by

Justin McCarthy | Apr 15, 2014

Key points:

- BOQ released a solid set of 1H14 figures, confirming continued improvement in profitability and balance sheet strength

- BOQ to acquire Investec Bank (Australia) Limited’s (IBAL) Professional Finance and Asset Finance and Leasing businesses and deposit book for $440m to be all equity funded. IBAL deposits will move to the BOQ Group and see a resultant improvement in credit profile

- BOQ subordinated bonds are considered expensive with our preferred subordinated debt issues the recent floating rate notes from Bendigo and Adelaide (January 2019 call, expected yield to call of 5.97%) and IAG (March 2019 call, expected yield to call of 6.11%)

- Treatment of existing IBAL subordinated debt is unclear with options ranging from early redemption due to the sale or moving over to the BOQ Group, similar to the IBAL deposits

1H14 results to 28 February 2014

Bank of Queensland reported solid 1H14 results on 11 April, continuing the performance turnaround from the problematic FY12. Statutory net profit after tax (NPAT) was up an impressive 34% to $134.7m for the first half and cash NPAT was $140.2m.

Highlights from the result included the following:

- Statutory NPAT of $134.7m, up 34% from $100.5m in 1H13

- Cash NPAT of $140.2m, up 17% from $119.9m in 1H13 and a record half year result

- Strong improvement in net interest margin, up 11 basis points to 1.77% from 1H13

- Improvement in underlying business and balance sheet evidenced by two credit rating agency upgrades in the past six months – from Standard and Poor’s and Moody’s

- Significant reduction in the level of impaired assets (impaired assets / gross loans) which are now in line with peers at 0.85%, down from 1.37% in 1H13

- Capital ratios amongst the highest of all banks with Common Equity Tier 1 (CET1) ratio of 8.84% higher than all the major banks as well as Suncorp and Bendigo and Adelaide Bank.

Acquisition of Investec Bank (Australia) Limited entity and assets

BOQ also announced the purchase from Investec Bank (Australia) Limited (IBAL) of its Professional Finance and Asset Finance and Leasing businesses and deposit book for $440m. BOQ will be acquiring approximately $2.4bn in loans and leases (and associated deposit liabilities) and around 310 employees. The deal is expected to introduce 33,000 new customers to BOQ and improve the diversity of their operations and loan book outside the Queensland market.

IBAL intends to restructure and remove assets not subject to the sale prior to BOQ acquiring 100% of its shares with the deal expected to be finalised by the end of August 2014, subject to regulatory approval.

The purchase will add around 7% to BOQ’s existing loan book of $35bn and be funded by a $400m equity raising and the balance to come from existing internal equity resources, and as such will be all equity funded.

Implication for IBAL deposits and subordinated debt

Whilst still subject to regulatory approval, it is expected that BOQ will acquire the IBAL entity with the assets and liabilities detailed above, including its Authorised Deposit-taking Institution (ADI) licence, meaning that IBAL deposits will move to the BOQ Group.

This position of IBAL subordinated debt is less clear with options ranging from early redemption (potentially at par) or moving over to the BOQ Group, similar to the IBAL deposits.

IBAL and its subordinated debt issues have been placed on review for possible upgrade by Moody’s reflecting the expected improvement in credit profile.

Relative value

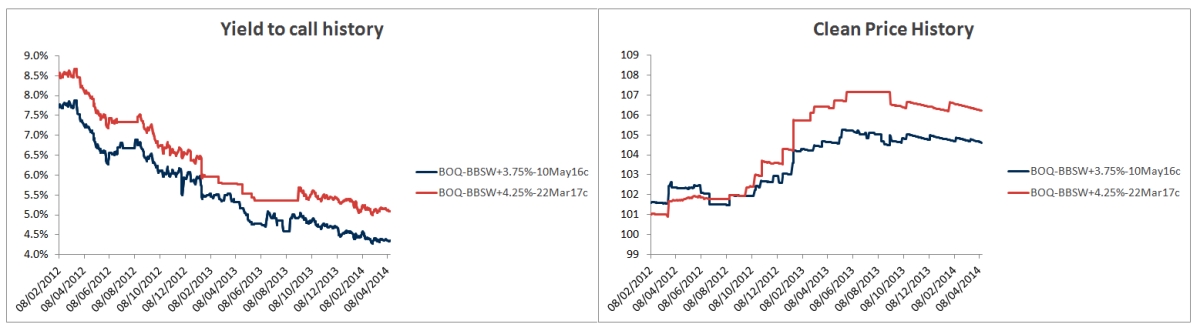

BOQ’s callable Lower Tier 2/subordinated debt securities (May 2016 call and March 2017 call) have performed well over the previous two years, as demonstrated by Figure 1 below, although note that as they approach call date the price will continue to fall towards par. These securities are trading well above par and investors may want to consider taking profit.

Source: FIIG Securities

Source: FIIG Securities

Figure 1

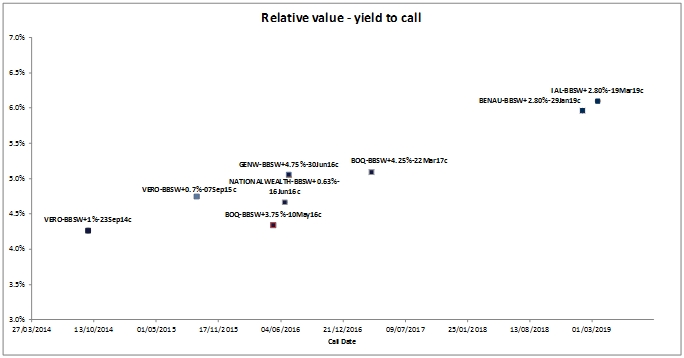

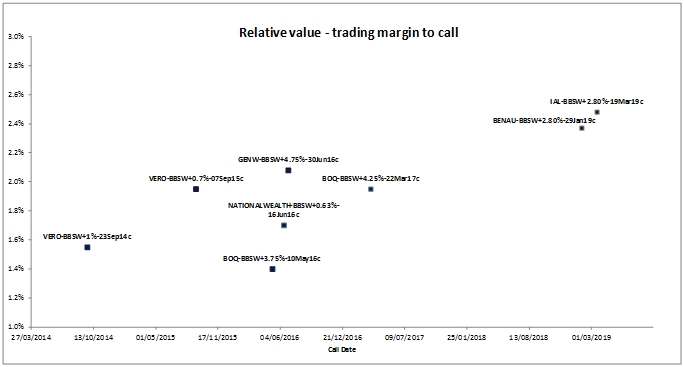

Figure 2 below plots the expected yield to call date and Figure 3 the expected trading margin to call for a number of floating rate subordinated bonds. As the charts demonstrate, the two BOQ issues are expensive, especially the May 2016 call, notwithstanding the improving credit profile. Our preferred selections on a risk-reward basis continue to be the recent Bendigo and Adelaide (January 2019 call, expected yield to call of 5.97%) and IAG (March 2019 call, expected yield to call of 6.11%) subordinated bond issues. The IBAL subordinated bonds are not shown due to the uncertainty detailed above.

Source: FIIG Securities

Figure 2

Source: FIIG Securities

Figure 3

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.

For further information regarding any of the bonds mentioned above please contact your FIIG representative. All the bonds listed in this report are available to wholesale investors only except the Vero 2014 and 2015 call and National Wealth Management Holdings 2016 call subordinated bonds.