92bps to 9.31% over 1H13, with the benefits of the sale of BEN's stake in IOOF (+13bps), the sale of subordinated notes relating to past Torrens securitisation issues (+29bps), and the issue of convertible preference shares